London life

I’ve been keeping busy as winter in London sets in. The Christmas lights are all out and looking resplendent, and both the West End and the City are feeling pretty buzzy. For all the general ‘UK stuck in the weeds’ economic commentary, we feel a long way from any talk of recession.

A political month

It’s been a good month for the right wing.

First of all, when only about 100k Tory party members were paying any attention, England’s Tory party elected its new leader – Kemi Badenoch. For somebody who holds a candle to the best bits of the Tory party over the last 40+ years, I think it could have been worse. But I certainly don’t expect the Tories to come bounding back into electoral success just yet, and I am not convinced Kemi Badenoch will still be the leader by the time of the next election.

Far more noticeably than the opposition party’s pinhead dance leadership election, Trump won a convincing victory in the US election. You don’t need any political commentary on this from me. What I will say is that I am more sanguine about it, from the point of view of a UK / European business-minded person, than I would be if I lived in the USA.

Markets in November

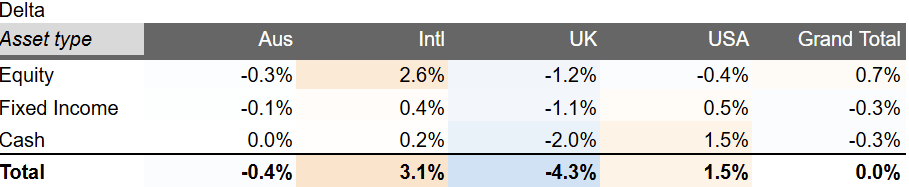

What’s obvious is that the US stock market is very happy with the Trump result. The S&P has continued its relentless climb upwards. The dollar has risen quite strongly too. UK and Australian markets rose too; both recovering from their late October swoon. On a constant currency basis, the markets rose on average 3.3%, and measuring things in pounds lifts the market average to 3.9%.

AI changes everything, or Bubble – 2025 edition?

We have just started to see some prominent ‘USA is a bubble’ articles too. I’m not a chartist, but if I were I think the ‘bubble’ argument is showing up pretty clearly in the charts. Almost whichever way you cut it, the index looks like it was overvalued in late 2021 (which I think it was, and a correction duly occured), and it looks overvalued now, relative to long term trends – even if you think the long term started in 2016 (amber dashed line below). Only if you think the current trend started at the worst moment (from a stock market point of view) as Covid-19 lockdowns kicked in early in 2020 could you argue the current S&P500 appears broadly in line with the medium term trends (the red dashed line below). A near term correction down to 4000-4500 (400-450 on the graph below) would not be a surprise – though quite what would trigger it is much harder to call.

My portfolio returns

Against a weighted market average of 3.9%, my portfolio actually rose 4.4% – with my leverage helping me this month. November turned out to be the strongest month of the year so far, thank you Trump.

November is a fairly normal month for dividends, albeit the bulk of mine land right at the end of the month. My haul last month wasn’t quite as big as the year earlier, due to me having exited (or had forcibly redeemed) a couple of positions, and a special dividend in 2023 not being repeated in 2024.

I finish the month a little bit overweight on International, and a bit underweight on the UK.

Past performance is not necessarily a guide to the future

November’s performance takes my overall returns, on a unitised basis, above 3x from when I started tracking my portfolio in January 2013 – pre taxes, but after fees. Compounding at 9.6% per year for 12 years will do that for you too.

My actual portfolio hasn’t actually tripled, because I keep raiding it for whimsical house purchases (see previous posts such as this one and this one), tax payments and such like. But assuming I avoid any more dramatic raids on the portfolio, trebling again in 12 years feels possible. And assuming I make it this far, trebling again in the 12 years after that also feels possible. So a further 9x gain, or even a 27x gain if I modestly outlive the national average life expectancy for my cohort, could happen. Taxes will reduce that significantly, but on the other hand I am – for a few more years I expect – adding to my portfolio out of earned income too.

These sorts of gains will, unchecked, result in telephone numbers. This would be very welcome news for my dependents / beneficiaries – not to mention the tax man. But in reality I will likely begin distributing this money while I remain healthy. Which will be whole new challenge to consider.

Appendix: Press clippings

But in reality I will likely begin distributing this money while I remain healthy.

Have you read Bill Perkins’ recent book ‘Die With Zero’? That discusses this scenario (among others) and I think it’s the most sensible one. The more common alternative being waiting until you’re dead and buried to give your dependents money, meaning you don’t get to see them enjoy that money in your lifetime.

LikeLiked by 1 person

Thanks for the book tip!

LikeLike

I would go for the podcast version on Mad Fientist (a guest podcast), or watch him on youtube. The concept and passion is brilliant. The book’s ghostwriter however failed to capture it.

LikeLike

haha compounding at 9.6% a month for 12 years would make you the greatest investor that ever lived and just a little over 3x by my maths

I’ve read die with zero. The problem is that dying with zero starting at 1mm just isn’t the same as dying with zero starting with 100mm. So you can’t take his story seriously. He doesn’t have any skin in the game.

LikeLiked by 1 person

Oops thanks for spotting the non-deliberate mistake! Yes 9.6% pcm is the sort of thing those crypto nutters look for….. I’m reasonably happy with 9.6% pa myself

LikeLike