July has been quite a busy month.

I’ve been getting about a bit. Some South Coast action, some Mediterranean fun, a trip up to Oxford, a visit to one of England’s great Cathedrals, and more.

And July saw some fine times in London. Both outdoors and inside.

And of course we had the UK election. Not much news there, really. Labour won, the Tories were routed. Next?

Oh, some Olympics started, in the rain. More on that no doubt next month.

Markets in July

I write this update on the 5 August. And already my July update feels a bit stale.

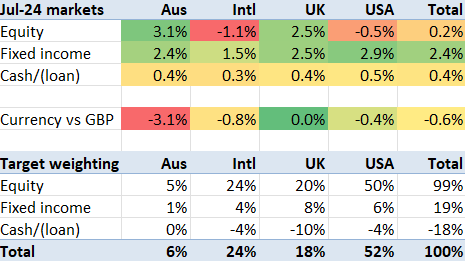

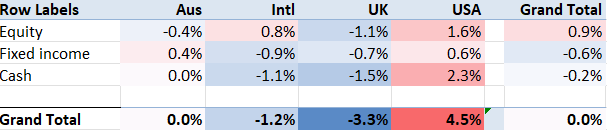

Roughly speaking, not much happened in the markets in July. My markets, on a constant currency basis, rose 0.6%.

An exception was Australia, where the AUD fell 3%+, and their equities rose by a similar amount – I’m not up to date on what’s been happening out there so can’t comment.

But elsewhere, bonds had a good month, and equities didn’t move that much. Inflation news is generally positive, which implies cuts in interest rates, which is helping bonds.

As to equities, the month-to-month view masks some quite lively mid month activity. The S&P500 is a case in point: it finished July on 5522, starting on 5475 – an increase of about 1%. However mid month it peaked at 5667, an increase of 3.5%, so the month end position was a decline of 2.5%.

And as of 5 August, markets have dropped quite a bit. The S&P500 is now on 5186 – a drawdown of 8.5% from its peak. And August has barely started.

The pound had a relatively good month – particularly against the AUD, where it is close to $2:£1. Currencies overall fell 0.6%.

My portfolio

Versus +0.6% for my markets overall, my portfolio rose 1.4%. I haven’t had a chance to dig into why this.

I found myself having to raid the portfolio for a material five figure sum, to pay the HMRC. They want mid year topups these days, and my tax situation is such that this figure definitely does not ‘pay itself’. This is another example of borrowing money to pay the taxman.

Thankfully the increase in my portfolio – as of July, remember, and not yet looking at what’s happening in August – more than offset the increase in my margin loan from paying the HMRC. My net loan, as a % of my overall portfolio, dropped a bit from 15.7% to 15.6%.

I remain slightly imbalanced versus my target allocation. I am slightly overweight USA equities, slightly more indebted in GBP/EUR and slightly less in USD. The main thing I care about is my cash/leverage position, which remains very much under control.

Do you think investment income surcharge may return ( went out in mid 1980s ) when it was 15% extra income tax on investment income over £6.5K ( i.e. about £27k today) or possibly a wealth tax ?

LikeLiked by 1 person

Interesting Q. I haven’t thought about the income surcharge. But I have thought about a wealth tax and, no, I don’t think a wealth tax is imminent.

What I think is more likely is a change in allowances. For instance a lifting or even removal of the upper ceiling on NI contributions. Or a cap on ISA allowances.

LikeLike