The temperature in the Middle East got even hotter in April, with Israel and Iran trading attacks on each other’s sovereign buildings/territory. Somehow World War III has never really seemed in danger of breaking out but it is a reminder that only change is constant.

Over in New York Donald Trump was falling asleep in court. You have to hand it to him he knows how to stay in the headlines.

The markets in April

Meanwhile the UK stock market continues to fill newspapers for the wrong reasons. Amidst all the doom and gloom – heightened at the end of the month by the takeover of Darktrace, a rare UK tech stock – you might have missed that the FTSE-100 is not only at a record level but in fact outperfomed other markets significantly in April.

All the markets seem to want to know now is when interest rates are coming down, and how fast. April saw expectations of cuts dampened / postponed, which appears to have dampened valuations of both equities and bonds. In the US this was heightened by an increasing sense that the AI-driven tech boom may have got a bit ahead of itself – there is still little to show for concrete extra revenue / cost savings (bar a few notables such as Klarna) but plenty of increased infrastructure spending.

Markets, weighted by my exposure, fell by 2.2% in April. Currencies stayed fairly stable, a slightly stronger AUD notwithstanding. This means my benchmark fell by 1.6%. This was broadly in line with my portfolio’s return for the month – which dropped 1.3%.

New UK tax year

It’s a new tax year in the UK, which means it’s a fresh set of allowances for tax-free ISA accounts. I have had quite a shortage of cash / drain on funds recently, but I’ve managed to ringfence a couple of chunky dividends to use for topping up my ISAs. As at the end of the month I have topped up my and Mrs FvL’s ISA accounts by about £30k. I was expecting a mini windfall shortly and will use that to complete this year’s topup (£20k per person, £40k in total). Thanks to strong investment returns over the last year, my ISAs are very close to the £1m mark – but I will dive into that more in a future blog post.

Mortgage refinancing – borrowing to lend?

I’ve also had a property remortgage to organise recently. In the unfavourable mortgage climate, this has been a difficult and tedious process. I’ve finally got the deal through, but with a smaller mortgage than I had hoped for. As a result I’ve had to fund some of the refinance myself. I’m putting some of this financing on a medium term basis but I’ve also had to provide some short term funding to cover a cashflow gap in the property venture. That gap that should be closed within a couple of weeks. In the end I decided to exploit my margin loans to raise these funds; this avoids me needing to sell assets / crystallise gains. While the cost of these margin loan funds is quite high, it is roughly in line with my returns from the property venture. So my costs are covered (ignoring taxes) and the convenience benefit of the margin loan is high.

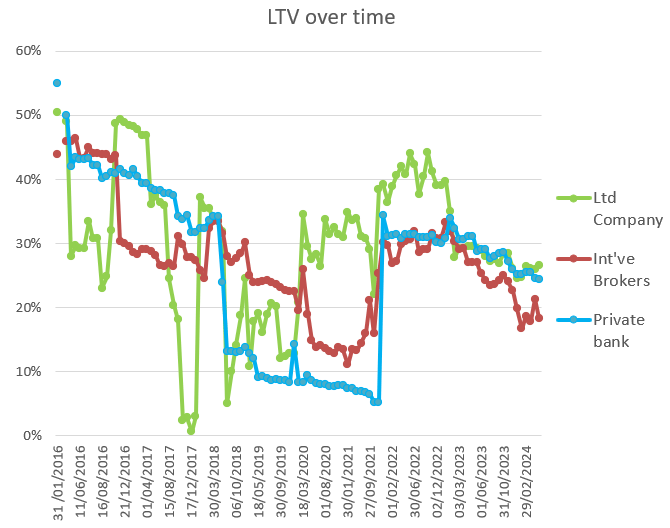

The property venture’s cashflow gap was closed a week after I funded it. And in the end I received my mini windfall right on the last day of April. This means I was able to restore my margin loan to its position at the start of the month, just in the closing hours of April – so there’s nothing to see on my monthly LTV chart on my returns page. But if you’d been tracking the chart mid month you’d have seen a temporary blip up in my LTV. And here’s the more detailed view, by source – where you can see I used my Interactive Brokers margin loan (despite it being an annoying faff these days) to raise cash in a hurry.

How did using the margin loans to fund the cashflow gap in the property venture? I thought IB didn’t allow the funds provided through margin loans to leave the account (isn’t therefore their only use to buy other securities)?

LikeLiked by 1 person

IB makes it a lot harder than it used to be – but if you read the comments on my May Day blog post about it you’ll see there are ways to do it.

LikeLike

also just funded the ISAs. Similarly Feels like the seven figure ISA is in sight now. Will be interesting to see where things are in a years time.

LikeLike