I think I first clocked Warren Buffett’s (and Charlie Munger RIP’s) Berkshire Hathaway around the year 2000. I loved the story. Starting from, as the story was told back then, humble beginnings and a paper round, Warren Buffett (and Charlie – who I will stop mentioning but absolutely deserves practically half the credit) had built Berkshire into a giant.

Buy & hold – what’s not to like?

Berkshire was the holding company of an investing approach par excellence. Buy great businesses at a fair price, hold forever, reinvest dividends, job done.

The business had never paid a dividend or split the stock, which by that point had reached over $70k per (Class A) share. It had annual meetings in Omaha, its home town, which were already becoming a cult following.

There was also something about Warren Buffett’s penny pinching ways that appealed to me. He lived in his first house, he drove practically his original car. Part of his aversion to splitting the stock was the (tiny, in the scheme of things) cost of a stock split (though he did thankfully create the B shares in 1996, which are identical to A shares but a fraction of the price). He preached from the book of compound interest and his lectures were very compelling.

And yet

There was something sufficiently compelling about Berkshire Hathaway to me, as a baby FIREr back in 2000ish, that I named one of my assets after the business. That asset remains to this day, though it has sadly failed to prosper in line with the mighty BRK.

But at about the same time as Berkshire caught my eye, we saw the dot com boom. The world was changing. Technology was re-writing the rules of the game. Companies like Yahoo, Netscape, Alta Vista, GeoCities and others told stories of astronomical growth – with incredible profits just a few years/decades away.

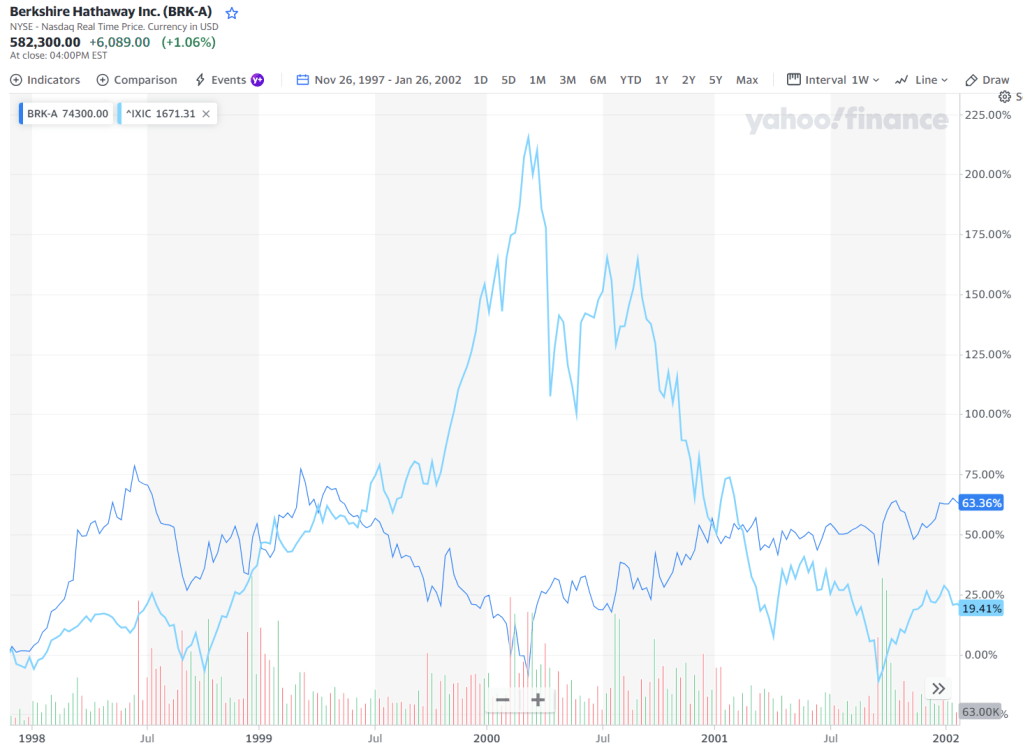

And in that dot com world, Berkshire Hathaway wasn’t looking so good. Its (A-class) share price dropped from c.$70k to c.$50k while the NASDAQ-100 almost quadrupled from 1,100 to 4000 in mid 2000.

Moreover, Berkshire’s principals were Messrs Buffett and Munger. Fine, outstanding individuals, clearly. But Buffett was now 70 years old and Munger was not far from his 80th birthday.

So, while I had sufficient admiration for Berkshire to name a key asset in its honour, I didn’t buy any stock (BRK.B: $45-$50). The principals’ ages were very offputting for me. I was young, and looked at octaganarians as both a) likely to die imminently b) probably not fully mentally capable c) on the verge of retirement d) etc. So I sat Berkshire out. I thought I might take a pilgrimage to Omaha one day, one day, but that was it.

Buy when others are fearful?

Less than 10 years later, we all experienced the Global Financial Crisis (GFC).

I remember the GFC much more clearly than I should for something that happened 15 years ago. By this point I was well onto my investing journey. I hadn’t yet identified with FIRE, but I knew my self directed investing delivered higher performance than the professionals/advisers that I could have delegated my discretion to.

The GFC saw levels of fear, panic, astonishment that I hope I never see again. Not even lockdown, furlough, or the Russian full-scale invasion of Ukraine quite measure up to what was going on in 2008/9.

And in that time, of course, Berkshire Hathaway bailed out Goldman Sachs. Warren and Charlie were still going strong. BRK.B peaked in 2007 at $95, and drooped in the fearful early 2009 period to $51. Most of us would struggle with 46% drawdown – most of us are not Warren or Charlie.

It didn’t take too long before the world started to recover, and it became abundantly clear that Berkshire Hathaway had played a blinder. The stock had regained ground to $80+ a year later.

And this was almost 10 years after I had decided that their best days were behind them, and that it was too late to get involved.

Watchlist and learn

So when I stepped up a gear with my investing activities in 2012/2013, I started to reconsider whether I should in fact buy some BRK.

I began this blog in 2013. But I still didn’t buy any BRK ($100, ish, by this point).

Two years later, in 2015, BRK.B has reached $150. Buffett is now in his 80s, Munger his 90s. But I’d learnt my lesson. I knew I should have bought, a mere 15 years ago.

Buy and hold

It would be overstating it a bit to say by this point I’ve resolved to buy the stock.

Nonetheless, as the stock dips in 2015, I spied an opportunity. In 4Q 2015, I buy my first holding in Berkshire at $137. I bought some more for $130. And a bit more early in 2016.

I’ve bought more, over the years. My average ‘in price’ is almost $200/share - roughly the price the stock stuck at for three years 2018-2020.

With only one minor exception, I haven’t sold any Berkshire. It doesn’t pay any dividends – so any funds you are looking for need to be taken by top slicing. The capital you have in Berkshire and the income it throws off is going to be reallocated for you by Berkshire.

Charlie Munger RIP

2023 saw the late great Charlie Munger move onwards and upwards. I won’t reprise here what an astounding, magical, inspirational, charismatic character Charlie was but a quick Google will uncover reams of tributes and not a single ill word.

Where does Berkshire sit, without Charlie? That picture isn’t yet clear. Though the stock price has remained resilient.

There obviously is some form of succession plan. Warren Buffett may want to go on forever, but he clearly understands that a) he can’t and b) investors want to know what happens when he doesn’t. What he hasn’t given people is transparency, but that is only natural I think given the circumstances.

What next?

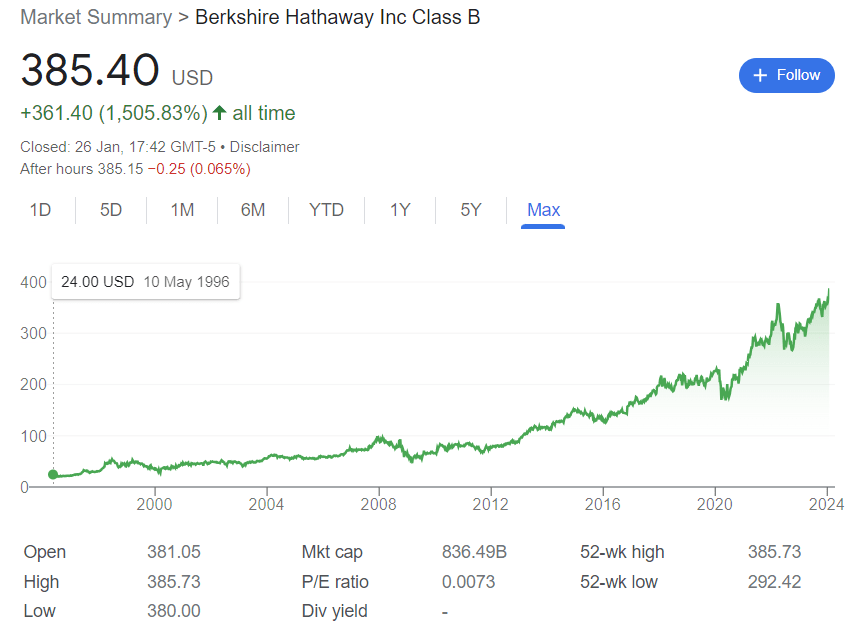

As I sit today, BRK.B is at $385/share, and approaching $400/share (the A shares are approaching $600k *per share*). By my rough calculations, that’s averaging around 11% per share per year over many years.

Berkshire has become one of the top 10 holdings in my portfolio. Like so many thousands of fellow Berkshire shareholders, what began as a diversified holding (in every sense) is starting to crowd out the rest of my portfolio.

It looks too late to join the party – especially assuming that Warren Buffett statistically speaking won’t see out the decade. But I made that mistake once, around 25 years ago, and now you don’t need to make it again. If anything, the recent death of Charlie Munger RIP has helped stress test the stock – and so far it’s passed that test with flying colours.

What you get with Berkshire is a diversified collection of mostly American conglomerates. For a consolidated P/E of 11. In other words, for every $10k you invest in BRK.B, there is around $900 of annual income. You won’t receive that income, but it will be there, it will grow, and it will periodically be reinvested in additional productive assets. The assets you will own include Apple, American Express, Bank of America, BNSF, Coca Cola, Kraft Heinz, the list goes on. These are great assets; they throw off cash; they have ‘moats’ (a phrase Buffett popularised); they grow; they don’t depend on Warren Buffett at an operational level at all; they will live long and prosper.

There is one other lesson I’ve learnt from Buffett. For decades he has made a point of saying ‘don’t bet against America’. You could I think sincerely make the same point about the UK, Germany, France, Australia, you name it. However in America’s case there really has been something very special about it, for investors. The tech boom of the last 20-30 years is only one case in point. Just watching its GDP and stock market outpace the rest of the developed world over the last 5 years is to illustrate Buffett’s point for him. And while the investment textbooks advocate a globally diversified portfolio, anybody who has just backed the US market instead over the last 20 years will not regret it. Will the US revert to the mean? Or would thinking that be to bet against Amerca, and ignore Buffett’s advice? The next couple of decades will see. But in the meantime, Berkshire Hathaway provides exposure to much of what’s great about America, without the froth/hype that has driven the NASDAQ/Tech sector.

My Berkshire holdings have doubled, on average, in around 10 years. The stock is up 2.5x since I took the plunge, 15 years too late. If it’s not time for you, yet, when will that time be?

I’ve ended up with about 15% of my equities pot in BRK (avg purchase price 193). It provided some nice ballast through the tech rout in 2022 (I have a large VGT position) – it seemed to be zigging when tech was zagging (or was at least zagging less).

600 trading days vs VGT

https://stockcharts.com/freecharts/perf.php?BRK/B,VGT&n=600&O=011000

1000 trading days vs VGT

https://stockcharts.com/freecharts/perf.php?BRK/B,VGT&n=1000&O=011000

LikeLiked by 1 person

I wonder if there are any European equivalents which exhibit long term serious growth and wise leadership. InvestorAB? https://www.investorab.com/

LikeLiked by 1 person

I wasn’t aware of InvestorAB, tho in general I don’t perceive anything else competes from a track record / blue chip perspective.

I will check out Investor AB. Rothschild’s vehicle RIT has similar mindset/objectives (old school family money) but invests in very low grade/speculative assets by comparison, and has (thus?) delivered a very disappointing track record compared to BRK.

LikeLike

I heard about them from a twitter follower and reading one of John Kay’s books. Apparently they own vast amounts of the Swedish economy. Might to a review of a book about them soon. You mentioned RIT – an exceedingly grim proposition I think (I sold recently) because it’s hard to figure out what they even own and who is managing it. Layers upon layers of complexity and I don’t really want that.

LikeLiked by 1 person

I just sold my BRK, partly because I felt it too concentrated in Apple now, partly as I need some capital gains for the year (whilst we still have some sort of CGT allowance in the UK!), but also because I am buying large positions in NTSX/WTEF now it is available in the UK and don’t want to be over exposed to the US via duplicate holdings. The lack of dividend remains very tempting for non tax sheltered holdings but the forthcoming reduction in UK CGT allowance is offsetting that somewhat.

LikeLiked by 1 person

NTSX/ WTEF is really interesting…. I wasn’t aware of it before.

Would love to know what other good ideas you have:)

LikeLiked by 1 person

Not sure if it counts as a good idea, but I’m doing this anyway: Get professional status in IBKR, transfer (one of the) ISAs there, and buy other capital efficient funds like NTSI, NTSE, GDE, RSST and RSSB! Alternatively, sit tight and hope Wisdom Tree doesn’t take too long before expanding its UCITS offerings beyond NTSX/WTEF!

LikeLike

I once tried to buy BRK stock but didn’t have the few tens of thousands required (this is back in 2005 or so)

and after that, rejected the idea that one guy could be a consistently better investor than passive investments.

maybe he’s different, but we are all thinking that we are contrarians but most likely we are wrong. Neil Woodford is a good comparison of cards investment stylings

but, the track record of the old man is truly impressive, so maybe at any price BRK is a worthwhile investment.

LikeLiked by 1 person