(Republishing an old post which I somehow accidentally deleted)

It’s the end of the third quarter. As the summer comes to an end and we approach harvest season, I am struck by the analogy between farming and portfolio management. I’ve been doing quite a bit of farming in the metaphorical sense. Let’s take a look.

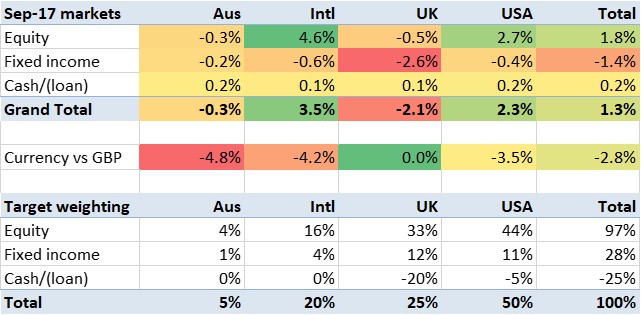

- Adjusting my business plan. For my portfolio, a key part of my business plan is my target allocation. As my deleveraging continues, it’s time to revisit my target allocation. I’ve now reduced the net debt target by 10% of my portfolio value. As I do this I also need a compensating drop in the ‘asset’ part of the balance sheet. So now I’ve been revisiting the appropriate mix of assets – is the mix of ‘arable’ (equities) and ‘wheat’ (fixed income) still the right mix? Overall as I deleverage, reducing my risk level, I am slightly increasing my target equity exposure. The table below shows the changes, and the resulting new targets are further down this blog post. You can see I’m also, indirectly, increasing my US weighting (to 50%) at the expense of my UK weighting (now 25%).

- Move one of my ‘mortgages’. I have two portfolio loans, and borrow in both GPB and USD. I only recently noticed that with US interest rates on the rise there is now a significant difference between borrowing costs between GBP and USD. My UK bank charges me around 2.50pc for borrowing GBP; my broker charges less than 1.50pc for GBP, but about 2.5pc for USD. By shifting some USD debt into GBP I save. Hence the business plan’s change on cash is all in the USA column. I am not a forex trader so this is not a bet either way on GBP or USD – it’s just arbitraging the interest rates. Already, I’ve moved around £100k this way, saving me around £1k pa.

- Selling a ‘field’. To deleverage I need to sell assets. Normally I hate selling. But if the asset is owned by the bank anyway, and I repay the bank with my proceeds, then my net position doesn’t change – only my risk levels and my exposures. The question is what to sell. I’m mostly selling fixed income holdings, as long term I prefer equities and the fixed income was mainly there to smooth returns.

- Moving a ‘fruit tree’ away from the ‘taxing squirrels’. Some of the work required to manage my ‘farm’ is to reduce fees and taxes. My main effort here has been to shift assets into Mrs FvL’s name, as well as into my Ltd company. She is a basic rate taxpayer and I am a higher rate one. I’ve moved about £30k around in Q3; not as much as I’d hoped but still useful. If this makes 3.5pc and I’ve saved 20pc tax then this is £200 pa. For one quarter’s work this is OK.

- Paying down the ‘mortgage’. Deleveraging continues, as repay my portfolio loan. I’ve done pretty well in Q3 on this, and have got my loan-to-value ratio down below 25pc. My farm would have to drop in value an unprecedented amount to trigger foreclosure.

- Topping up the farmer’s wife’s pension. My own pension is big enough to be on track to exceed the Lifetime Allowance. If if my investments do well then the taxman will penalise me. But my wife’s pension still has some way to go. So I’ve topped it up by £5k. In theory, at least ; right now the SIPP provider can’t trace the payment.

- Off to the market, but to buy not to sell. As usual this little piggy’s assets have been productive, with several of the animals providing me with income. I’ve redeployed these funds into a mixture of ‘arable’ assets (equities such as Disney, WPP, QCom – more details here).

But enough of my farming. How did I finish up in Q3?

Looking back at Q3 the most obvious market developments felt currency-related. But it is noticeable how equities – particularly US and European equities – rose significantly. Being long global equities and hedged on the the pound has felt like the right strategy throughout.

In September in particular we saw a big jump in the value of the pound. At the same time, and unrelated (unlike FTSE movements), US/European equities rose significantly too. Fixed income fell slightly – the more so in the UK where foreign investors presumably marked prices down as the currency rose.

.

Sure enough, my investment portfolio lost 1.2% in September. This was roughly in line with my market exposure.

In terms of my three financial goals for 2017. I had a very similar Q3 to Q3. I was pretty successful in sticking to my target allocation. I haven’t tracked my spending/cashflow properly but my earnt income remains unusually high at the moment and I am pretty confident I am living within my means. And I have fallen further behind on my objective of moving £200k this year into Mrs FvL’s name. Overall I would say I got a PASS, PASS, FAIL again.

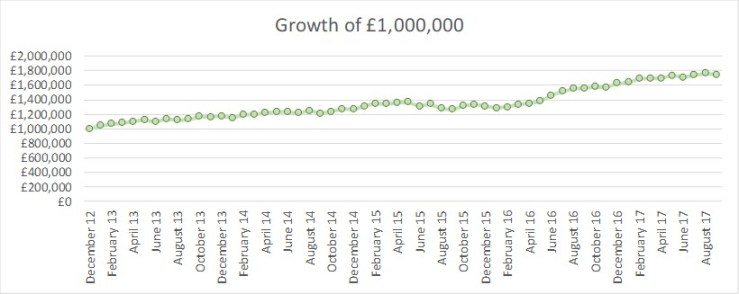

Q2 saw the portfolio grow by 2.2%. This is close to the long run average. So while the farm feels in many weeks like a hive of activity, in reality it’s just business as usual.

If you’re moving your debt into GBP, you are essentially taking additional short exposure to GBP aren’t you? If GBP strengthens you debt is going to have to be repaid with USD (or whatever you have liquidated to repay the loan). So I don’t think it’s quite as simple as an interest rate arb – it’s also essentially a short GBP long USD position?

LikeLiked by 1 person

Interesting question.

I want to make sure my debt in any currency is always very well covered by the assets in that currency; my exposure is roughly -20% cash and +45% equities/bonds, so I still have a healthy +25% UK net position. If GBP strengthens then UK equities tend to drop but bonds needn’t, so I should maintain healthy cover. I would not want to have to crystallise USD to repay GBP but don’t think I will need to.

And to the extent that I *did* want to make a bet on the GBP it would be a bet that it weakens, not strengthens, so this would encourage me to have more GBP debt in any case.

LikeLiked by 1 person

Makes sense, and sensible that your debt is covered by assets. I guess my point is that (in addition to the interest rate arb) you *did* make a bet by exchanging your USD debt for GBP debt, so it’s good that it was in the intended direction. 🙂

I’m personally on the other side of that bet in that I’m bullish on GBP with a 5-10 year view (when hopefully the dust has settled from the whole brexit fiasco and normal operations can resume). I always like to back the truck up (with a long term view) when I see a currency at extremes on a 10-15 year chart.

Always interesting to read your posts, and I’d also be curious to hear about the motivation for using a LTD company for housing assets – I presume in your situation being a higher rate tax payer one of the big motivations is the relatively lower corporate rate of tax which will allow the assets to compound (net of the relatively lower tax burden), and you can then withdraw them from the company at more suitable times in future (e.g. when your personal income is lower in a particular year, or you’re domiciled outside the U.K.)? I’m out of the UK for tax purposes currently, but considering it as a domicile again in future, so it’s useful for me to understand what’s possible so I keep my tax models up to date.

LikeLiked by 1 person

@Grasmi – Thanks for the attention! Sorry for belated reply. This is just a quick note to say that I don’t put housing assets in the Ltd Company, tho I do have some commercial property assets in it. Motivations/benefits/costs of the Ltd have changed a little over time but but yes the lower corporate rate is a big plus point. It is a trading company though in danger of having the investment side overtake the trading side before too long!

LikeLike

Thanks for another interesting post.

Would be great if you could do a piece detailing your thinking re limited company. Eg, overall reason for this vehicle, whether this only contains investing P&L or other income, what items you deduct, etc etc.

LikeLiked by 1 person

[…] Down on the farm: Q3 portfolio review – Fire V London […]

LikeLiked by 1 person

Hi FvL,

Good to see that you are moving things to a more tax efficient approach – just out of interest when you put money into Mrs FvL’s SIPP do you get the full tax refund at the higher rate or just the 20% uplift?

Good work on keeping to your target allocation, especially in reducing overall net debt as well.

I am going to have to look into the margin loans as from what you say that would appear to be lower than our current mortgage! Only question would be if I can get the right balance – or even split the loans, but I probably wont get round to it!

Cheers,

FiL

P.s. I love the idea of taxing squirrels – given they seem to have a propensity for burying nuts in some of my plants I think I may need to start charging them 😉

LikeLiked by 1 person

Hi FiL

Thanks for your comment.

The contribution to Mrs FvL’s SIPP is actually from my Ltd company; this ensures that it goes in gross i.e. free of any tax.

I think of squirrels as taxmen – they take away my assets without my control – and try to avoid them (while obviously not evading them)!

LikeLike

Hi FvL,

Ah a very sensible and efficient approach to tax planning – I like it!

Given how much the taxman tries to take would it be closer to anteaters than squirrels? 😉 Although the squirrels works better!

LikeLiked by 1 person

[…] to patch up my roof. My Loan-To-Value is now below 24%. I’ve got further to go to reach my latest target allocation, at which point my LTV will be 20%. But I’m under […]

LikeLiked by 1 person