Phew, what a month.

I thought December was nerve-wracking. Check out how January compares – the UK/US equity markets fell almost 10% in the first 20 days and then clawed most of this back at the last minute. Bonds had a much smoother ride, unlike December.

Those of us, er, trying to fund a major house purchase out of stocks/bonds must be Stark Raving Mad. Not to mention anybody actually borrowing money backed by a portfolio of this rollercoaster.

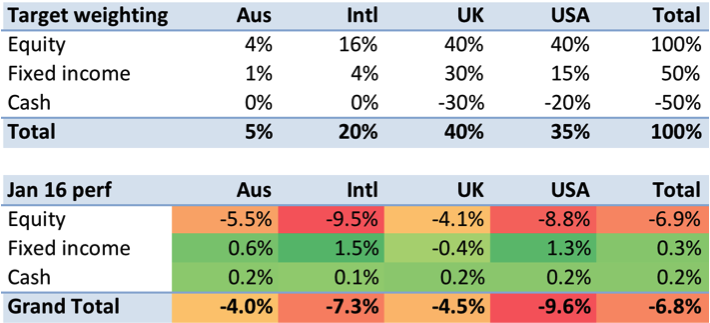

When you look at the returns by asset class and geography, you see two things clearly:

- Bonds up, equities down.

- USA worst, UK least bad.

Where does this leave me? Well, based on my target allocation, the market has fallen 6.8%. In the month. One fifteenth of its value down, in one twelve of the year. Heavens. In fact it’s worse than that, because right now I’m not at my target allocation – I remain overweight in equities (which are down) and the UK (which is the least bad). The market I’m actually exposed to fell by about 7.8%. This really is down a twelfth in a month.

The truth is, I’m lucky. My actual performance for the portfolio I manage was down only 2.2% (though I need to caveat this because unitising my portfolio has been particularly complex with the number of transactions I’ve been performing, so I may yet need to correct these figures). I outperformed my markets by about 5%. How did I achieve this? Mostly, because I was very fortunate with my sales – the bulk of my sales were the week either side of Jan 1st – as my graph above shows this was the right time to be selling. I was selling in one account and bulking up in my marginable account and I managed mostly to buy at lower prices than I’d been selling at. I’ve been range trading FTSE-100 and that strategy, again, continues to broadly work.

Nonetheless, negative 2.2% isn’t helping my performance. At least my worst drawdown remains unscathed at -7%; with my leveraged portfolio this number is particularly key to me. I await February with some trepidation.

Always find these monthly posts interesting. Thanks. As we’ve discussed previously my portfolio carries less volatility risk than your good self. In ‘good times’ I lose out (or is that I am thumped) in comparison as we’ve seen. In ‘bad times’ I should win out and we see that today. For January I’m down -0.9% vs your -2.2%.

Will be interesting to compare over the very long term.

LikeLiked by 1 person

If you are down 0.9% – on a unitised basis (i.e. ignoring ins/outs) – in the month then you haven’t much market exposure at all. Well done, for now!

LikeLike

Yes, whenever I report returns it’s always net of ins/outs. January was almost a perfect demonstration of the intention behind my widely diversified portfolio. I have plenty of market exposure, it’s just a lot of differing markets. This month falls in all of my equities was nicely counteracted by a 9.7% increase in my gold, a 4.0% increase in my index linked gilts and a 2.0% increase in my European property. Exactly what I hoped I’d see when I set my strategy all those years ago.

LikeLiked by 1 person