There wasn’t a huge amount to report from July.

Politically/economically I fear the most important event in the UK was the Labour government’s failure to enact its intended welfare reforms. This leaves the government a) unable to control spending b) unable to nudge the economy towards more jobs and more growth and c) facing politically expensive tax rises later in the year. For now, this hasn’t impacted the stats or portfolio very much, but it will have more of an impact over the next few years.

Meanwhile, it was a nice pleasant summer month in the UK. I managed to get to Wimbledon for the semi finals, which was a delight. I also explored the bird sanctuary at Arne, near Poole, and other bits of Dorset. I even visited Italy, which was surprisingly good value for money.

Markets in July

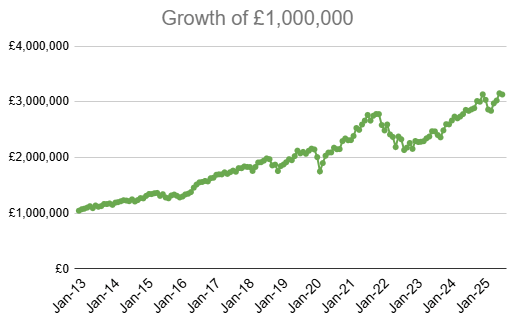

The equity markets have continued to recover/grow despite the wider Tariffs saga.

UK equities had a particularly decent July, for some reason I didn’t particularly notice. Overall, the markets I’m in rose 2.6%. Currencies didn’t move too much, a slight uptick in the USD being countered by a 0.9% drop in the EURo. So the combined (forex + indices) market movement was 2.7%. Against that, my portfolio returned 3.4% for the month – slightly assisted by my leverage, and recovering a bit of the recent lag versus the market.

My portfolio’s return to July 2025 now exceeds the previous high watermark, set in January. That tariff damage wasn’t too bad after all – if you believe we’ve now seen the worst of it (which I don’t).

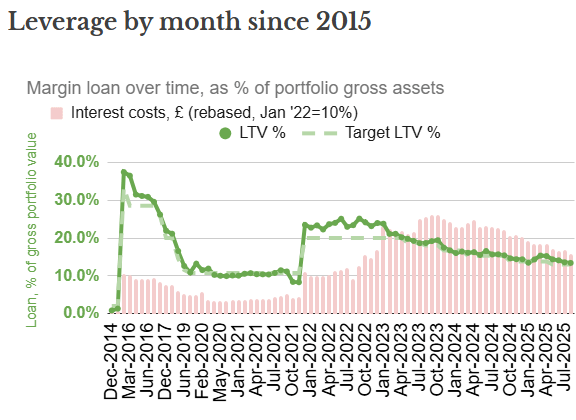

I had a mini windfall in July – actually a personal loan repaid to me at long last. I used most of this to pay down a bit of the margin loan (that had funded the loan in the first place). This leaves my leverage situation looking even more manageable, and with the post-July interest rate drop my margin loan metrics are as healthy as they’ve been since I bought the Coastal Folly.

The actual leverage level (shown in the darker green line) is 13.4%, close to the current 13.0% target (the light green dashed line). My cost of servicing the debt, i.e. my interest costs, are shown above in pink. The graph shows the size of the interest expense, relative to my exposure in January 2022 (just after I’d funded the Coastal Folly with a significant expansion of my margin loan). While the loan has shrunk considerably since then, my interest expense remains about 57% higher than it was in that January, thanks to interest rates being a lot higher these days. But considering that my loan had risen to over 25% of the value of my portfolio, and is now around half that relative size, and that my interest costs were (in October 2023) about 160% higher than my starting point, I’m a lot more comfortable.

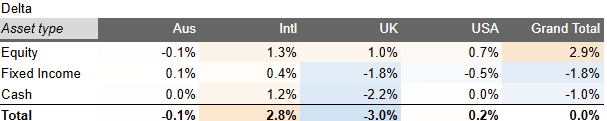

With the rises in equities, particularly the USA up from its Tariff low in March, I am now overweight equities again – even US equities. I’m back in that familiar pattern where as equities grow my fixed income exposure drops to be underweight, and though I am slowly topping it up with dividends/etc, my dividend yield isn’t enough to make the difference. My most significant underweight is in GBP cash and fixed income; I am not borrowing as many EUR as I target, and I am a bit overweight international Equities. But my current imbalances are all fairly small.

August is a fairly quiet month for dividends/etc. I’m going back to the summer. See you next month.

Appendix: press clippings