Readers will know that I dabble with active investing – I pick stocks.

Lord, make me passive, but not yet

Rather like The Investor at Monevator, I firmly believe in the merits of low cost index tracking as an investment strategy, but I also enjoy the thrills / intellectual excitement of deviating from the true path.

Over the years I have owned dozens of ‘single line’ stocks. These days, partly due to my competing desire to reduce complexity, I have a rather simpler portfolio with ‘only’ around 25 single company holdings.

One question I have wondered about for a while is: what happened to those stocks I used to own, but have ‘exited’? Was I right to exit them? Are the stocks I continue to hold better than the ones I used to own?

A full analysis of this question is beyond the scope of my blog or, for that matter, my abilities.

But let’s start with Facebook.

My Facebook nightmare

One particular investment exit: Facebook/Meta – has gnawed away at me. I know I made a mistake exiting this position. But maybe I make serial mistakes, maybe Facebook is just the tip of a poor judgement iceberg.

By way of context, the story begins really in 2019 when I first bought Facebook (/Meta). Facebook was a bellwether NASDAQ stock by then, and tracked Nasdaq pretty closely. I slowly accumulated shares in 2020, with a more decisive topup in early 2021 – taking me to over 200 shares. I then topped up in the summer – at $360 – citing a P/E of “only” 26x combined with good growth – “Know anything better value?” I asked in my diary.

In September 2021, having peaked at around $380, sentiment in Facebook turned negative. At this point I held around 300 shares. This was roughly when the wider tech ‘crash’ of 2021/2022 started, but a few weeks ahead of Nasdaq’s decline – as the graph above illustrates. In Facebook’s case, a key reason was poor trading performance at Facebook coupled with a revenue-free obsession by the CEO Mark Zuckerberg in the Metaverse, which he was investing tens of billions of dollars in.

As Facebook’s share price fell late in 2021, I carried on topping up. As I’d been topping up at $360 in Q3, I continued to top up in Q4 at $330-$340.

In early 2022, Facebook’s stock took a big dip – it was announcing it was losing 1m Active Users a day. I bought 50 more shares at $222/share in February, and a few more shares in Q2 at $180. I noted in May that it was now on a P/E of 15, with revenue growth still exceeding 10% p.a.

The stock however continued to drop. July, $160. September, $140. I actually sold a handful at $139, for reasons that escape me. October, $110. By November 2022, Facebook stock reached its nadir of $90. Zuckerberg was off in his virtual ivory tower, and the key assets Facebook, Instagram and WhatsApp were being hammered by new rivals such as TikTok.

And I, credit to me, bought 125 shares at an average of $95 – including some on 8 November. This was purely a ‘average down’ decision – it was days before the big Zuck announcement. My diary said: “I think Facebook is oversold. It still has Zuck running it… it has [reasonable] control over its profits as it could just suspend R&D. It’s on 11x P/E”. Fair play, me.

Facebook’s fall from $380 to $90 was a drop of over 75%, considerably more than Nasdaq which fell about 40%.

On 9 November 2022, Zuckerberg changed direction. He cut back on metaverse investment, and started cutting back on expenses. He announced a cut of 13% of employees, 11,000 jobs. I bought more shares – another 100, at $112. This took me to almost 900 shares.

Meta entered 2023 at $130/share. Zuckerberg went on a few weeks later to call 2023 a ‘year of efficiency’. Meta continued to trim costs, and invest in its core/legacy products. By mid 2023 it had cut a further 10,000 jobs – a cut of 21,000 jobs in total. Facebook folk aren’t cheap, so that reduced expenses by over $2bn a year. The stock was back to $300.

Where was I? I was long gone. I pressed the Sell button in late January 2023, at $150/share (“cutting my losses, having recovered somewhat”), and stopped pressing a week later at $190. I’d exited. Those sales at $180+ felt great when I’d been buying at $100 two months earlier.

But what did I know? By January 2024, the stock at $390 had exceeded its mid 2021 peak. Since then, while Zuck hasn’t stopped investing in the metaverse, he’s toned it back in and restored the competitive performance of the key brands Facebook, Instagram and WhatsApp. By Jan 2025, Facebook had climbed to $700, fast outpacing the S&P500. Argh. At this price, if I’d never sold any shares, my holding would be worth around £500k.

Other exits

This woeful Facebook decision has been preying on my mind since then.

So finally this month I went back five years, to the beginning of 2020, and reviewed all my exits. In the last 5 years, I have exited 40 investments.

2020 saw a major cull. I exited 18 positions, many as I struggled to retain my poise during the covid-19 stock market crash / recovery. But it wasn’t all a panic reaction – even in February 2020 I was already on a journey to fight complexity and reduce the number of holdings in my portfolio.

Since 2021, I tend to exit 3-4 positions a year. 2022 was a slight exception, with 8 exits.

Good riddance? Or bad call?

Looking back at old holdings, I’m making something of a snap judgement about whether my exit was a good call or not. I’ve made that judgement for each of my 40 exits. I’m using my diary page to remind myself of why I made the decision to sell/close the position. And a key criterion is how the stock has performed versus world equities since then. I haven’t done this rigorously; it’s impressionistic.

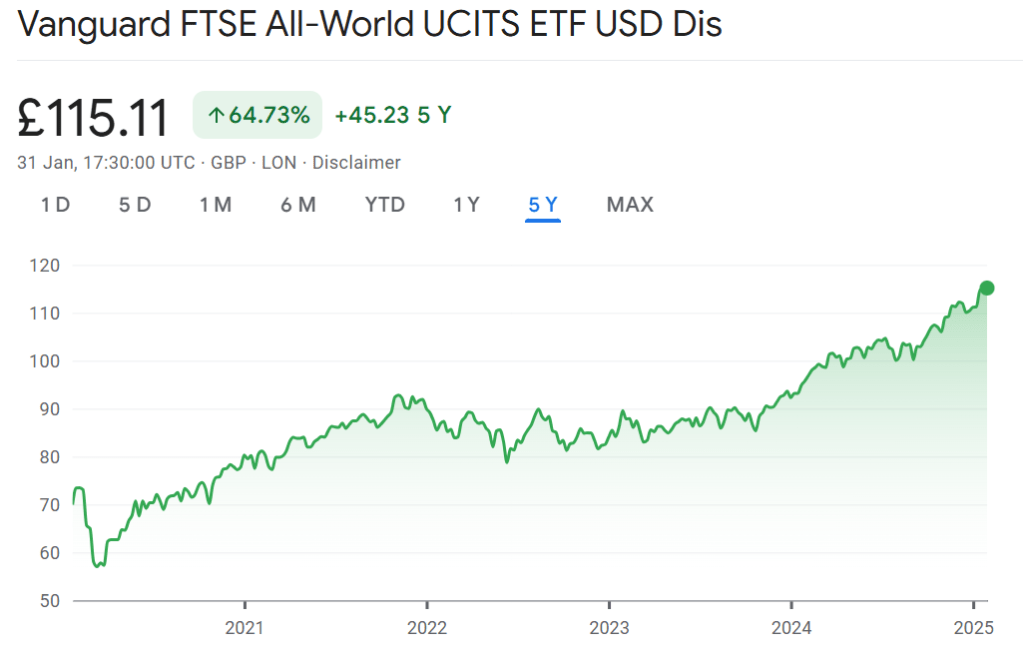

For a quick reminder of world equities (measured in GBP), see the 5 year graph below: If you ignore that blip around the advent of covid-19 lockdowns in March/April 2020, VWRL has risen from 70 to 115 – i.e. about 50% in five years. Crudely speaking, an exit in mid 2020 that is less than 2x is an OK call, and an exit in mid 2023 that has risen by less than 25% is also an OK call.

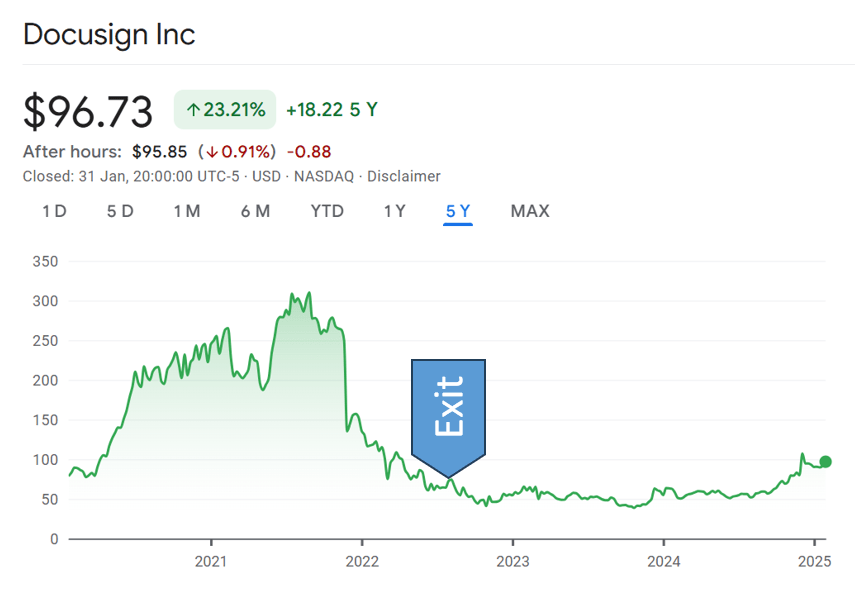

This is a bit more judgemental than mathematical because I also looked at what happened to that particular stock in the months after I exited. Take DOCUsign, for instance… I exited this in mid 2022, at around $67. These days it is at $97, suggesting I may have snoozed. However looking at what its share price did since I exited, I regard this exit as the right call.

Taking the 40 exits I’ve made in the last 5 years, 4 of them are too recent to rate. 16 of them are now ‘bad’ calls, and 20 of them are ‘good’ calls. They say if you make the right call 51% of the time, you’ll do OK; I’m not sure that’s right, but I would say 20/36 is not a disgrace.

Some good calls – good riddance, indeed

As mentioned above, 2020 was my biggest year of exits in the last 5 years. Covid and complexity reduction were both big reasons. Let’s look more closely at that year.

Several of the stocks I jettisoned in 2020 are stocks I’m glad about being out of:

- Carnival (c.£30). I had the good sense to get out of this cruise operator in February 2020, and the stock hasn’t regained those levels. If I’d had the balls to get back in as lockdown was called, at <£10/share, I’d be very chirpy now about the £25/share price but I wasn’t in that position.

- WPP (out at £10). Here’s what I said in January 2020, as I exited: “It’s slowly getting back to the Sorrell era. But strategically I am less and less convinced of relevance of mega agencies in world of Google/Facebook. Shareprice climbs reduce the losses I have been nursing; I’m out.”. It’s now at £7.73. No regrets.

- PRU (out at £10). Prudential’s stock has had quite a roller coaster since I bailed, rising at one point to around £15. But it’s now at 5 year lows of £6.77. No regrets here either.

- Daimler-Benz (out at €46). I exited this position at the end of 2020, at the equivalent of around €46. The stock has spent much of the last five years between €60 and €75, and today is at €59. There would have been dividends too, but I’m happy being out of this one.

- Taylor Wimpey (out at £1.45). The construction sector was still a mess when I quit in July 2020. Taylor Wimpey has been broadly flat, before dividends, ever since – today it’s at £1.18.

Some ‘exit in haste, repent at leasure’ stories

Unsurprisingly, some stocks I sold right at ‘peak panic’, March 2020, have all gone on to do well. Cisco has doubled, but that is nothing compared to Booking.com (sold at $1200, now 4x higher), Tanger Inc (up 6x, grrr) or Inditex (up 7x – doh!). Against that, Target’s 35% stock price gain since I sold in March 2020 makes my sale look sensible, covid or no covid.

Nonetheless, some level of ‘active management’ of a portfolio when confronted with a shock like covid-19 is, I think, at least understandable – however much I might look back and wish I just held still. Selling travel businesses and shopping mall businesses was understandable, even if I was selling at the bottom, and hindsight is obviously a wonderful thing.

And some wider lessons

The more interesting exits back in 2020 were the ones later in the year. Here the position is more nuanced:

- Some ‘good’ exits included the Taylor Wimpey and Prudential exits mentioned above, both of which were a few months after the initial shock of covid-19.

- Several ‘bad’ exits happened, generally of very long term businesses. Aviva, the insurer, has doubled since I sold it in May 2020. Airbus has doubled since August that year. And Shell has more than doubled, even ignoring chunky dividends. Most egregiously, I quit Wells Fargo once it cut its dividend by 80% in August 2020, and Warren Buffett sold stock. Since then, the stock has almost quadrupled. Even the greatest investors get things very wrong. All these businesses are ‘long termers’, unlike some of the better exits I made.

Since 2020, I would say around twice as many of my exits have been Good as have been Bad.

- In 2021 I exited Diageo, Experian and the Berkeley Group. None of those decisions look bad.

- In 2022 I exited Docusign (see earlier), Comcast, the Asian income trust HFEL, Verizon and Qualcom. Those decisions all look fine too. However I also exited Hubspot at $335, missing out on it doubling in the next two years.

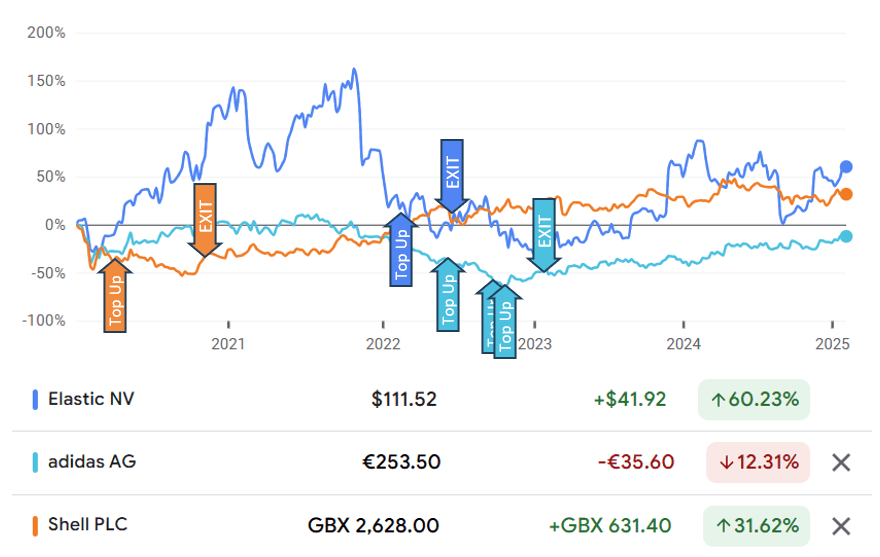

- In 2023 I closed JPM, a long term holding. It has been on a tear since, almost doubling. I also closed Adidas, which has a story a bit like Facebook’s but involving antisemitic rants by Kanye West and involving a decent-but-less-stellar subsequent share price gain. I also closed PEPsi, which has worked out fine for me.

- 2024 is a bit too recent to evaluate properly, but my exit of DISney at $90 looks like a bad call.

One mistake I must learn to avoid making

Looking back at several of the decisions I now regret, including particularly Facebook/Meta, I can see a flawed pattern in my behaviour.

The stock goes down. Maybe helped by the market, but aided in its decline by stock-specific reasons. Eventually it bottoms. I’ve been topping up, potentially I’ve topped up near the bottom – with a small nibble at significantly better value than my earlier purchases. Still, my holding of more shares is worth less than it was before the decline started. In any case, then the stock starts to recover. Before you know it, it’s up 30-50% on the bottom. Hooray! Time to exit – it could have been worse! And then the stock carries on climbing, making that exit look foolish.

- You can see that story with Shell. I was visibly wobbling in 2020, and I was following the dividend commitment signal strongly against mood music of ‘stranded assets’, buying at £15. Late in 2020 it cut its dividend, and I took that as a signal to exit. That decision looked OK for about a year, but since 2022 (and the Russian full-scale invasion of Ukraine in particular) that has not worked for me.

- You can see the story with Adidas. The Kanye West scandal broke, and the stock fell, and fell, and fell. I had limit orders topping up, and I topped up myself. I topped up very near the bottom in fact at €99, smiling at the 3.x% dividend yield. But when the stock started to recover, as soon as it hit €140 I was so anchored on my topup price that I exited.

- And you can sort of see the same pattern with Elastic Search. Though admittedly the stock is much more volatile than Adidas or Shell. But I exited not long after I topped up at about $65, but notably after the stock had climbed 30% up from a long term low of $50. That didn’t look too stupid for quite a while, but it doesn’t look clever three years later.

I am exhibiting some classic cognitive biases here. I have recency bias – remembering that I have topped up Facebook or Adidas at under $100, but forgetting what prices I was happy to buy at (Facebook, $250+). And I am anchoring – on the most recent topup price – instead of considering my entire position. Plus I clearly have loss aversion – I am sour about the loss in value, more than I am optimistic about the potential gain in value.

What I should have done in these situations is sell only my low-priced nibble, not the whole position. The stock ended up worth more than it was worth before the decline; I didn’t need to top up. I should view those nibbles as a separate short term bet, and get the money back when possible, and let the original holding do the long term work for me.

Conclusions

Stock picking is a risky activity, as this walk through memory lane vividly illustrates.

The last five years have seen covid-19, the covid-19 vaccine, the Russian full-scale invasion, and Trump being re-elected. That’s a lot for a stock portfolio to take on.

Overall my exit decisions look roughly par for the course.

I’ve made some good calls. Keeping a diary has been helpful, for this blog post if nothing else. Topping up to ‘average down’ when stocks I broadly like become cheaper. Using limit orders to assist the topup process. Using margin loans, arguably, so that I can buy stocks without keeping cash sitting idle. I’m happy with all of this.

But, wow, I’ve made some deeply regrettable decisions. My decision to sell META during its ‘year of efficiency’ remains top of these regretted decisions. I’m reassured I didn’t find other decisions of comparable kick-myself-ness.

I’ve learnt that I need to think more carefully about how to handle these stocks when they emerge into better times – I would do well to trim down my topup but keep the original holding. Let’s see if I can put that into practice in the years to come.

Have you tried looking back at past decisions? What lessons did you learn? Do share in the comments.

Having trodden the same path, made the same mistakes and now having gone down the passive route the last 5 years. When you’re younger you like to think that you are picking winners and highlight your gains. The early working life, building a successful profitable business, outsourcing your pension and investing decisions to the investment professionals. Review time comes everything is good, even the loses seem good from the words of your advisor. Reality kick’s in one day, decision time, self managing part of your portfolio and compare. Then you decide I will manage it all, enjoying the challenge until the later years and you take the passive’s route. Enjoy the next stage, relax but still review and compare.

LikeLiked by 1 person

When approaching FI, I conducted a clear-eyed comparison of my active versus passive investment returns by unitising the returns of both independently. The conclusion I reached was that the volatility and effort required to manage my active positions simply didn’t justify the marginal gains over my passive holdings (which depending on which time horizon I looked at, were not always above the passive portfolio). After confronting this data objectively, I made a deliberate choice to exit all active positions. Today, my portfolio is streamlined to just six passive ETFs + BRK.B.

This shift wasn’t just about numbers; it was a personal reckoning. I realised my active portfolio had become more about ego validation than wealth-building. Just as elite sprinters can break the 10-second 100m barrier, I believe there are investors who can genuinely outperform markets consistently. I’ve accepted I’m not among them. For most of us mere mortals, the wiser path is to recognise our limitations early and embrace market returns with humility and discipline.

Unlike the investment instruments I now use, I’m not 100% passive. I still attempt to rebalance and resize positions strategically while reallocating or deploying new capital (I do this aggressively when I see a good once in a decade opportunity – like VGT in 2022, bonds after rates shot up), which has worked very well for me. 99% of the time, I do nothing, and use the time for other more enjoyable endeavours!

LikeLiked by 1 person

Thanks for sharing. That point around unitising active vs passive separately is a very interesting one. I track my allocation/exposure to both, but not quite in a unitised way – divis from either are redeployed haphazardly into either, and my accounts mostly have both active and passive holdings in them. One for me to mull over.

LikeLiked by 1 person

Like many internet experts, I never lose – so this is a new problem to me.

LikeLike

Thanks for another great post. I’ve been following you for the last six months and always enjoy your updates. I’m purely an index investor but am considering dabbling in active investing, particularly in the UK where there might be overlooked opportunities at the moment. I was wondering if you could share some insight (perhaps a separate post!) on your investment approach?

LikeLiked by 1 person

Thank you for sharing FvL. Even as someone who values (or more accurately prices) companies for a living, I’ll confess I’ve always struggled with the exit. We are a product of our history – all the emotions, thoughts and urges. Exiting is particularly challenging when the investment story we once believed has changed. As you identify, sometimes we have subconsciously internalised that change without realising. Equally challenging is when we hold on to the story when the facts have changed. Having the humility to accept our mistakes and attempt to correct them is difficult. I’ve long come to the view that even if I was good at investment appraisal (which I’m not) I would be hopeless at knowing if and when to exit. It requires something that I do not possess. I’m happy to be passive.

LikeLiked by 1 person

Well said.

However hard it is with public, listed companies, it is significantly harder with private, unlisted companies!

LikeLike

A brave exercise (and post!)

If it makes you feel better, I see your Meta lost opportunity and raise it!

Not only did I blow the bounce from a trade made during the post-VR pre-cull lows for a quick 25% or something similarly silly, but I first bought Meta on its first existential dip – post-IPO a decade or so ago, when the market was worried about mobile. (Seems ridiculous now and it did then to me, but there you).

Reader, I do not own Meta now – nor for most of the intervening years. There goes a 35-bagger!

Then there’s this classic, if I may be allowed a link:

https://monevator.com/how-i-lost-436957-trading-tesla-shares/

It’s helpful to see what you’re doing right/wrong with your selling, but I think mostly what one is doing wrong is not knowing the future… 😉

Though if you can identify behavioural tics like your deadcat offloading, that’s useful.

Mostly I think if you buy and sell a lot of stocks then you’re guaranteed to have regrets.

Or you can never sell (the Davis Dynasty is a good read on this) and then potentially not have any funds to buy the future winners, unless you’ve a lot of new capital coming in. Hobson’s choice!

Clearly what matters as @grasmi says is whether you’re overall compounding ahead of your passive alternatives over some reasonable timeframe. That’s hard enough without risking paralysis due to the fear of selling.

(And yes, this does all sound a bit like ‘cope’ as the kids say…! 😉 )

LikeLiked by 1 person

[…] Portfolio exits: a post-mortem – FIRE v London […]

LikeLike

Great post and refreshing to see a transparent view of someone’s investing performance. I’ve long been meaning to set up a ‘what if’ portfolio, that holds sold positions, to conduct a similar exercise to you. I suspect the results would be similar!

One observation that strikes me is that I get the feeling that you would have done better overall if you had just never sold (coffee canned your picks – similar to Monevators point above and the widely quoted Fidelity study on the best investors being dead). You can use dividends to either reinvest or pay for new positions. If you’re not using leverage, the most you can lose is 100%. Whereas your winners (likely just your Meta position) would more than make up for that if you just held them. The ‘don’t just do something, stand there’ approach.

Have you read The Art of Execution by Lee Freeman-Shor? He identifies the most successful investor as the ones who are prepared to average down, but let those positions run when they’re winning, taking little bites of profit along the way to keep them in the position. These investors only got 40% of their picks correct but this strategy was the most profitable. It is difficult to do though, which is why despite knowing this, I still struggle to execute it!

LikeLiked by 1 person