Another month, another stream of Trump headlines. You have to hand it to him, he certainly knows how to drive the ‘ratings’.

However for me the biggest news of the month was Kraft/3G’s aborted bid for Unilever. Unilever is one of the biggest companies in Europe/UK. Its share price has done pretty well of late, courtesy of the ‘flight to safety’ and the ‘bond proxy’ trends towards the reliable defensive inflation-proof stocks that it represents. But the fact that Kraft, a company with less than half its revenues, can table a bid for it including a takeover premium suggests there is obviously significant room for further value creation. I’ve got a reasonable position – of a ‘buy and hold’ type – so I’m paying attention.

Meanwhile, how have the markets and my portfolio done this month?

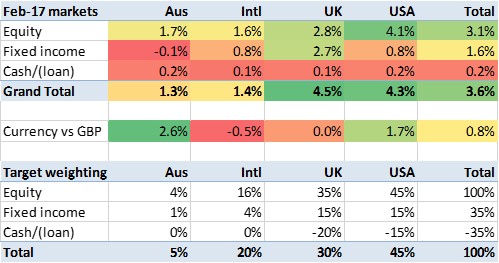

We’ve had another month of the Trump-driven equity rally. In the USA equities rose over 4%. The UK saw an almost 3% gain in the FTSE-All-share, and the Oz/other markets I track were up over 1% too.

Fixed income was a mixed bag. The UK saw bonds recover 2.7% from their recent dips, but elsewhere the rises were muted.

Overall based on my target (leveraged) weighting markets went up 3.6%.

How did I do last month? My investment portfolio rose by 3.2%. Slightly less than the market, but in the zone. I don’t immediately know why I underperformed; I am slightly overweight equities and the US, and overly leveraged in the UK, all of which should help me. I suspect I am underexposed to mining/banking/similar and that thus I didn’t capture whatever drove such strong equity performance in the UK/US.

Another decent month leaves my last 12 months at +30%. Happy days. Happy, unsustainable, days.