September was fairly action-packed.

I enjoyed getting out on a friend’s boat around Poole and the Solent.

I made it to the Labour party conference in Liverpool, which was fascinating albeit wet. I am apparently firmly in the tax-raising sights of the Government, but I wasn’t the only potential target at the conference.

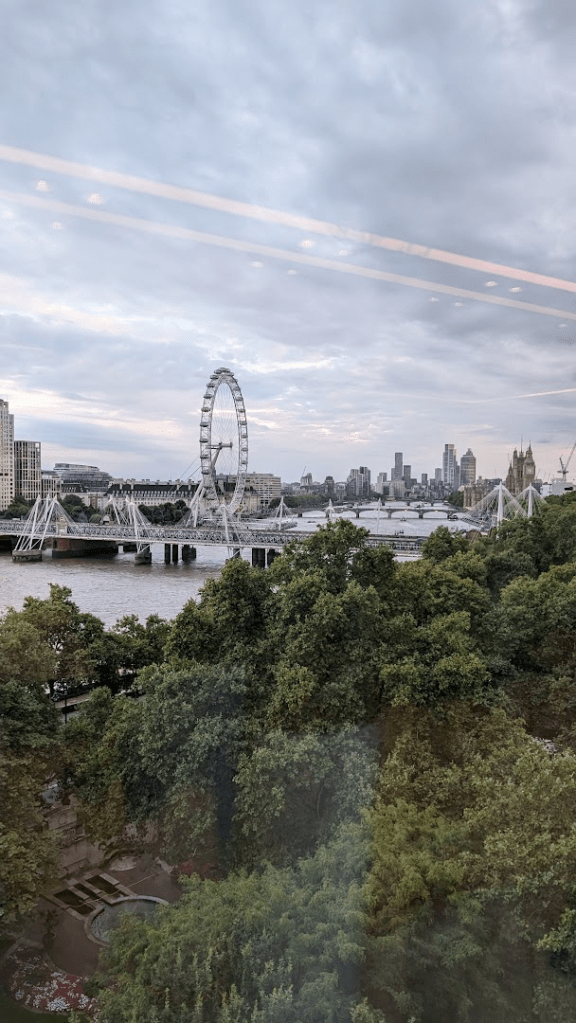

I enjoyed some work drinks with an elevated view of the Thames.

I was also invited to a formal dinner at an Oxford college, Harry Potter style.

And I took an out of town visitor around some of the sights in London town.

Markets in September 2024

I didn’t pay enormous attention to the markets in September. The pound continued to rise. Equities generally were quite strong, though the wider mood in the UK is gloomy – with the new Labour government taking a ‘freebies’ hammering in the media, and business fearing the worst from the new government’s budget due on 30 October. Inflation news was mostly for the better, which helped bonds.

The markets overall in September rose a weighted 1.5%, but with the drop in the USD this looks like +1.0% in GBP.

My portfolio rose a little bit less about 0.7% in September, another slight lag versus the market. I took quite a hit on a large work-related holding, that accounts for most of that lag.

I had a very good month for dividends and income. Even without any rent from my rental property for the last three months (see future blog post), my income is holding up well. September as usual was a bumper month.

What was also striking is how much better my loan now looks, compared even to a year ago. I may yet do a short separate blog about this. If you pay attention you can see what’s going on in my leverage graph on my portfolio returns page.

Press clippings from September

Or juicy politics, ominous economics.

Happy forthcoming Budget day.

LikeLiked by 1 person