It’s been a dismally wet July here in London. About 50% more rainfall than normal (which, before ye scoff, isn’t that much – London is a fairly dry city – drier than Rome and much drier than Sydney). It has been long trousers weather, for the first time in several years. But at least the evenings have been long.

I’ve managed to spend a bit of time on the south coast. Over in Dorset and even getting over to the Isle of Wight.

The political weather has changed considerably too. We had three Tory by-elections, with each won by a different party – i.e. the Tories lost two out of the three. But the big news has been the one, Uxbridge (the former PM Johnson’s former constituency), on the north west of London that the Tories hung on to by a whisker. Their “success” was attributed to their exploitation of Uxbridge disaffection with the impending expansion of the low emission zone (a scheme introduced by, erm, Johnson when is was Mayor of London) to include Uxbridge. This supposedly signals the high water mark for Net Zero political consensus in the UK.

I must say I find this general analysis about the end of the UK’s Net Zero fairly compelling; the economy is in a rum state and asking UK voters to cough up for green principles when half of America resists even the notion of man-made climate change feels brave and the Indians/Chinese are building coal power stations and buying Russian petrochemicals by the gazilitre feels brave to put it mildly. I would be interested in readers’ comments.

The other major news story here has been the private bank Coutts (part of NatWest) having picked the wrong populist to ‘de bank’ – the “disingenuous grifter” Nigel Farage. I don’t want to give him any more airtime than strictly necessary but the story has been compelling reading, and in fact much as it pains me to say this I think Farage has been scored some justified points (though I loved Emily Maitlis’ counter narrative!). I consider the UK’s anti money laundering regime to be a protectionist anti-competitive not-fit-for-purpose shambles, and some of that (particularly how difficult life has become for Politically Exposed Persons) has been surfaced in this fracas. The NatWest CEO Alison Rose has lost her job over the incident, but the wider regulatory approach remains intact for now.

Markets in July

Never mind the weather, the markets have been pretty hot. Equities seem to be up everywhere. Tech stocks continue to lead the charge but aren’t the only ones increasing. Old school stocks like 3M, JP Morgan, and Domino’s Pizza PLC are all up a double digit amount.

The USD continued to lose ground; its battle with inflation has progressed better than Europe’s, meaning interest rates have almost certainly peaked. Meanwhile UK interest rates, despite recent positive news on inflation, have further to rise – which is supporting its currency vs the USD.

My portfolio

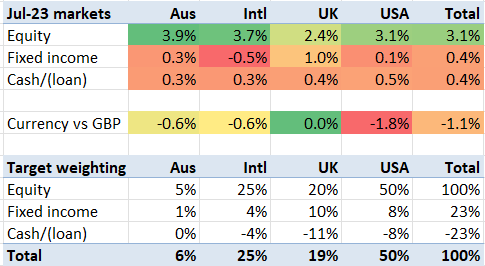

My portfolio grew by 4% in July. At the same time, even though July is a quiet month for dividends, I repaid a modest amount of the portfolio loan. This combination means my leverage has dropped to a level where I will soon want to adjust my target leverage down a notch – not least because rising base rates mean my interest charges continue to climb. In the meantime, my line up versus my target allocation is as follows:

Recently I also saw my transfer of my SIPP from one provider to another finally complete – several months after I initiated it. In theory this will save me over £500 per year. Not even a week’s interest, sigh.

— Ends —

Media clippings

“Green crap” wind/solar/hydro/batteries and to a lesser extent nuclear power seem like great inflation hedges compared to natural gas. Once they’re built, the operating costs are minimal. So they’re worth it in my book.

If you think UK PLC is too poor to make 30 year investments in infrastructure, we should apply this principle more widely than just to power generation.

LikeLiked by 1 person

I honestly find the “China builds coal plants so we shouldn’t bother with green energy” a poor argument. To give the other side of the coin, China has more than quadrupled Nuclear energy generation over the past 10 years. Renewable now make up around a third of electricity generation. Growth in both outpaces growth fossil fuel generation (data from IEA). China is now, by far, the biggest generator of wind and solar energy. Yes, China has a lot still to do but it is doing stuff.

Regarding subsidies, this comes down to an ideological decision. Conservative governments decided that the private sector must fund green and nuclear projects and, to make that palatable, we had to offer subsidies. There were other options including funding from borrowing (at historically low interest rates) or general taxation. The government has now been dragged in to part financing Sizewell C. Let’s remember that the “private” sector in nuclear investments is in reality the French and Chinese governments. Nuclear is essentially not possible without large state involvement (if that was ever not the case).

As a country we set out our stall early on net zero. We’ve done a good job in reducing emissions. However, the governments of the past 10-15 years have been half-hearted (Call me Dave’s “Green Crap”), the big aims have had little tangible behind them. We lost whatever advantage we had. (For reference, have a listen to the podcast “A long time in finance”, episode “Power to the people!”)

LikeLiked by 1 person

To the casual, relatively uneducated in this field but interested observer (me), our energy/ environment policy seems to be a complete shambles. A succession of vote winning promises, easy to give, but ignoring the impact that have been ill thought out.

The good news here globally is that with regards to carbon emissions and general environmental impact the UK will be a bit of an irrelevance over the next fifty years given our current inability to put in places any measures across any policies, including a value creating energy policy.

It’s a bit odd as energy independence should satisfy everyone (a) the hawks worried rightly about Russia (b) the bean counters worried rightly about the current account deficit (c) the non-showerers worried about the environment (d) the housewife/husband worried about the cost of their energy.

It’s a bit of a mystery to me why the government hasn’t twigged that energy independence should keep everyone happy. Probably as the electorate is focussed on some sweety give outs and arguing over their share of the pie instead of trying to grow it.

Energy policy along with foreign, economic, health, education, you name it is just one of a number of areas to be pretty despondent with our governance over the last two decades. Sorry about the rant. I don’t see the tide turning over the next twenty years. I’m pretty sure we’ll dig ourselves out of the whole we’re in but I reckon it’ll take us at least a few decades. Looking back at history, that’s just a page in a book. Depressing!

LikeLiked by 1 person

I can see the general election next year being a “pocket book” election: all about how it hits people in the pocket. Labour are following the Ming vase strategy, saying nothing, hoping that the Tories lose by default and they don’t drop the ball. So far so good. Uxbridge doesn’t change that.

The Tories see a angle. Despite taxes having only risen in the last 13 years, they are positioning themselves like an opposition, telling voters that Labour will cost them even more in the pocket. Green policies will be part of that blank cheque that voters will be giving Labour. I can see this working. Voters like net zero for the far future but are not so keen for the now or nearly now. Voters are easily manipulated.

This may well not be enough to give the Tories a real chance of winning but I think it can extract enough votes to result in Labour not getting a majority. Labour need to stop trying not to lose and try to actually win.

LikeLiked by 1 person

To your question about the ‘fairness’ of net zero…

We could just institute a carbon tax and let higher prices make people figure things out (but people don’t like paying for stuff, see Uxbridge…) Instead. – we are going about banning stuff (e.g. gas boilers…) which is clearly less optimal than using the price signal and will probably irritate people more down the line when the bans actually happen.

Personally I think it’s nuts that we don’t just tax carbon lots and use the revenue to cut VAT / income tax (or whatever tax would most likely stimulate growth…)

LikeLiked by 1 person

I totally agree with this. We have forgotten as a country the merits of markets – they find solutions for things better than central bureaucrats do

LikeLike