What’s in the news?

The Trump, is in the news. He gets more than enough coverage without me adding to it.

From the point of view of what affects portfolios like mine, a few things happened

- Tariffs. Lots of chat, lots of yo-yoing. Not good for larger businesses, possibly quite good for smaller ones?

- War, lots of yo-yoing. Might it/they stop? Or might Russia become more terrifying?

- Defence spending is clearly going up, though I suspect by less than the claimed amounts.

- Longer term, the life of the US Dollar as reserve currency has shortened.

What’s going on with me?

My personal life was quite busy in February. I visited the UK city with the most caves (anybody know?), I had a short break in the Canaries, I enjoyed some time on the South Coast, I went to a play in East London. Busy, good busy.

Markets in Feb

Vanguard World Equities (VWRL) fell 3.5% in February, but UK Equities (which are <4% of World Equities) rose 2%. US Bond aggregates were up over 2%, though international (non UK/US/Aus) bonds dropped 1%. So your market benchmark very much depended on which markets you are benchmarked against. But the top does seem to have come off the US S&P ‘bubble’… let’s see how it unfolds in the next few weeks.

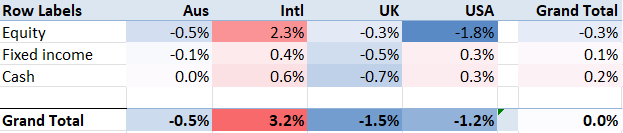

My weighted benchmark rose 0.5% on a constant currency basis; my non-GBP currencies fell 1.5%, so my benchmark dropped 1.5%. Being overweight the UK and underweight the US is currently a good place to be. As a result my index’s fall was a lot better than VWRL, which I tend to track quite closely.

My portfolio in Feb

As it happens my portfolio *did* track VWRL closely, by falling considerably, by 2.8%. My tech exposure was not helping me.

For a while I have been slightly overweight International (non UK/USA/Oz) equities. Right now, this is probably a useful tactical overweight.

I also went slightly overweight cash – and reduced exposure to the US – earlier in the year. That has left me with the perfect shock absorber for the declines in the portfolio so far.

Already, as I write this, I know there will be more to say about March. Until next month….

Appendix – press clips