What’s in the news?

Talking about the news in March, given what’s been happing on the tariff front over the last few weeks, seems a bit pointless.

We entered March with a lot of drama about Ukraine, and some notable ‘ceasefire’ activity on the diplomatic front.

We finished March waiting for ‘liberation day’, April 2nd, when Trump unleashed a basically bonkers cocktail of tariffs on every country in the world – except Russia, of course.

What’s going on with me?

In the meantime, life goes on.

I attended a funeral of a long time friend and neighbour in north London.

I visited a rather bizarre concert in the Royal Festival Hall.

And I visited hospital for my first MRI scan, participating in a clinical research programme at University College London Hospital. I was impressed, I have to say, and grateful that I live within relatively easy reach of this excellent hospital.

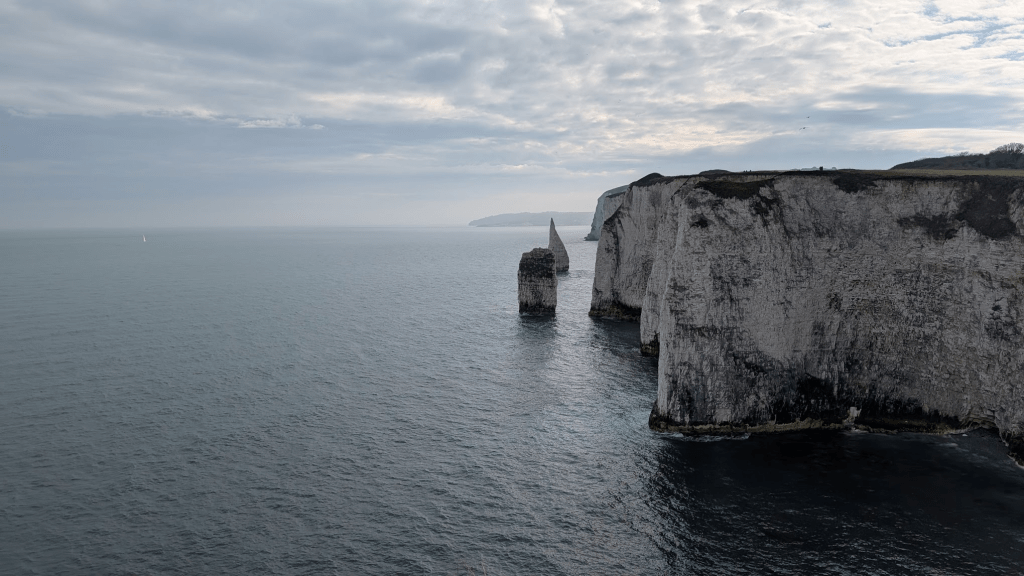

I also visited Dorset – Studland to be precise – and went yomping up to Old Harry Rocks, the start of the Jurassic Coast. It’s a beautiful part of the world, and less than 3 hours from London Waterloo.

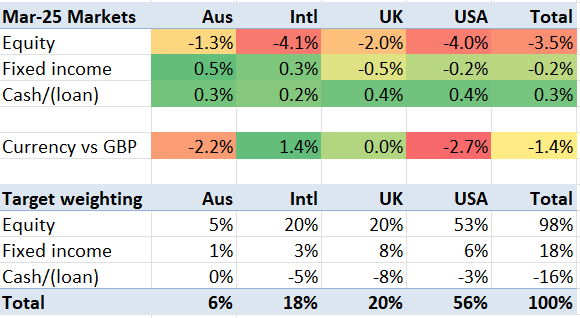

Markets in March

Markets generally drooped in March, particularly the US’s S&P500. Enthusiasm/animal spirits from Trump’s election win are being replaced by trepidation / concern about Trump not being good for the US economy after all. The dollar, and the AUD, fell against the pound.

My portfolio in March

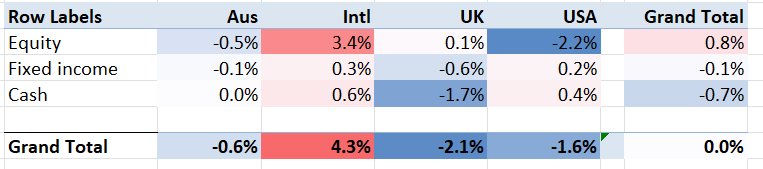

My weighted benchmark fell almost 4% on a constant currency basis; my overseas currencies fell 1.3%, so my benchmark dropped over 5%. Against that I fell ‘only’ 3.8% which, considering my leverage, is surprisingly modest.

.I was quite active with my portfolio in March.

I have been buying on the dips. Google, Microsoft, Adyen and Wise all are being topped up slightly.

I have been releasing some funds for a ‘dip into savings’ holiday trip. Generally selling overweight things like European equities.

And I have been hoarding cash in anticipation of the new ISA tax season starting early in April.

Lastly, in a completely meaningless ‘rage against the machine’ I have shifted out of some USA-run ETFs into their European-run (UK, in fact) ETFs with HSBC. This is easier to do with equity trackers than fixed income – there are no obvious European-run ETFs equivalents of IGLT or VGOV for instance.

I finished the month a little overleveraged, significantly overweight European/International equities and somewhat underweight on US equities. But I’m comfortable with this tilt for the moment

Appendix – press clips

Well… it wasn’t tech/AI that let the steam out after all… just an own goal by a man painted orange.

Any particular reason for moving to the UK domiciled ETF’s? It’s a horribly complex and nuanced topic, and there are few good threads (if I recall correctly) on the bogleheads forums. The key points from memory:

LikeLiked by 1 person

Are you sure about that Estate Tax figure?

https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

Or does your figure apply to foreigners?

LikeLiked by 1 person

AFAIK it applies to NRA (non resident aliens), but I believe the figure is 40% of US listed ETF’s over 60K. I’m not a tax advisor, but I have lived in many places around the world and as a result, pored over a lot of DTA’s over the years!

It’s a very complex and nuanced topic, and depends on your personal taxation situation (and the relevant double taxation agreements in place between your personal tax residency’s jurisdiction and the US), so I’d strongly recommend speaking to a tax specialist (although to be honest, after speaking to many over the years, I’m not sure anyone REALLY knows what’s going on! :)).

You can check out the boglehead’s post here https://www.bogleheads.org/wiki/Nonresident_alien_taxation

This is the relevant section:

It’s something worth considering if you don’t live in the US, and are choosing which ETF’s to use. The higher fee EU/IRE/LUX domiciled ones can often be a better choice for non US citizens, but it does depend on their personal tax situation!

LikeLike

By golly, thank you for that. My own policy, easy for us to adhere to, is to own nothing that might be taxable by the US IRS.

I shall, however, forward your remarks to members of my extended family. Some may blanche.

LikeLike

Ha! Blanching averted. An email reply includes “Thank you. Our financial advisor made us aware of this a couple of months ago …”

Our own financial affairs have never needed a financial adviser. If I did go to one, however, it would be about technical stuff – taxes, trusts, what have you – not about simple stuff such as equities, bonds, cash, gold.

For the latter I know that the key thing is not to check valuations too often – every year or two will do.

LikeLike