So, it’s over. Both the month of February, and the process of buying the Dream Home. My portfolio is in a very different place from where it was on 1 December. It isn’t yet where I want it to be but it’s made a major transition already and hasn’t far to go to reach my new intended asset allocation.

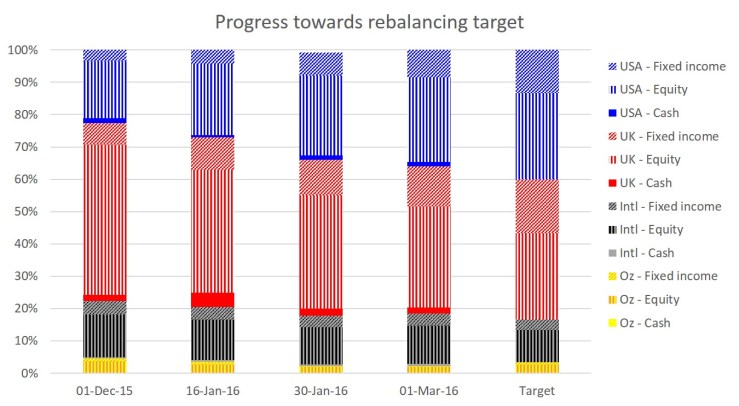

You can see in the graph below the transition I’m trying to make. Essentially I am rebalancing away from the UK, and towards fixed income. My upweight on the USA is almost done, with the blue US exposure having increased from about 20% to about 35% of my exposure. My downweight on the UK and International has further to go. But I am struggling to switch from equities (74%, versus 66% ideally) to fixed income (~25%, versus ~33% hopefully). Thankfully in February this hasn’t affected me much, as we shall see.

Amidst this major upheaval, including finding a six figure sum to pay the transaction taxes on my new Dream Home, how has the portfolio performed?

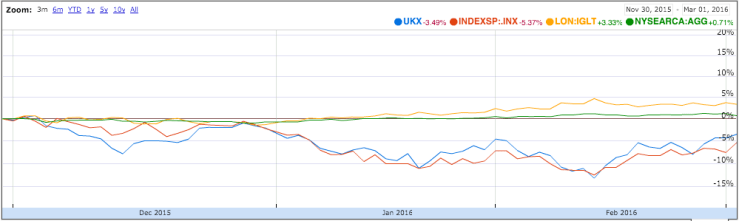

Overall my invested portfolio rose by 1.3%. This was against a weighted market average fall of about 0.6% – mostly from International Equities. Bonds, yet again, did pretty well, especially outside the UK, but my exposure to them is small. My portfolio’s positive return in this environment was a reasonable result.

I haven’t quite worked out what to attribute my relative outperformance to but think that I was fortunate with both my exposures and my trade timings. During the month the equity markets have dipped and risen by almost 10% in each direction (see below) so it is relatively easy to catch an edge and fall if your timing is sloppy.

Despite my performance in February being up by more than 1%, my three year return has dropped. This is because I had some very strong results three years ago, which are dropping out of the system. My Sharpe Ratio, which is many ways is the best comparable measure for any portfolio of its risk-adjusted returns, rose slightly from 1.0 to 1.1. It’s good enough for me.

Good observation on the small margins with the resumption of volatility, and yes with all the money you’re moving around it’s probably best to chalk that month’s edge up to noise?

Better to be lucky than right, as Napoleon almost said. 🙂

LikeLike

As always many thanks for being so transparent here. YTD I make your return -0.9%. In comparison I have the slight edge with a YTD return of +1.5%.

LikeLiked by 1 person