January media seemed dominated by Greenland and Davos. As part of my efforts to avoid amplifying unstable narcissistic media-whore leaders, I haven’t got much to comment about. London has been pretty wet and miserable, as is January’s reputation.

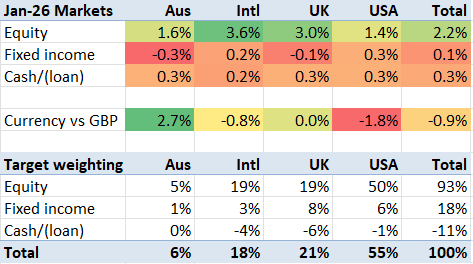

Meanwhile, markets were up quite a bit in January, for those of us measuring in GBP. This is despite widespread mayhem over Greenland – which the markets shugged off – albeit with a mid-month wobble.

My target allocation’s markets grew 2.4% on a constant currency basis. But their currencies fell by 1.4%, meaning my benchmark rose 1.0%. Against that my actual portfolio was flat. I am a little bit underweight USA equities, and a little bit overweight International equities, which in theory is not a bad tactical position to be in. In any case, I took a couple of hits on larger individual holdings.

Tweaking the portfolio

I made a few changes to my portfolio in January. One of the more significant was moving all my fixed income ETFs held with IB into their own subaccount. I have been meaning to do this for a while but the move gives me better optics into my various asset types and how much money they spit out / return.

I have also sold one of my Swiss equity holdings. The Swiss withholding tax arrangements aren’t properly supported by my brokers – so I don’t get a full tax credit for them – and moreover with ii you can’t actually trade CHF or Swiss equities online. I’m getting rid, of an ii holding at least.

I also can’t escape the conclusion that I would do as well, if not better, if my portfolio had only two holdings in it – VWRL and VGOV, for instance. I’m a long way from that, but I’m determined to track steadily closer to this ideal this year. My unsheltered accounts – which contain around 68 unique holdings – are harder to simplify because they incur capital gains, and most of my accounts do only have one holding per asset class. But for my tax sheltered accounts = with 27 unique holdings – in theory I could drop right down to two holdings tomorrow. Watch this space.

Death & taxes

January is tax payment month in the UK. My tax bill was slightly lower than I was dreading. I have funded it by borrowing from my margin loan – not for the first time – which remains slightly smaller than my target allocation would suggest.

Two more months of this tax year remain. I have been looking at opportunities for tax loss harvesting – few and far between sadly given the widespread gains across the portfolio.

Appendix: Press clippings

Thank you for a great update, as always.

You might like to consider a factor ETF such as global enhanced value (IWVG) in combination with your existing global equity ETFs. This would balance away from the U.S and uses fundamental metrics (such as forward P/E) rather than market cap weighting which you currently rely upon.

Broadly, markets are rotating towards value and have outperformed over the very long term time period (since 1997).

Anyway, your blog is always an interesting read and our portfolios are fairly similar. All the best.

LikeLiked by 1 person