It’s the end of the month and the end of the quarter. This is a combination post with my usual monthly portfolio performance along with a quarterly review of how I’m progressing on my goals for 2017.

What happened in March? The UK saw its first terrorist outrage for years, with the disgusting car/knife attack at the Palace of Westminster. While five people died (about the same as an average day of car fatalities, in fact), over 70 people were injured – which is thousands of people in families/friends affected. It reminded me of the January Melbourne attack, in which a malcontent killed five people and injured 30 in a drug-fuelled car-only attack on the busiest street in the city centre.

Why in London there were twice as many people injured (or half as many people were killed, relative to total casualties), as in Melbourne I have no idea but would be interested if anybody has any insights.

What I can say is that I think London’s authorities/emergency services did an amazing job, with the criminal apprehended (erm, shot fatally) 80 seconds after the attack started, no collateral damage and lots of heart-warming stories of common sense, thinking under fire, charitable support and so on.

The other thought that will have occurred to lots of us is how thankful we Brits should be for our (almost) gun-free culture. Extremists in the US do a lot more damage far more easily.

From an investment / UK markets perspective the big event was probably the UK government formally triggering Brexit via Article 50. This event was so well choreographed that it had a negligible impact on the markets. While I am no defender of the current UK government, in fairness to them they ended up implementing a Brexit process that they had laid out around six months ago, with zero amendments. They do deserve some credit for remaining in control and being true to their word.

By contrast, March also saw the UK’s first budget under the new(ish) regime. This led to a farcical U-turn around National Insurance (the UK’s social charge, a.k.a. a tax on work). Unlike the Brexit saga this showed our senior leaders at their anti-leadership worst, in a petty dispute which did nobody any credit. But nothing in the budget made any impact on markets /etc either.

Overseas, the main news in the markets was the defeat of Trump’s repeal of the Obamacare bill. This wasn’t what pharma investors wanted. But the wider impact is to call into question the Republican regime’s credibility, which in turn suggests they may not achieve the market-friendly changes to taxes and regulations that many hope for.

So in this environment, how did markets fare and how my portfolio perform?

You wouldn’t know it from the UK media but the European stock markets were up 4% in March – a pretty awesome result. In fact, across major geographies and asset classes, nothing really fell, except for overseas currencies against sterling. US market gains were very small, thanks to the disappointments from Trump/the Republicans. So the blended average constant-currency change was about 1.4% up for a UK investor with my target asset/geographic weighting. Given that 70% of my exposure is overseas, the fall in other currencies was a 0.7% drag on my performance. A perfect passive exposure should have seen me gain about 1.4-0.7=0.7% on the month.

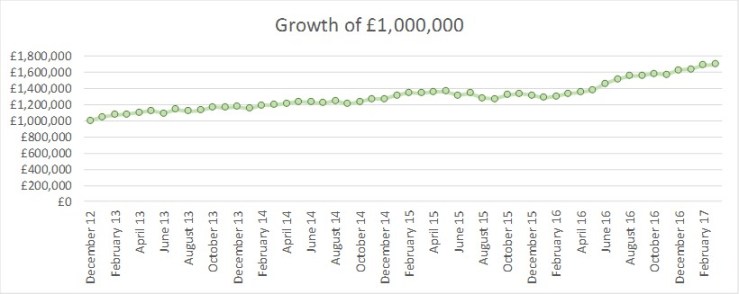

How did I actually do? My investment portfolio gained about 0.5%. Almost, but not quite, what I should have seen with a pure passive exposure. Why the lag? I haven’t looked into it carefully and am not really bothered on a one month basis.

Yet another month of gains leaves me feeling slightly giddy. And this giddiness has had me focusing hard on one of my three goals for 2017. Let me turn to those next.

I had three financial goals for 2017.

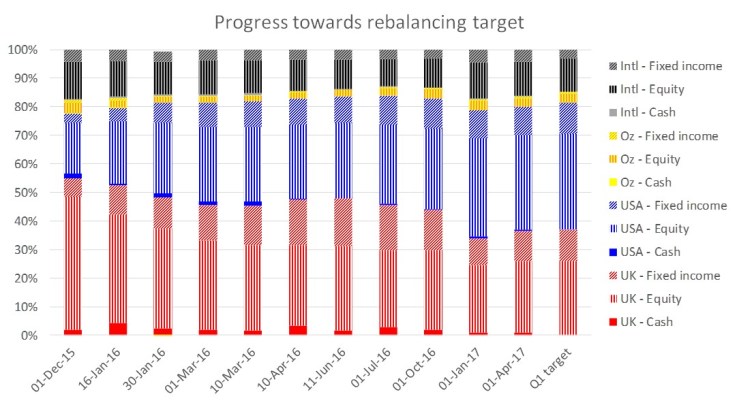

The first goal was to stick closely to my target asset/geography allocation. I finished Q4 with a very different exposure than I started, thanks to a big sort-out of my private bank. At the start of Q1 I updated my target allocation, but was still significantly overweight in equities and the USA. As markets have risen in Q1 my overexposure to equities has worsened. At one point I had 4% more of my portfolio in equities than I wanted. This isn’t in itself a disaster but when markets are at record highs, the bull market is one of the longest on record, and you lack confidence in policymakers, there isn’t a good reason to be overweight equities.

On top of that I am running a leveraged portfolio, i.e. borrowing money to invest in equities. In January 2016, I had a strong conviction that this was a prudent bet, and in fact that bet paid off handsomely. But right now I have a (weaker) conviction that leverage is not my friend. As well as being overweight equities by 4%, my excess borrowing amounted to 4% of the portfolio too. So I’ve been trying hard to pay down some of my margin loan. In theory I just need to sell equities, and repay my margin loan. In practice I have found it hard to decide which positions to trim, and which moments to seize. No trader, me. Overall last quarter I paid down debt by around 2% of my net portfolio value, using proceeds from selling various equity positions. My overall loan-to-value has fallen in Q1 by about 1.5% to about 28%, from a Feb ’16 high of about 38%. I’m pleased with this progress, even though most of it is due to market gains.

The other small annoyance to record is that I am overweight on ‘International’ – mostly Europe. I would be delighted to sell some of my Fixed Income exposure here. However I can’t; the bulk of this is a fund I was sold by my private bank and I can not sell it for a few more years. Nor can I margin it. Even without considering its high fees, I regret holding this more than ever.

At the end of all this I have got almost all my allocation/geographic exposures to within +/-2% of my portfolio value of where they should be. This is solid progress, and I’m going to treat this goal as PASSED admittedly not with flying colours. The exception is my cash/borrowing situation where I am overextended in £pounds, by about 4% of my portfolio. I remain slightly overweight on equities, and in ‘International’, but not by much.

My second 2017 goal, about spending/cashflow, is a bit of a pain to measure and track (not very SMART, basically) so I’m not yet ready to assess it. I’ve been musing over how best to think about spending proceeds from selling stock market gains, without reaching a firm conclusion. Yes, you guessed it – I’ve been overspending and don’t want to confront reality. Not yet at any rate. In the meantime this goal is FAILED.

My third 2017 goal is about tax efficiency, and moving £200k into my wife’s name this year. This is pretty easy to measure. How’ve I done?

As we speak I am waiting for a (fairly small) contribution into my wife’s SIPP contribution to show up in her account. Fingers crossed it appears this tax year… But given that it’s definitely left ‘my’ pot and will end up in ‘hers’ at some point I’m counting it.

My big win in Q4 is moving a decent sum into my wife’s Fidelity account. This will takes her into the ‘big investor’ (>£250k) category at Fidelity and reduces both her and my platform fees by 0.15% per year, i.e. roughly a 15% cut in my Fidelity fees. This has been on my mind for months so I’m pleased I’ve accomplished it. I find it annoying that though the discount applies to all the household accounts, the threshold test is applied to individual accounts so you need one of the household accounts to exceed £250k to qualify. But anyway we are now there, barring stock market crashes.

In case you’re wondering why I didn’t make a bigger contribution into her SIPP and a smaller one into her unsheltered assets, this is a fair question. I am not so wedded to pensions to be aggressively maxing them out; I value liquidity and don’t like locking funds up in pensions for years (even more years, after the news last month); I fancy my chances of hitting the Lifetime Allowance limit even off a low base; I don’t trust the government not to meddle further in an unfavourable way. You get the idea.

Between these two shifts I’ve moved £50k into my wife’s name, which is exactly on track for moving £200k over the full calendar year. This goal is PASSED. It’s not looking likely I will deserve any bonus points for moving it all by June however.

In conclusion, I have been spending quite a bit of effort/time on the portfolio, and have some results to show for it. I’m a bit less exposed to a stock market fall; I’m a bit more tax-efficient; I’m a bit less indebted. My portfolio has roughly tracked the markets, which have had a good quarter. Certainly my portfolio has earnt a lot more than I have in Q1. There is much to be thankful for.

Well, I’m glad you’re rebalancing and getting the gearing down. Even though not doing so has done wonders for you over the past 12 months!

On a long enough time horizon, and all that malarkey… 😉

LikeLike