Last week was the worst week since, well, a very nasty week quite a long time ago. And this week has started even worse. We are now officially into S&P correction territory.

Jeremy Grantham types (thank you @Monevator for the link) will tell you this wolf has been lurking just around the corner and we had it coming.

Typical, really. Just after I have leveraged up. And published a piece about ‘feeling rich’. Maybe I caused the global stock market drop, through sheer hubris? Just to compound the sense of nemesis , I am about 3% overweight on USA equities going into this correction.

When is a fall a fall?

Mind you, the fall has barely started. Jeremy Grantham describes how these corrections start with the riskiest stuff. Maybe that is why, until today, FTSE hadn’t moved yet.

In fact my portfolio – and its graveyard – are full of surprises.

I have a few ‘spec tech’ holdings that are down over 30% – e.g. HUBS, DOCU, ESTC. So is Homeserve, though Homeserve’s decline pre-dates the recent woes by several months.

And my big tech is down materially – Amazon down to $2800, MSFT, GOOG and so on down 12-15%. Not nearly as big a drop as the ‘spec tech’ but more impactful to my portfolio due to my substantial holdings in a couple of these.

But, reflecting FTSE remaining at 7300+, some stocks I gave up on a while ago though are doing OK – HSBC is above £5, and Shell is above £20.

What’s worse than a drop? A leveraged drop

And of course I am hot off the heels of borrowing a seven figure sum to buy a Coastal Folly. This leaves my portfolio materially leveraged. What happens to leveraged portfolios when they fall in value? Their value falls faster. Ouch.

My headline leverage is a little bit painful. But this ignores my desire to not touch my tax sheltered assets. So my leverage of ‘taxable accounts’ is somewhat more painful. And I don’t have every account margined, which means that the accounts that are margined are even more painful. I have one account in particular where I need to pay attention already.

What’s going on?

The proximate cause of the market turmoil isn’t the impending disruption when China, the world’s second biggest economy, gets its first major Covid (Omicron) outbreak and shuts half its economy down.

Nor is the market appearing to react adversely to the impending World War III that Russia may be about to launch.

Nor, even, is the market having the jitters about inflation rates of 5,6, 7% – levels we haven’t seen since 1991.

The market’s wobbles are being blamed on the rise in interest rates, led by the USA’s Fed, which at a stroke have changed the narrative from ‘money made in N years time is worth the same amount today’ to ‘any money you have to wait N years for has a significant discount today’. In fact the FT argues that it was precisely the sense that the covid-19 pandemic made it very difficult for central banks to raise rates that helped accelerate the stock market boom over the last 2 years.

Back to basics

So while the Mr Market is throwing a wobbly, I have been reflecting on my stance.

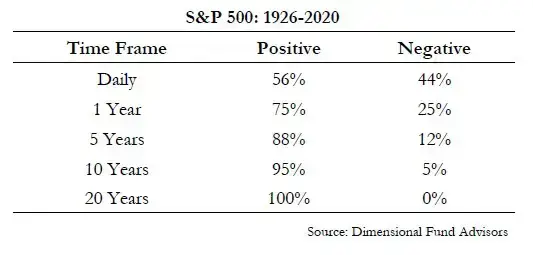

I am a reasonably wealthy investor, with a long term view. Touch wood, I don’t need to rely on my investment portfolio for at least 10 years. And even if I had to rely on them from tomorrow, they should be more than sufficient. That perspective has me allocating heavily towards equities – which over 10+ year timeframes almost always go up (see table below).

My equity investments are diversified globally. With the huge boom in the USA stock market, this means they are approximately 50% held in the USA. But beyond that they are almost everywhere. About 20% UK, about 6% Australia, around 10% EU, around 10% Asia. Very little in South America or Africa.

Inflation, what is that to you? To me it says you need ‘real assets’ (as distinct from ‘nominal assets’). The classic ‘real assets’ are buildings. But equities are not far behind. If you own 0.0000X% of Apple, or Amazon, or Vodafone, or HSBC, this percentage isn’t changed by inflation, or war, or an abrubt loss of confidence. So if after the dust settles, everybody is earning twice as many pounds and spending twice as many pounds, then ultimately HSBC’s revenues, and Amazon’s revenues, and so on are going to be twice as big. And the share price will be, other things being equal, twice as high.

The wrong thing to hold in inflationary times are ‘nominal’ assets – things based on the number on the tin. The most extreme example is cash – where the note itself says ‘I promise to pay the bearer on demand the sum of [£10]’. It doesn’t say ‘I promise to cough up for two pints in a London pub’. If London pints end up costing £11, then the bearer is going to have to order half a pint, and won’t be able to drink the change. Whereas if I own shares in Fullers, and if Fullers still brews beer (which in fact it already doesn’t!), then as Fuller’s revenues have grown in a ratio of 11:5, so should my share price, touch wood.

So in fact the classic guidance during inflationary times is to hold nominal liabilities – i.e. to borrow a fixed sum of money. That debt becomes less and less material as inflation whithers it away.

Do I need to revise my investing principles?

My basic principles remain sound, I believe.

Equities continue to make sense, from both a long term point of view, and a ‘real asset’ point of view. I need to be careful that I am not forced to sell any at inopportune times by market tantrums.

Global exposure continues to make sense. Nothing about the current meltdown is country specific. If I had held a lot of Ukrainian assets I might be avoiding them, but I don’t.

My recent move to lever up my portfolio, from the point of view of falling equity values, looks badly timed. But from the point of view of high inflation, having more debt makes sense. It has allowed me to own more long term assets. .

To paraphrase the boxer Mike Tyson, all plans make sense until you get punched in the face. The punch I risk taking is that the market plummets to a level that forces me to sell holdings – or worse, triggers my broker to sell my collateral holdings – my long term assets – for me.

So, I have two short term objectives at the moment:

- Objective 1: Hold onto my investment assets. No net sales. Selling one to swap for something better is fine. But ending up holding less than I started with, unless matched by a reduction in my liabilities, would be a #fail.

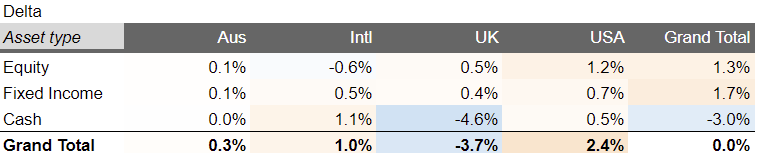

- Objective 2: Maintain my exposure within target. First of all, I need to correct my current imbalance, which means reducing my USA exposure – I can justify being at target, but not being overweight. So I am trimming my USA holdings and topping up with International equities assets. Next, I just need to keep trimming any new deltas, to let rebalancing do the work of Selling High and Buying Low. As of today my delta vs target is shown below – you can see that the equity dips have already pushed by Fixed Income exposure overweight noticeably:

And in the meantime I am scrutinising my positions. Key holdings like Google and Facebook I see as very inflation-proof. Berkshire Hathaway will be fine. So will Nestle. I’m not so sure about Amazon, JP Morgan, or Disney – they might stumble, or present possible buying opportunities. My ‘spec tech’ holdings are very beaten up, but they weren’t enormous to begin with, and I am still sitting on paper gains. I suspect ESTC, which is now close to its IPO price despite being 5x bigger, is oversold.

This won’t be the last report on this journey. Seatbelt duly fastened….

Very timely article. I have been wondering if I should swap out equity for bonds for a short term( 1 to 3 months) & then swap back in. Buy that doesn’t guarantee buying back at lowest prices as no one knows what the bottom would be. Instead, with nervous hands, have placed a small buy order for global equity index fund.

Fingers crossed!

LikeLiked by 1 person

Very interesting article

On your previous article regarding feeling rich I almost posted ….well a thirty per cent decline in markets and a healthy dose of inflation should see you right….!

I found the margin article very interesting to read btw. I had thought about something similar. However I ultimately took out a five year fixed interest only mortgage at 0.94% (no longer available) which was considerably more hassle than a margin loan but provides more certainty.

I think in your position I would still find a long term fixed mortgage myself. Markets could (no idea) fall substantially – it’s interesting to see just how sensitive markets are to rates which haven’t risen much in absolute terms yet.

On inflation and equities – fullers is a nice example. In the short term if prices go up I fear people will just go to the pub less. Equities have generally been a poor hedge in the short term to inflation but as you say good in the long term as generally wages eventually catch up. The FTSE 250 looks reasonably good value albeit domestic inflation, taxes, brexit and geopolitical factors are the obvious risks.

I took our the mortgage to invest on a DCA basis in financial assets and also hopefully in real estate and hedge out against inflation. Will see what happens over the next five years.

LikeLiked by 1 person

Perhaps we should all chip in and get Grantham a copy of “The boy who cried wolf” – he’s been calling for a crash for as long as I can remember…

I don’t however disagree with the bulk of his observations.

LikeLike

Saying there will be a crash is easy, and not very valuable. Saying when it starts and when/what level it will stop would be very valuable , and can’t be done!

LikeLike

The trick is to call for the crash every month for a decade, and then when you’re eventually right, just highlight the most recent call and say “see – I told you so”, and then bask in the mass media glory.

LikeLike

Nice one as always. I was just explaining to my partner that interest rates and inflation are denominators in the main method used to value assets (CAPM) despite it being very imperfect. All she has to do is read your blogs!

Another thing to look at, my modest addition, is the weight of index constituents. When Netflix crashes it brings down the benchmark even if the rest are OK. I don’t mean to be in denial of the correction, but, like you, it’s important to look at each position individually: monitor/cut the vulnerable, double up the strong businesses.

You are right (no news) equities historically are one of the best assets to own in inflationary times. On leverage: I bet that behind closed doors a few governments are blessing finally the onset of inflation to improve their D/gdp ratios.

LikeLiked by 1 person

Tax sheltered ISAs could be a temporary fix if you’re over feeling over leveraged and need a quick cash injection. Flexible Stocks & Share ISAs allow you to withdraw all funds as long as you deposit them again before the end of the tax year. Not everyone offers these though, for example Interactive Investors don’t whilst Vanguard Investor does.

LikeLiked by 1 person

[…] The market’s in freefall: what should I do? – Fire V London […]

LikeLike

[…] The market’s in freefall: what should I do? – Fire V London […]

LikeLike

I wouldn’t worry too much about interest rates. The Fed cant afford for rates to rise too much due to their debt repayments. They have to finance a 3 Trillion dollar budget deficit. Tapering might be the current buzzword but they will have to keep stoking the fire under the stock market to keep the baby boomer generation happy.

More worryingly when did Fullers stop brewing beer……

LikeLiked by 1 person

[…] Der Markt ist im freien Fall: Was soll ich tun? – Feuer V London […]

LikeLike

[…] The market’s in freefall: what should I do? – Fire V London […]

LikeLike