Better late than never, I’m doing a quick update on April. More for the record than because anything particularly notable happened in the portfolio, ignoring the mid month gyrations.

It was a lovely month, April. I did a bit of travelling, but the UK had generally lovely spring weather – as the photos illustrate. I find a consequence of having both the Dream Home in London, and the Coastal Folly is that when the weather is lovely I can really begrudge being in London – a relatively new feeling for me I must admit.

As I write this, it’s almost the end of May, so rambling around April market performance doesn’t feel like it’s going to be of much interest to anybody. In fact with a week of May to go, the S&P has recovered from the Trump TariFFS episode. The key point is that Trump announced a u turn / 90 day pause in his tariff plan, which the markets took as a reason to return to normal. Go figure. Since when has Very Bad News in 90 days’ time been discounted away to practically zero?

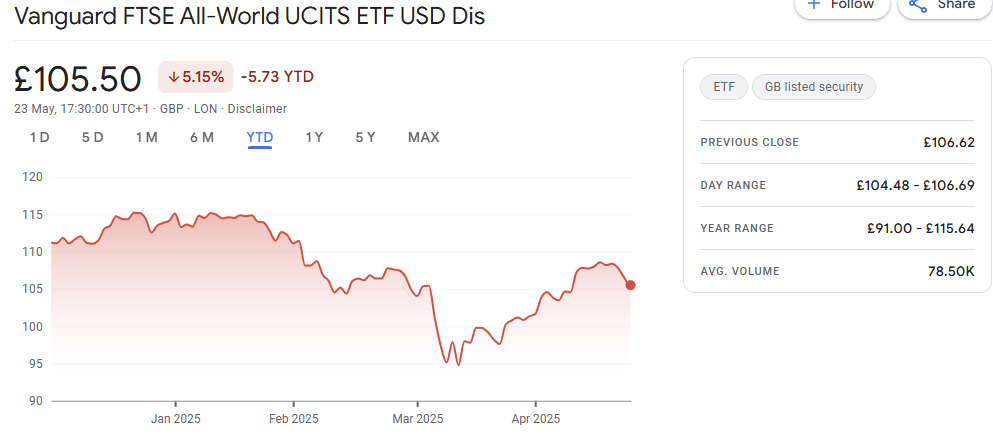

That said, VWRL – World Equities – hasn’t reached its January peak again.

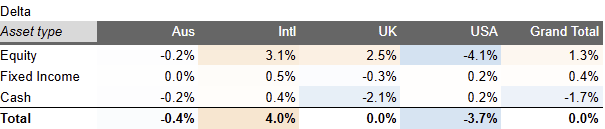

Overall April was quite a tumultuous month in the markets, for well documented Trump-related reasons. But with a few weeks’ hindsight you can see the month generally ended down a bit, with the exception of Australia – where the signs that Trump Always Caves and the prospect of an imminent defeat of the slightly-Trump-esque Dutton in the general election both boded well for the ASX 300.

Bonds ended up, for reasons I can’t remember – though I think that signs that interest rates are continuing to fall (except for the USA) have been a boost.

My portfolio was down about 2% in the month. This is about 0.6% worse than my weighted markets moved. Knowing I have bounced back quite a bit in May – at the time of writing – I’m not going to dwell on it too much.

I haven’t had much activity in the portfolio.

The big ‘news’ for us UK investors has been that April saw the start of the new UK Tax year, which means a fresh set of ISA allowances to play with. I’ve managed to fill my ISA boots already, thank goodness, giving me a bit of an opportunity to buy into a slightly fallen market.

I remain tactically underweight US equities, and tactically overweight UK / International Equities. My borrowings are slightly more GBP concentrated than my target. I’m slightly more leveraged than I’d like to be – reflecting borrowing money last month to buy on some dips, and the slight decline in the value of my portfolio. I’m comfortable with my posture and glad I have been relaxed and calm through the Trump mayhem.

could I ask what advice would you give to someone who has never leveraged and considering it now but only on a very minor conservative scale to reduce some tax now. Top tips for a leverage novice ? (Have a portfolio similar to yours geographically)

LikeLike

Andy

This site can’t give advice, sorry

You should do your own research, and remember that

a) margin is risky – all the smart folks say it doesn’t mix with long term investing

b) in UK for a personal investor, margin isn’t tax deductible and won’t reduce income tax.

c) however if you need to raise funds and don’t want to sell assets (and realise gains) then margin can be a solution that reduces (capital gains) tax

d) most brokers won’t support it – though private banks usually do and so does IBKR

e) the lowest interest rates are in EUR but most things I invest in are in GBP or USD. Borrowing in EUR to invest in GBP/USD injects forex risk.

LikeLike

Given USD is down 8% YTD, have you significantly hedged your FX risk to be almost flat again in May?

LikeLiked by 1 person

No, I don’t hedge FX. My own portfolio, like VWRL, remains some way off flat! Thanks to its 50% exposure to USD, and as you say the drop in USD. However given I am underweight USA versus the global index (and VWRL) this should in theory be helping me a bit.

LikeLike