October in the markets was one of those slightly giddy months. My portfolio crossed through a big number threshold, and kept going up.

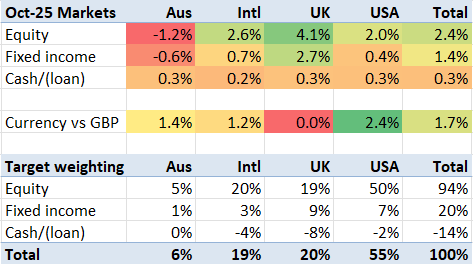

The market stats don’t quite tell the whole story. On a constant currency basis, markets rose 2.8%. Non-UK currencies (AUD, EUR, USD) rose (versus the GBP) about 1.7% too. So my weighted benchmark rose 4.6%, measured in GBP. My (leveraged) portfolio‘s rise of 5.3% is roughly in line with that.

A 5% gain in one month is pretty extraordinary, but it does happen. While October was the best month since January 2023 (+6.6%), I have had 7 better months in the last 13 years.

However, what the market stats don’t show is what it really felt like in October.

AI everywhere all at once

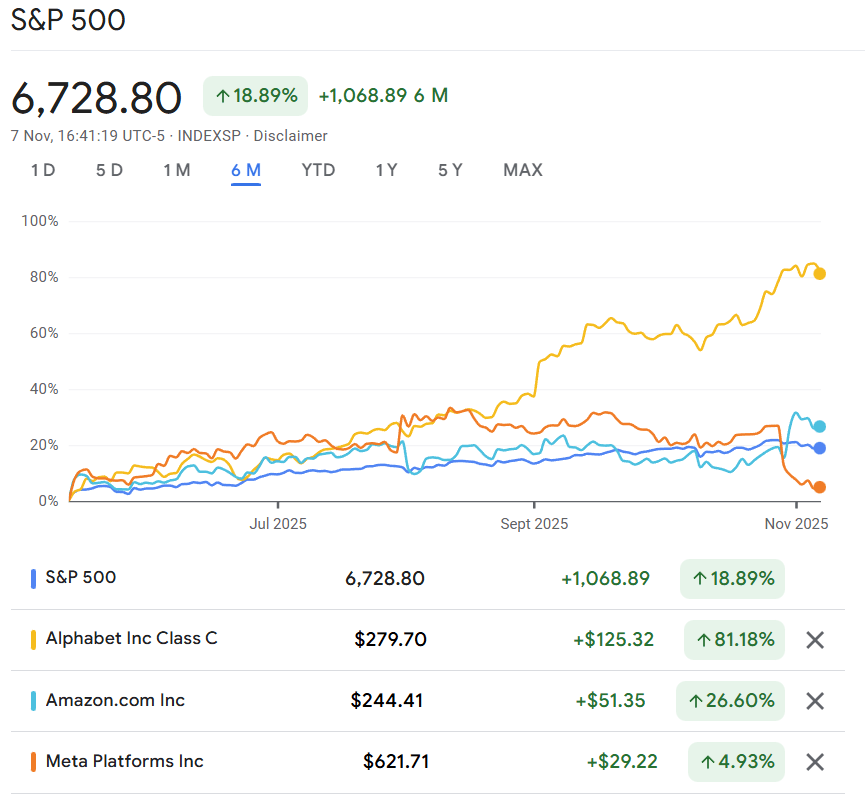

What was going on in the USA was continued AI-driven movement in US tech stocks. Mostly, this was up. In particular, Alphabet/Google clipped up almost 20% and Amazon jumped up over 10% based on solid earnings – these guys are two of the handful of key ‘picks & shovels’ suppliers to the AI boom. As a counter factual, META dropped over 10% based on booming costs without, so far, the AI revenues to really show for it. GOOG’s share price has been on absolute tear – up over 80% in the last six months.

Somehow the FTSE, with no material tech/AI exposure to speak of, did better than S&P in October, rising from 9400 to 9800 during the month. I can’t immediately explain why, though I note that GSK, a big component, rose more than 10% in the month.

Actively trading my portfolio

With my US holdings on a tear, and every alternate markets article talking about the bubble being about to pop, I was quite active during the month – as shown on my diary.

The main thing I was trying to do with my October trading was rebalance from US Equities into UK/USA Fixed Income (where I am underweight). I don’t know when the ‘bubble’ will ‘burst’, but I’m doing my best to avoid being overexposed to US equities if/when it happens. US stocks are up enough that rebalancing simply by investing dividends isn’t enough. So I sold over £100k of holdings, a large amount of trading by my standards. This created some significant realised gains that I will owe tax on, in over a year’s time. Time will tell whether crystallising these gains was a smart move or not – while I don’t believe in timing the market, crystallising gains is somewhere in the blurry grey zone.

The second thing I have been doing is reducing my leverage level a bit, to reduce the risk of being leveraged during a market fall. When I have been selling positions I have not been fully reinvesting the proceeds. This has seen my loan shrink by tens of thousands of pounds. My loan is now almost as low as where it was at when I first went to view the Coastal Folly in the summer of 2021. My loan interest costs are still much higher than back then, and I am not yet meeting my ‘Silver Rule‘, but I am getting closer.

The third thing I was doing was shrinking my GOOG position. It is my largest position and I don’t really like having single stock risk to this level – Warren Buffet’s “20 punch card rule” or not. I have been ‘top slicing’ – reducing down my holding a little bit, taking profits in the process. I took some profits at $255/share early in October, then at $265/share a week later, and 10 days later I was staring at $295/share.

This year is nearing its end, and already I expect 2026 to be a very different year. For now though, I’m hoping to hold on to the +10% gains year to date (as of 8 November).

Appendix: Press clippings

I know I should be rebalancing… but…

Are things frothy in the AI space, almost certainly. Am I playing with house money? Yes. Where I’ve gotten to in my thinking is that I’d prefer to let the AI gamble (with house money) roll, as I think it’s got some more to run, and the alternative of paying ~15%+ of the capital to the tax man, followed by investing the balance in things I don’t really like is not particularly appealing. Only time will tell if I regret this decision! I’m not planning on touching the equities for 20 years (I’ve got a large bond tent to burn through first having RE’d earlier this year), so I figure whatever happens it will look like a blip on the 20Y chart by that time, and if there’s a big draw down, whilst they’re never pleasant, I can stomach it.

At this moment at least, a guaranteed tax bill seems much less palatable than a possible drawdown!

LikeLiked by 1 person