I’ve had quite a busy May. It’s been a lovely month, featuring a wedding in the country, a trip to the Isle of Wight, my first visit to a dairy farm in 40+ years, a lovely trip to the Cotswolds, and more.

If you can identify any of the locations above feel free to shout out in the comments.

And of course London has been providing its fair share of entertainment too:

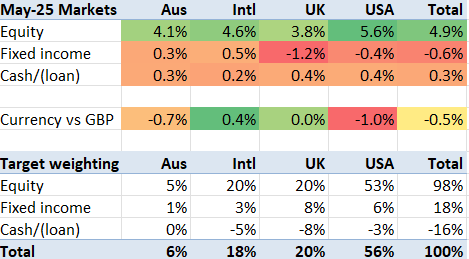

Markets in May

The markets had a good May, as the ‘TACO meme‘ proliferated. In local currencies, my markets rose 5%. The USD fell 1% vs the GBP, so my weighted markets overall rose 4.5%.

In £GBP terms, world equities have almost recovered to January levels, but not quite.

My portfolio itself rose a smidgeon more than my index.

Tweaking my target allocation

I have made a slight tweak to my target allocation. In effect my tactical underweight of US Equities is becoming a strategic shift. I’ve pulled my US Equities target down to 50%, and lowered by target loan/leverage ratio to 15% (an LTV of 13%) – and tweaked the target loan currency mix slightly away from USD towards EUROs.

I’m left overweight UK/International equities, underweight Fixed Income, and slightly overleveraged. I’m relatively comfortable with these imbalances for the moment.

Appendix: press clippings

Thank you for a great website.

Would you consider reducing your leverage in time? My apologies if I’ve incorrectly assumed your age, I’m guessing your 55-65 years of age? You seem to be doing pretty well and leverage increases risk, whilst only enhancing total returns a little.

Perhaps by paying off the leverage you could then reduce the fixed income component of your portfolio, which may, result in higher returns with less risk.

If you disagree it would be brilliant if a post could explain your thinking/rationale. Much appreciated.

LikeLiked by 1 person

@Zak – thanks for your comment. You ask re my leverage intentions. You are right that I intend to reduce my leverage over time – in fact it has been reducing significantly over the last few years as my Monthly Returns page shows.

Are you familiar with Modern Portfolio Theory? This argues that leverage can enhance returns. It is very much theoretical – and the wisest folks all say Don’t Use Leverage – but I try to hold both theory and wisdom in my head. The key point is that the return for a given unit of risk/volatility can be maximised using leverage. I have not been that scientific about it, to be clear.

LikeLike

Thank you for your reply. Yes, i’m sure you can enhance your returns with leverage, over the long-term. But by how much and at what cost? When rates are probably SONIA plus a few percent. I also worry about leverage terms changing on a whim, at a time of market stress.

In general, I personally want to reduce my risk over time to preserve capital. Having about 90% of my capital in equities and property is enough of a rollercoaster ride for me personally (i’m 51). I’m intrigued (& maybe admire!) that you still can sleep OK at night intentionally choosing to leverage when you’re already pretty comfortable and at your stage of life.

All the best.

LikeLiked by 1 person