The best tax break in the UK is the ISA tax-free savings regime. Each UK tax-resident adult can put £20k per year into an ISA account – use it for a wide range of investing activities – and not even have to report on what happens in those accounts, let alone pay tax on them.

This tax break is not exactly mass-market – not many people have £20k of spare funds every year – but for those of us who can avail of it, it is potentially enormous. Kids can have ISAs too, with an annual allowance of £9k. So a family of four, that can find £58k of liquid funds every year, can rapidly shelter a very large sum.

If you are a dual citizen, especially if you are a US citizen / green card holder, then Uncle Sam is certainly going to want to hear about these accounts and is absolutely going to tax them, but for plain UK citizens 100% resident in the UK, these tax breaks are awesome.

I’m now one of thousands of ISA millionaires

ISAs have now been around long enough that the number of investors whose ISA accounts exceed £1m is reaching many thousand. Expect to see this number skyrocket in the next few years. The top 25 largest ISAs average £11.66m of pot each – with I imagine a healthy dose of NVidia / similar holdings. If you haven’t followed the story of (Lord) John Lee, who is one of the first UK investors to amass £1m in ISA accounts, he’s worth checking out (£paywall).

My aim is to see my ISA accounts grow to well beyond £10m – which if I live another three or four decades, and the current policies don’t change, appears achievable.

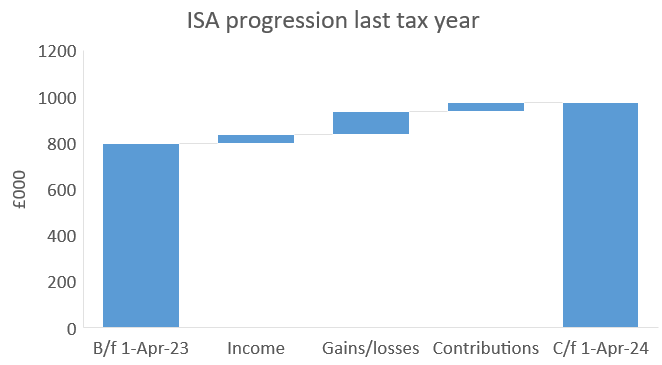

I have just seen my ISA accounts exceed £1m in value for the first time. I crossed the $1m barrier only a year or so ago, and now they’ve been hovering around the £1m level for a few months, but with recent stockmarket gains I can accurately say I have added another digit to the ISA values. The graph below is to the start of the tax year – there have been slight gains in value since then.

How to chase that ISA millionaire dream

Now, you might be thinking that numbers like £20k let alone £58k are well beyond you. Indeed, with UK average earnings still below £40k pre tax, you are not alone. However, your time may well come. Specifically, if you find yourself in the following positions, make sure to consider making a significant ISA contribution:

- Inheriting assets – such as a family home.

- Receiving a bonus at work.

- ‘Winning’ the premium bonds, or at the Grand National

- Selling your practice / business

- Receiving a redundancy payout when you are laid off / take voluntary retirement / similar

- Retiring, and taking a tax-free lump sum from your pension (which you can do under current UK pension rules)

- Various other scenarios I’m sure – feel free to add them in the comments

Confusingly, there are a number of different types of ISA – e.g. Cash ISA, Stocks & Shares ISA, Lifetime ISA, Innovative Finance ISA, and potentially soon a British ISA . But my perspective is that only one ISA type matters – the Stocks & Shares ISA. Fortunately, if you have unthinkingly got a Cash ISA, you can move funds from Cash ISAs into a Stocks & Shares ISA without affecting your annual allowance.

Stocks & Shares ISAs are normal investment accounts, usually held at stockbrokers like Hargreaves Lansdown, AJ Bell, Interactive Investor or perhaps one of the newer kids on the block like Monzo or Moneybox. Yes, the old school high street banks offer them but stay away from those ones – the fees are absurd and the platforms are rubbish. These investment accounts work pretty much identically to a general investment account, with a few minor exceptions, such as all investments must be held in GBP (so USD-listed holdings will see any dividends converted into GBP, for instance), you need to lodge your National Insurance number against the account, and you can only open one ISA (of any type, I think) per tax year. So if you are familiar with buying / selling stocks, or ETFs, or funds, then you can handle an ISA.

What do I put in my ISAs?

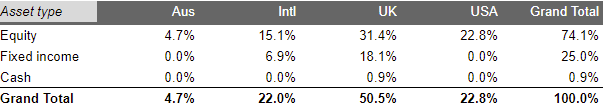

My own ISAs have holdings which are pretty similar to my wider investment portfolio. I have some ETFs, some individual UK and USA shares, and even one or two investment funds.

However my asset allocation is a little different to my overall allocation – I have much less USA exposure and am much longer on UK (no need for a British ISA here!). And ISAs can’t directly be leveraged – i.e. you can’t use borrowed money in them – so you can see my cash position is positive (though small), unlike my wider investment portfolio.

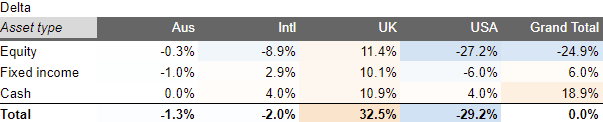

My deltas versus my overall target allocation are here:

Relative to my overall holdings, my ISAs are more income-orientated. My ISA holdings yield about 4.5%, versus around 3% for my portfolio as a whole. My largest single ISA holding is a preferred share which yields about 7% per year (all tax free). Having higher income holdings in an ISA somehow feels like better use of the tax break – though this is more of an emotional argument than a rational one. USA holdings are generally lower yield than UK ones, which somewhat explains the low USA weight I have in my ISAs – something which has slowed me down in reaching the £1m threshold.

I can’t easily track the investment performance of my ISAs as a whole. I have taken monthly snapshots, and the unitising is easy because I have made no withdrawals (ever!), and contributions (between me and Mrs FvL) are £40k per year – generally early in the tax year. But that analysis would take me a while, and hasn’t happened yet.

I’d be interested to hear how others handle their ISAs, versus their other accounts (such as pensions, general investment accounts, crypto wallets, etc). Are there any tips/tricks I am missing? Also if you are an investor who hasn’t opened an ISA yet, why not? All comments very welcome.

Congratulations on crossing the threshold!

Do you think its likely that the current rules will still be in place by the end of this government let alone in 30 years? Best to make hay while the sun shines.

I’m working on following down this path. Filling my ISA every year for several years now, however haven’t quite managed to fill both mine and my wife’s yet. Keeping out of the 60% tax bracket by making large pension contributions has so far prevented this. Life is always a balance!

To pick up on one of your uncertain comments. There is no longer a limit on the number of ISAs that you can open with different providers (with the exception I think of LISAs). How they are monitoring total contributions I’m unsure, but you can open as many as you like.

LikeLiked by 1 person

Another informative article. Thank you for taking the time to share your story. I was on a similar track to you with our family ISAs until fairly recently. As BoE rates increased and the distance between my loan debt and ISA % growth narrowed my thoughts turned to what to use our ISAs for. As interest rates peaked, I buckled and used it to pay redeem my renaming BTL mortgages.

I’m 55 now having pulled the plug on paid employment at 48 with a plan for rental, SIPP, defined benefit and state pension income to provide an income through retirement.

The decision to cash in the ISAs was a difficult one after I had nurtured them for so many years but now on reflection the peace of mind it has secured by eliminating debt feels worth it. Let’s see how I feel about this in a few years time!

LikeLiked by 1 person

On asset allocation for ISAs vs GIAs, I’ve actually taken the opposite approach – having gone overweight US shares and for tech-specific ETFs (ie IITU). This luckily coincided with the recent tech boom so I’ve done well from this allocation, but am in the process of moving back to weights more closely aligned with a global 100% equity tracker.

I think Stocks & Shares Lifetime ISAs are also worth considering if you’re still young enough to open one. From my perspective, if you’re using ISAs predominantly as a retirement vehicle, it’s hard to turn down the immediate 25% return (government contribution of £1,000 for a £4,000 max contribution per tax year) that you receive for contributing to one. While you are more limited in the platforms you can use relative to general S&S ISAs (the main platforms being HL and AJ Bell), I don’t think using a LISA limits you in terms of the shares, ETFs etc that you can hold within it.

Given LISAs as a retirement vehicle are a very long term investment, I go very hands off for LISA asset allocation – a simple developed world equity ETF tracker combined with an emerging market equity tracker.

LikeLiked by 1 person

On asset allocation for ISAs vs GIAs, I’ve actually taken the opposite approach – having gone overweight US shares and for tech-specific ETFs (ie IITU). This luckily coincided with the recent tech boom so I’ve done well from this allocation, but am in the process of moving back to weights more closely aligned with a global 100% equity tracker.

I think Stocks & Shares Lifetime ISAs are also worth considering if you’re still young enough to open one. From my perspective, if you’re using ISAs predominantly as a retirement vehicle, it’s hard to turn down the immediate 25% return (government contribution of £1,000 for a £4,000 max contribution per tax year) that you receive for contributing to one. While you are more limited in the platforms you can use relative to general S&S ISAs (the main platforms being HL and AJ Bell), I don’t think using a LISA limits you in terms of the shares, ETFs etc that you can hold within it.

Given LISAs as a retirement vehicle are a very long term investment, I go very hands off for LISA asset allocation – a simple developed world equity ETF tracker combined with an emerging market equity tracker.

LikeLiked by 1 person

I saw an article a week or so ago that some now have junior isas > 1mm!

I guess the goalposts have moved 😉

Its been a strong run the past few months, so if I cheat and count the kids as well as my wife and I we’re about 40k off. But I can’t spend those kids ones so its a bit of creative accounting on my part…

LikeLike

It’s a drop in the ocean, but anyone younger than 40 and willing to wait until 60 to take the cash out can start a S&S LISA and put there £4k/year (leaving the other £16k/year for the regular S&S ISAs).

If done this way, the government will top up an extra 25% to every year of contributions (so £1k/year extra returns).

The caveats, of course, are:

* You can only open a LISA if you are younger than 40.

* You can only contribute to a LISA until when you are 50.

* You can only take the cash out of a LISA when you are 60 or older – otherwise, there are punitive penalties.

* Very few brokers offer S&S LISAs currently (AJBell and HL come to mind now)

Not sure if this will apply to you or your Mrs. (though I can only think about the age maybe being a problem) – but for everyone reading this, it is an absolute no brainer if young enough and willing to wait to reap the rewards.

LikeLiked by 1 person

We’ve found the lifetime ISA to be useful. We hold S&S in it in exactly the same way we do with a normal S&S ISA. It just means we can expand our combined annual ISA contribution by £2k (to £42k) once the govt contribution is included, albeit with the downside that we can’t access the LISA until 60. The combined value of our government portion (the top ups plus the investment growth in those) currently stands at around £20k, and we’re still early 40s – so should compound to an even juicier pot of free money in time!

LikeLiked by 1 person

would I be right in saying using a LISA as a pension substitute (rather than first time house buyer) only makes sense if you are a lower rate tax payer?

LikeLike

You may be right. But we use it as a supplement, not a substitute (we can’t get any more into SO’s pension and mine has more than enough). In that / our case, it seems like free money.

LikeLiked by 1 person

Suppose someone lives abroad under a tax regime which would expect to tax him on his British investment and savings income. The local tax authorities presumably expect to check his reported British income with HMRC. But HMRC will have no record of his ISA income (will it?).

Won’t this tempt him simply not to declare his ISA income? I wonder how many people who have retired to France or Spain are doing, or not doing, this. I wonder whether this is seen as an advantage of ISA savings over SIPP savings. Come to that, how about the quasi-income from Premium Bond winnings? Or the income from ns&i Savings Certificates?

LikeLiked by 1 person

I think I’m right in saying HMRC *does* have a record of pot sizes, at least (hence their response to the Freedom of Information requests) – linked to your national insurance number. So if you think just because you aren’t telling them about the income/gains, they don’t know about it, you could be mistaken.

LikeLike

great work on the £1m+ ISA. We are expecting to hit a combined £750k next year, the £1m will take 2-3 years more.

my plan is to grow the isa until it’s around £1.2-£1.4m (about age 60) then take 6% pa to spend /gift to kids. Happy for the pot to drift down 50-70% in real terms over the following 20-35 years.

I’m not planning on marrying a much younger wife in the future! What’s the logic with a £10m+ ISA that’s going to be hit with 40% IHT? It sounds really cool but is it the best solution to your families financial objectives? I’m slightly worried about not spending enough/under living – and the kids getting more than I planned

I suppose if your destined to be worth £25m+ then a £10m ISA is sensible

LikeLike

great work on the £1m+ ISA. We are expecting to hit a combined £750k next year, the £1m will take 2-3 years more.

my plan is to grow the isa until it’s around £1.2-£1.4m (about age 60) then take 6% pa to spend /gift to kids. Happy for the pot to drift down 50-70% in real terms over the following 20-35 years.

I’m not planning on marrying a much younger wife in the future! What’s the logic with a £10m+ ISA that’s going to be hit with 40% IHT? It sounds really cool but is it the best solution to your families financial objectives? I’m slightly worried about not spending enough/under living – and the kids getting more than I planned

I suppose if your destined to be worth £25m+ then a £10m ISA is fair enough

LikeLiked by 1 person

[…] ISA millionaire status achieved – Fire V London […]

LikeLike

[…] ISA millionaire status achieved – Fire V London […]

LikeLike

congratulations on the £1m.

I sadly depleted my ISAs around 8 years ago as i thought there was no tax on dividends for lower rate tax payers.

it made sense at the time – but is an 8.75% regret!

so, I’ve paid in and the isa is growing, and I’m avoiding tax which is good and in intend to keep.paying in as.long as possible.

in defence of the LISA – the risk is that you lose 25% of the value if you cash it in before 60 (a 6.25% loss). But presumably you’ve also burnt through you total GIA account’s and your ISA, which at £16k a year per person is still quite a sum.

the LISA is a free £1000 for those that don’t really need it. Arguably it shouldn’t exist but who looks a gift horse in the mouth?

JISAs… at 42 and with kids aged 5 & 7 – there’s an overlap of when they’ll turn 18 and have free reign to squander and when I’ll get access to Pensions and LISAs. My priorities might change but I’ve not got the spare money to JISA up just yet.

LikeLike

as long as you’re able to invest up to £60k per year into a pension and get tax relief at the higher rate, an ISA makes no sense. Likewise, windfalls from redundancy should be invested into pension, not ISA – otherwise you’re throwing away nearly half your money. ISAs only really make sense for low earners.

LikeLike

In theory you’re right, but in practice, here is also a risk of governments tinkering with pension policy (the exact hows of withdrawing, associated tax etc) so putting something into ISA, especially if you are young, is is a way to diversify risk. ISAs are also much more liquid as they can be withdrawn anytime if life throws you a curveball. Another point is that unused pension contribution allowances roll forward 3 years (so if you anticipate a good chance of a windfall from bonus etc in the next year or two you can still fill it), whereas you have to use it or lose it for the 20k annual ISA allowance.

LikeLike

On inheritance specifically, it’s worth mentioning that you can inherit a spouse’s ISA value as your ISA limit if they were to die, even if you don’t receive that amount as inheritance. If your spouse dies with say £1 million in their ISA, you are entitled to add £1 million to your own ISA regardless of how much you actually inherit.

LikeLiked by 1 person

On inheritance specifically, it’s worth mentioning that you can inherit a spouse’s ISA value as your ISA limit if they were to die, even if you don’t receive that amount as inheritance. If your spouse dies with say £1 million in their ISA, you are entitled to add £1 million to your own ISA regardless of how much you actually inherit.

LikeLike

ISA millionaire status achieved in each of our mr and mrs portfolios and they mirror each other. They dipped below million mark briefly in latest tech correction but been hovering well above the million. We have SIPPs and GA but S&S ISA’s are the best performing. Just over 50% is Nvidia as it’s achieved growth of approx 4400% and i’m not in habit of balancing the portfolio, just buy and hold.

LikeLiked by 1 person

I’d rebalance and lock in your gain. If in doubt, ask yourself if you’d invest £1m in Nvidia today. If not, you shouldn’t hold it either. A correction could really hurt.

LikeLiked by 1 person

Congratulations on hitting the £1m in your Stocks and Shares ISA. I’m another proponent of using Lifetime-ISAs to get the £1K bonus from the Government when making a £4K investment each year. I’m going to be interested to see in the budget if they raise the maximum property price a LISA can be used to purchase (I believe it’s currently 450K which is probably below the average 1st time buyer’s property price in London). Also to add, Nick Braun’s book “Pension Magic” is an interesting read, and has a good chapter comparing ISAs with Pensions using case studies to show when each can be most beneficial at different earnings levels.

LikeLiked by 1 person

Great article. Frank – if you happen to read this – I am really intrigued that you cashed in the ISA to clear the BTL debt. I was forced also to do this as rates increased but do regret it. Unlevered buy to let is probably the only way to make any money in resi property any more; but value your thoughts on if you feel the cashing out and fully repaying debt was worth it?

Thanks!

LikeLiked by 1 person

https://archive.is/20210211211350/https://www.ft.com/content/2c2a8eff-0eae-4952-bb45-fbf2e79a66f6

This is hopefully the article by Lord Lee without the paywall.

LikeLiked by 1 person

Belated congratulations on your achievement!

LikeLiked by 1 person