Last year was the end of an era. I sold the Modern Flat, after owning it for over 20 years.

A bit of history

I ended up with my Modern Flat in that common way that many ‘accidental’ landlords have. It was my first rung on the property ownership ladder. Until it was time to get onto the second rung. I thought I’d live there for several years – though in practice I lived there less time than I had originally expected.

The flat itself is a new build flat in central London, to a reasonable spec. It is slightly bigger than average, but has no outdoor space whatsoever. I loved living there, albeit that was a long time ago. It had a great reception space but rather cramped bedrooms with insufficient storage. This suited me fine – bedrooms are for sleeping in, and living rooms are where you live. The building had a residents’ association, a management company, and a porter. I bought the flat on a long 200+ year lease, and had to sign up to both a ground rent (doubling every 25 years) and a service charge (set by the management company).

I managed to climb onto the second rung without selling the Modern Flat. Instead, I kept it, ever since, I rented it out. This isn’t, strictly, a ‘buy to let’ property in that I didn’t buy it to let it.

I haven’t strictly treated my Modern Flat as an investment. As an illiquid asset, I don’t track it as part of my invested portfolio. Nonetheless, my decision to sell it was mostly financially driven.

Buy to let financials – the theory

The case for being a landlord, as I see it, has three key financial arguments in its favour:

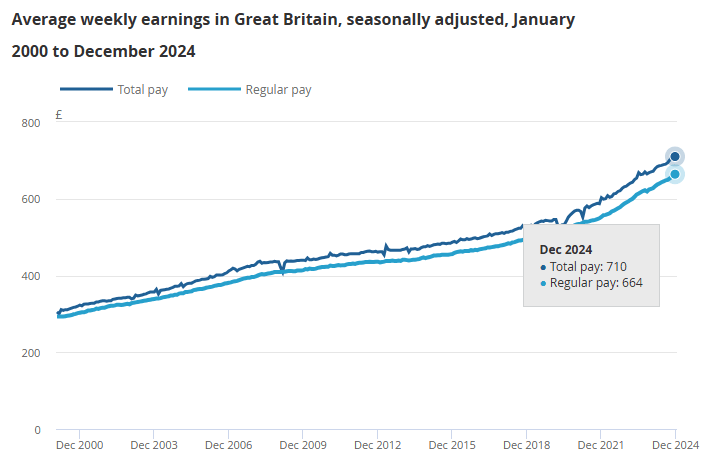

- An inflation proof asset. Bricks & mortar are the classic ‘inflation-proof’ asset. They are ‘safe as houses’, etc. Even in property crashes prices usually don’t fall too much in nominal terms. And if you get lucky you can see very healthy gains. Property prices are usually linked to wages, which rise faster than inflation (assuming some level of productivity growth). Since 2000, average wages have increased 3.58% per year, slightly higher than the CPI inflation index which has risen 2.65% p.a.

- With attractive regular income. Rent is a very tangible form of income. Your rental yield is probably between 3% (for a prime property in e.g. a quality London neighbourhood) and 10% (for a rather low rent student type property outside London). It’s usually paid monthly, and it almost always goes up over time. As above, economists will observe rents tend to rise in line with wages, not prices. My initial rental yield was around 6%, though more recently it has been lower. It’s worth noting that it isn’t necessarily compounding income – because you can’t readily deploy it right back into real estate – but it certainly promises to supplement the monthly cashflow.

- Boosted by leverage. Property is one asset class that people expect to fund via debt, at least partially. Mortgage interest is not a deductible expense for your own residence, but it is deductible on an investment property (though less so than it used to be before George Osborne’s reforms).

It’s worth mentioning tax here. Taxes here are relatively favourable, but have been worsening.

Gains from selling high buying low are taxed as capital gains, which has a lower tax rate than income tax. The good news is that the slightly higher rate that property attracted compared with other assets such as stocks & shares has been eliminated by Rachel Reeve’s October 2024 budget. Now all capital gains tax rates for individuals in England are 24%. Which is a lot better than 40% or 45% marginal income tax rates. CGT rates are the same across the UK, whereas in Scotland income taxes are slightly higher.

And of course income tax – which is how rent is taxed – is taxable at your marginal income tax rate, but subject to some deductible expenses including some relief for mortgage interest. The rules here are not as generous as they used to be but they still are a bit more favourable than for stocks & shares. But stocks & shares deliver a good chunk of their return through capital gains, which are taxed much more favourably. In contrast over the years your rental property’s return feels like it is mostly coming from highly-taxed income.

Annual real estate tax isn’t really a thing for UK landlords. In the UK it is called ‘council tax’ and framed as paying for local services such as street lighting, bin collection, etc – is a liability falling on the occupant, not the owner. In this respect it is quite different from, say, the USA’s system – as I understand it. It is also a relatively low tax by international standards; not that most landlords really care because they usually don’t pay it.

Buy to let – the practice

The financial arguments in favour of renting, laid out above, are not wrong. But they are incomplete and oversimplistic.

In practice, the real world doesn’t usually behave exactly like the theory describes. And specifically in my example of a relatively prime London property, as rented out here was my reality:

- Net rental yield of 2.7% was far lower than my gross yield of 4.9%, after deducting

- Service charge – of £7,500-£8,000 per year. Compared to service charges in central London these days, which often cover gyms/swimming pools/24-7 porters, this service charge was quite modest. The average for the building was lower but my flat was above average in size.

- Mgmt fee – to my management agent – of 12% of the annual rent. This is quite a high fee, though certainly not the highest it gets. A managing agent is something landlords would dispense with, but see Time section below.

- Ground rents – of £700 per year, after doubling recently from the initial £350 p.a.

- Insurance – a minor cost of £150 per year. Most of my insurance cost is handled under the service charge; this £150 cost is just for my contents (kitchen appliances, etc) that are not covered under the building insurance.

- Mortgage interest, at about 6%. This cost ended up being around 15% of my gross yield, thanks to a small mortgage. And since buying the Coastal Folly three years ago, I wasn’t repaying any mortgage principal – instead focusing my free cash flow on my margin loan.

- Leverage is expensive. As it happens, my mortgage was small; I originally borrowed 75% of the purchase price, but later repaid a significant proportion of the original loan. Meanwhile the property’s value has risen. So my loan has been under 15% of the property’s value for some time. For many years, post 2008, this cheap tracker loan was practically free money. But since base rates rose to around 5%, the loan has been a real expense. And only partially deductible. But if I’d had a five times larger loan, i.e. the original LTV when I bought the property, current interest charges would have put me into the red – even without making any mortgage repayments.

- Time/hassle – planned. There is a certain amount of regular faff that comes with being a landlord. Electrical and gas certificates need to be up to date, and renewed annually. EPC certificates need to be refreshed every 10 years. And so on. My property has been in pretty good nick so I haven’t had much work to do it. And I’ve had a managing agent to help co-ordinate annual certificates. But this is all work and stress that doesn’t come with stocks & shares. The looming drama is the tightening regulations about minimum EPC standards; my property was just about EPC C but only by a whisker. But anybody with a D, E or worse needs to make improvements by 2028.

- Time/hassle – unplanned. The unplanned work is the real dread. Fortunately I had relatively few “the boiler is broken” calls. But they have happened – and my managing agent was only really a conduit – she wouldn’t do anything without getting instructions from me. A washer/drier needed replacing, a dishwasher needed replacing, a boiler needed replacing, and that’s just what I remember. The time spent on these was not enormous – but the interruption value could be very annoying. A broken boiler does not respect a holiday, an important deal you are trying to close, or just a flat-out week. More significantly, I had a large building project nearby which led to a Rights to Light party wall process, which was quite a significant bother – requiring multiple professional advisers. I did get a useful cheque out of this process but it made dealing with the occasional Corporate Action elections in my stocks&shares portfolio seem trivially simple by comparison.

- No capital gains for 7+ years. With wage inflation averaging 3.5% a year, you’d have thought my property would have appreciated by about the same over that time period. What’s actually happened is that it appreciated quite significantly between 2000 and about 2015. But over the last 7 years I don’t think it rose in value at all, and in fact quite possibly fell in value by 10% or more.

- There is an additional kicker on the capital gains, which is tax. As an ‘accidental’ landlord, the first period of my ownership – when it was my principal residence – is tax free. But as the rental era grows, my tax-free period is shrinking. Which means that my capital gains tax liability is growing every year, even if the property value itself is flat.

This reality left me sitting on an asset which was netting me a total return of around 2.5% a year, pre tax, over the last 7+ years. This was ignoring the value of my time – which for unplanned interruptions is a very generous assumption. It also ignores the rising capital gains tax liability, which was around £1000 per year.

And – ouch! – the transaction costs

I resolved some time ago that this landlord lark wasn’t something I wanted to sustain. However I wasn’t so upset by it as to want to disrupt my tenant, and in fact my last tenant was a very good tenant in almost every way. So I let things sit until the tenant gave me notice he wanted to move out, almost a year ago.

I set about selling the flat. This is not something I have much experience in. I considered three agents, in the end appointing one who seemed to have the best understanding of the building and the local market. I negotiated an acceptable fee, though when you add on 20% VAT you are talking almost 2% of the value of the flat.

After a very opaque period of marketing and viewings, I received a small number of offers. I accepted one offer – in a small chain – and ultimately sold the flat to that buyer some months later, at that offer price. I didn’t get the price I was after but I felt that I had enough visibility into the market that I don’t think I was to far off. However potentially I could have held out for 2% more, maybe even 5% more.

As the dust has settled, the transaction costs are now clear. And they are painful.

I ended up completing on the sale almost six months after the tenant left and stopped paying me rent. This lost rent was over 2% of my sale price.

In actual costs, plus very clear opportunity cost, this transaction cost me 4-5% of the value. In potential value foregone, from a somewhat opaque market price, potentially I also endured a further 2% hit. This is fully a year’s gross yield, and an order of magnitude higher than what happens with listed stocks.

Returns analysis

So, what return did I get?

I looked at this in a 2023 blog post. As it turns out, this post overestimated my returns because a) since 2023 I have had no capital gain and b) the flat wasn’t worth as much as I estimated back in 2023.

The property value more than doubled under my ownership. This rise worked out on average as just under 4% p.a. When you allow for the Rights of Light payout, we can call it 4% per year.

My equity rose eightfold during this time. That works out as 9.5% p.a. compound return on equity. That is more respectable. Leverage made a big difference here. But very very close to my stocks/shares 14 year average return too.

My total return is higher still, as it would add in my net income (after fees/etc). I don’t have this recorded/analysed over the last 20+ years. In recent years the net yield has been around 2%-3% on average. But initially, when gross yields were higher, my return on equity from the yield alone was probably at least 10%. So on that basis my long run returns on equity have probably been around 15%.

Two key points strike me here.

- Returns are highly dependent on leverage – and indeed the cost of leverage. When interest rates were low, from 2008 for over 10 years, there was free money on the table – especially if you could pick properties that were appreciating in value. This was why the Tories started to first pluck, and then strangle, the golden landlord goose.

- Returns recently have been miserable. My total return over the last 5+ years has been under 3% per year. This barely tracks inflation. My decent long term return all happened in the first 10 years.

So, I’m out, and I’m moving my capital in search of better risk-adjusted effort-adjusted returns. More on that in a follow-up blog post.

How does my experience compare?

Those of you with rental properties, please share in the comments below how this compares with your experience.

And I’d very much welcome thoughts on how to deploy the capital released. In particular I’m looking for something which shares the same positive qualities as rental property, but with fewer of the negatives. Thoughts welcome!

Our only experience of letting was letting our own house when work took us away: we did that four times. It worked well. You may say we were lucky with our tenants but we may have been helped by a strategy we adopted.

We let in a university town. We decided we would never let to any teacher or student of Law, Economics, or Business Administration. We ended up with engineers, vets, and archaeologists – sensible, practical souls, and – it turned out – good eggs. British, Australian, Portuguese, Swiss.

I assume we didn’t break any law on protected characteristics but if we did, hard cheese.

LikeLiked by 1 person

I have a house in Liverpool, which is wrapped in LTD. Good thing is that property is cheap, so transaction cost of buying it was quite moderate.

Gross rent yields are actually around 12%. Expenses are quite small given there is no service charge / ground rent.

Big downside that capital growth is tricky as I bought through the auction and invested another 50% of the property value in renovation, which didn’t increase value of property proportionally, so over 3 years I am actually negative in appreciation.

Good thing is that all expenses are deductible as it’s wrapped in LTD.

however, THE BIGGEST downside is transaction cost, and mainly I am talking about time investment to acquire the property.

while I appreciate the good rental yields and probably keen to buy another property, I simple don’t have time go around midlands for viewings (I am based in London), negotiations, dealing with solicitors, etc.

so indeed, I am sticking now with stocks and shares for the future. Having liquidity and ability to buy an asset with few clicks are MAJOR upside (while returns seems the same or even better)

LikeLiked by 1 person

I have been a landlord over a similar two-decade period, with a portfolio of them in and around London, not in Prime areas. I relate strongly to your comments about the faff – it is remarkably easy to underestimate the cost of the faff, financially and personally, not just time but responsibility, interruptions, and uncertainties, and even when using an agent. Agents will often not deal with leasehold disputes, major works, court evictions, energy efficiency upgrades (at least not without chunky fees). My tenants do not want to leave (my tenancy lengths currently average over 13 years), partly because they are treated fairly certainly relative to some other landlords, but also because finding a new rental property in the current market is competitive and often difficult – this is a problem when I am keen to wind down the portfolio rebalancing more in favour of index funds, which I relish more of simply for not having tenants or toilets. For what it’s worth my experience is 10% of the rent often needs spending on maintenance to keep the condition fairly stable, but to improve condition over time 20%+ is needed, and that being especially so with the incoming energy efficiency rules (though if tenants are on low income or benefits or in certain deprived postcodes the Warm Homes: Local Grant will soon fund 50-100% of the cost of the works, even for landlords). I have seen a similar pattern of growth up to around 2016 and little since on properties in central and inner London, but some outer boroughs (historically more affordable, more traditionally working class areas) have done much better. I should also mention the Rental Reform Bill which will be an Act soon, and will make eviction harder (always a hearing, no online process, a valid reason must be given), no more Assured Shorthold Tenancy (being replaced with tenancies periodic from the start, esp bad for student lets where the annual cycle will be broken), landlord database registration, can’t take bulk rent up front, can’t accept rent above asking rent, landlord ombudsman, and of course more and more local authority areas are bringing in poorly designed landlord licensing schemes that cost a grand or two every five years and offer little to no benefit to decent landlords or their tenants. Increasing regulation will benefit some tenants and perhaps rightly so, but it will also reduce the size of the sector and of course some ex-tenants will buy, but many cannot or do not want to for flexibility, and government seems not to care where they are to live. Well done selling, enjoy the freedom from the faff!

LikeLiked by 1 person

Pre Tax Income ROI ranges from -1.48% to 8.1%

However I treat that as a payment – dividend if you like – for the lost opportunity cost while I wait for capital gains. So far I’ve made 140% capital gain across ten years – when you factor in costs of refurbishment – but market price capital gains of 250%. The property was a worse state than I expected lol.

Quick calc gives me a total annualised return pre tax of 4.37% all in. With a chunky CGT bill if I sell.

However, BTL lets you release equity, leading to me buying my residential property with cash, and avoiding paying for the roof above my head, quite a relief.

LikeLiked by 1 person

We have two rental properties, neither of which we originally bought with the purpose of letting them out. We’re very fortunate, but I also don’t enjoy it and don’t plan to do it for the very long term.

One is a 2 bed flat in central London. Probably worth £1.2m. Gross rental would be around £36k (lower at the moment, with long-term tenants). Take off steep service charge (£10k pa), and the fees of the management company (because we don’t live nearby and so can’t help the tenants promptly if anything’s needed), and cost of maintenance etc, and this is not a good rate of return. Unless the value of the property rises substantially – which it hasn’t done for the past 5-10 years, after rising a lot prior to that.

The other is a much smaller 2 bed flat in an East Anglian seaside town worth maybe £140k, with gross rental of around £9k and much lower service charge. A better rate of return.

We’re fortunate that both sets of tenants are lovely and, so far, have been there for several years quite happily. When either wants to move on we’ll reconsider things. I’m not quite sure where we’d invest an extra £1.2m but it’s, obviously, a nice problem to have.

LikeLiked by 1 person

Are you sure it’s worth £1.2mm? That sounds very high for a flat that only commands £3k a month rent with a service charge of £10k.

LikeLiked by 1 person

Well identical flats have gone on the market for £1mm to £1.2mm depending on various internal features over the last few years. Obviously, they may have sold for less than the asking price but that’s the ball park.

LikeLike

I have three properties on BTL in greater London area. Acquired in 2006. 2011 and 2013. Will start putting them on the market from 2026/27 before the mortgage deals start expiring which were locked in low rates for 5 years as the rates started increasing. As many have mentioned, can’t be bothered to deal with issues and keep up with regulatory changes creating burden.

Landlords have become an easy target since Osborne for successive governments and there is only so much they can milk the cow. It won’t be worth it anymore especially with high mortgage rates and can’t offset mortgage interest. Sucked it up until now but have decided to throw the towel in as the returns will be diminished going forth for the headache they create at the drop of a hat.

Investing in equities have fared much better for me and I feel comfortable with that and thats where the funds will end up. They don’t call up while I’m having dinner with some issues. I can deal with them from anywhere in the world.

Have had good long term tenants so will try and sell with tenants but if potential purchaser comes along and would like a vacant possession then so be it. The angle the Govt’s are going on by squeezing the private rental sector from every angle they could I think they’ll find themselves shot in the foot in years to come.

LikeLiked by 1 person

Regarding reinvestment options: it’s slim pickings. REITs are obvious but attract income tax outside tax wrappers. You could attempt to catch the falling knife of asset- rich investment trusts, or make a small allocation to a broad commodities etf. I’ll be interested to see what you plump for

LikeLike

Good stuff!

As for alternatives to BTL, I can’t remember if you’re a member (hopefully a stealth member? 😉 ) but I wrote a member’s post on one option six months ago:

https://monevator.com/better-than-buy-to-let-members/

There are other listed opportunities, as has been said above.

Heck even Land Securities said this week it wants to move 1/3 of its portfolio into residential! 🙂 The yield there is 7.5% and there’s no deductions from that when the tenant puts a metal fork in the microwave etc.

IMHO the only big downside on today’s listed valuations – ignoring individual tax situations – is for most people the lack of leverage, although I know you roll differently… 😉

And of course there IS leverage at the company level.

Personally I don’t understand why anyone would bother with buy-to-let right now given the discounts on publicly-listed options, unless you can add value yourself through refurbs, especially good/lean management, or whatnot.

Just my 2p — good luck!

p.s. flagged a typo over DM on X.

LikeLiked by 1 person

Pretty much my experience too. Have two remaining BTLs and they make no money after tax any more. Why even keep them then? Inertia, not wanting to evict the tenants (in one case reliable payer for over 20 years), Capital Gains Tax – plus the vague notion that one of the kids might need a London house one day. Once they are settled elsewhere we’ll probably be out.

LikeLiked by 1 person

We let out our former family home for 10 years. Good agent, mostly excellent tenants. Sold to existing tenant during the pandemic, agent waived their fee.

Lots of very low level maintenance friction during tenancies meant that I couldnt really forget about it, by the end I’d dread the phone ringing.

Total return was around 4% pa. So not really worth it. However it provided a backstop for my brothers until they were established in their own houses, and the small regular income was at the time important to me.

Would do it again under the same circumstances but wouldn’t choose to do it now.

LikeLiked by 1 person

Part of the reason residential yields are so low is because the value used reflects the higher capital value (£psf) owner-occupier market where valuation is driven by different factors. Contrast that with say an office where the value is income yield driven.

A saving grace is that rental growth has been high. However, the new Renters Rights Bill could very significantly impact this. As currently drafted, a tenant can take the (annual only) rental increase to Tribunal at no cost and any increase determined by the (no doubt overwhelmed) Tribunal is not backdated. Rent determined by the Tribunal cannot be higher than what the landlord requested. It is a free option for tenants which I would take if I was renting.

LikeLiked by 1 person

2 rental flats in London. I lived in both. owned since 2004 and 2009. They have now become quite the burden as I transition into my later years. Just got 2 sets of good new tenants in each but I feel my time is up when they leave and I’ll sell up. Service charges, leasehold issues with a dwindling lease, EPC on one is an E; the fear of an enormous bill dropping at any moment (have had various bills £30k; £10k; £20k drop out of the blue for major works). I echo what someone said above about keeping one of them for my kids should they need a zone 1 london pad. But that is a decade or 2 away so I’m somewhat indecisive on that front. And am I going to regret selling them: when am I going to own a zone 1 flat again…?

LikeLiked by 1 person

My dip into london property has been a disaster. Paid £700k in 2015, have now bought a house for £3mm, and had to pay the 5% additional stamp duty, so have just 3 years to sell the flat or face not getting my £150k extra stamp back… Currently trying to sell for £650k and no interest at all so will reduce soon…

LikeLiked by 1 person

Have one BTL flat in Greater Manchester, bought in 2011, gross yield 10-11%. It’s fully managed, the agents charge me 9% and do everything, but it’s still a faff having to approve repairs, replace white goods that breakdown etc. I’ve always bought boiler cover and that’s been a godsend for call outs. Fortunately, have always had good tenants and there has only been one void period of just 2 weeks over the years.

I still have a small mortgage, which is on a fixed rate of around 5%.

My ground rent is doubling every 15 years (currently at £500); the EPC is C, which is fine until the government wants to move the goalposts.

I never intended to have this property for so long as I had meant to sell it to fund my current home but was unable to do so as it’s still awaiting cladding repairs (work has not even started yet). Prior to the cladding issue, the property was valued at around £100k (I bought for £60k).

My intention is to sell it as it’s never been part of my retirement plans.

LikeLiked by 1 person

[…] year ago this week I sold my Modern Flat. And shortly afterwards, I reinvested £500k into a liquid stocks/shares portfolio with a […]

LikeLike