I’ve had quite a lot of culture to enjoy in February.

Aside from some travel for the Six Nations rugby, I’ve been to two shows – one in London’s Royal Opera House and one on the south coast.

Both events were either full or practically full. Covid feels fully behind us now. But the prices have stayed with us.

I was struck by the demographic difference between these two nights out. I know, I know, the demographics of opera and concerts are not a fully reliable guage. But I was practically the youngest person in the audience at Poole’s Lighthouse concert hall, whereas I felt 2nd quartile old in London’s Royal Opera House. Is this a reflection of where the money sits – with retirees only in Dorset, and with well-heeled workers and tourists in London? A rhetorical question, for now.

Markets in February 2024

The USA stock market continued to be the main story in February.

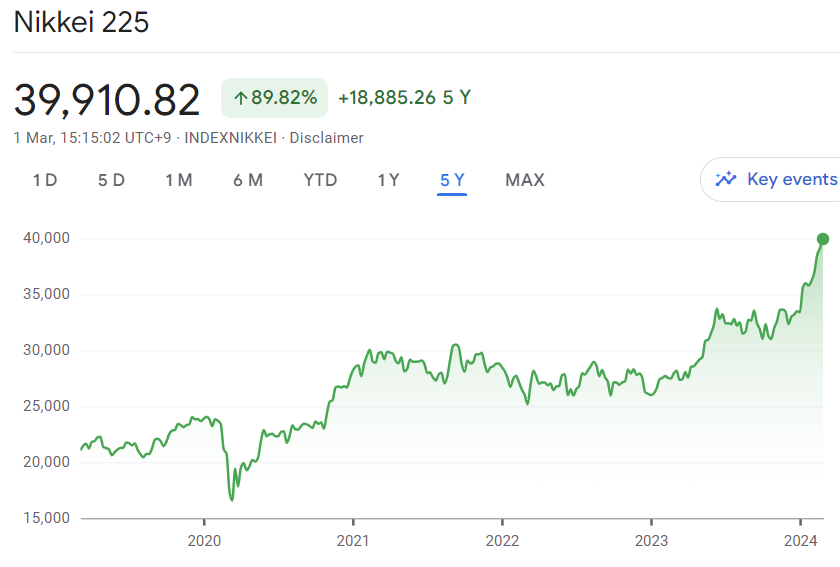

Though if you were paying attention, the Japanese market has been setting new records too – the Nikkei 225 is up 20% Year to Date.

It wasn’t just Japan that’s booming, with Asia ex Japan up 4.5% in February itself. Over in Europe and Australia we had much less excitement; Europe ex UK was up 2.8%, Australia up only 1.2% and the misery-guts UK’s market rose only 0.5%.

Continue reading “Feb ’24: Envyidia”