June was busy.

I travelled more than usual in June. Partly in the UK – visiting Glasgow, the west country, the south coast and the Isle of Wight; partly overseas – I visited Ibiza for a few days of R&R.

Meanwhile, the election campaigns were in full swing. Nigel Farage did his Nth U-turn, and decided to enter the race after all. I didn’t write it about it contemporaneously, and now that it’s after the election I’m not going to say much about it here.

My main observation is that Labour’s talk about supporting ‘working people‘ was defined pretty sharply by Sir Keir Starmer as thus meaning that investors (people who can “write a cheque” when they need to) are likely to end up paying more tax/contributing more. That means me, and every other reader of this blog.

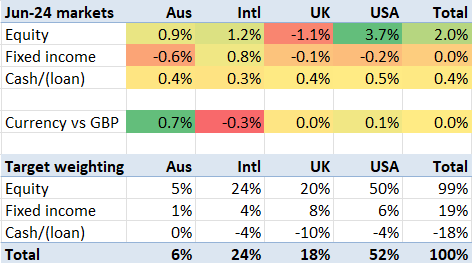

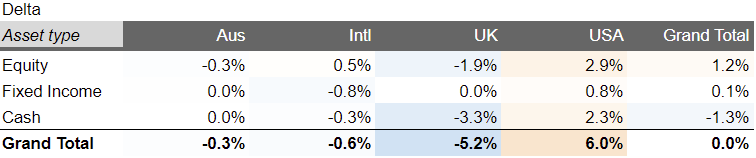

Markets in June

Meanwhile the markets in June saw tech stocks – Nvidia particularly – continue to drive the US stock market. Most other markets were fairly stable; inflation is down but interest rates haven’t yet started falling.

My returns

My portfolio rose modestly. I’m still teetering around my 2021 high water mark; my ISAs are teetering around the £1m combined value.

I put my old flat, let out for the last 10+ years, on the market in Easter, after the lovely tenant of the last 7 years served notice. I had an offer at the end of June that I have accepted, though I am not holding my breath as the buyer has a chain.

My debt levels have increased somewhat, partly due to needing to shoulder a short term commercial property funding gap, and partly due to a personal loan which I will most likely blog more about in the near future.

Thanks to the wider market gains, my overall level of leverage remains absolutely manageable (about 1.3% over-indebted versus my target), and my invested portfolio is a little bit bigger than earlier in the year; if I hadn’t tapped the portfolio debt facilities it would be significantly bigger still. I’m left in a similar place to recent months; slightly underweight cash, slightly overweight US stocks, and slightly underweight UK equities.

Appendix: Press clippings

I am also fully fitting the profile of the allegedly filthy rich who should be taxed until the pips squeak. It is only a small comfort to see that Starmer’s second phone call was to the guy who designed Blair’s plans to privatise the NHS. So maybe he’s not as left wing as feared.

a couple of other thoughts. First of all, the nondoms. Since Darling introduced the annual fee to be able to report on a remittance basis I have reported my full global income. Ironically thanks to the market crash my firts global self assessment included a couple of millions tax loss carryforward, it took a long time before I paid a penny in CG tax. Back to today, chatting to the school parents crowd I haven’t found anyone yet rich enough who pays the fee and reports only their UK income (lots of finance/consulting/private equity professionals, most of us foreign born). Therefore I have a feeling that the really rich have fled or sheltered their wealth already, while the rest of us already pay the full taxes in the UK. Meanwhile our cleaner has apartments in Brazil who she rents out. Theoretically she has to report global income, or pay the non-dom fee (she does neither) let’s see if they catch her. Oh, in any case, the tax rate she pays in Brazil is higher than the UK, so she will get a rebate under the double tax treaties. In summary: the government will raise virtually nothing.

On the other hand my own personal opinion Labour is probably right about the private school VAT thing. Adding VAT to private school fees will raise a lot of money. Our school (schools, not just my kids) have been increasing their fees way above inflation every year forever. This year they will take a hit – i.e. increase their all-in fees by less than 20%, absorbing some of the added VAT. While higher than the past, this increase is far from new and (cursing and swearing at them) I haven’t met many who will take their kids out. Next year it will be back to above-inflation fee increases, business as usual.

LikeLike

I would love to get your thoughts on bonds, I’m in my 40s and am 100% invested in equities with zero bonds (but I do have some cash ISAs). I appreciate that bonds are a “safer” investment however they just lose money year after year, especially factoring in inflation. Is my strategy really that risky?

LikeLike

my simple answer, maybe simplistic, and slightly inaccurate, but just to make a point:

Bonds represent the cost of capital, equity represent the return on capital. If you believe in capitalism and in the human spirit of initiative, curiosity and entrepreneurship (after 2 millennia of history I do) the return on capital is always above the cost of capital in the medium/long term. Hence no bonds for me. Equities all the way.

LikeLike

That feels like a good question to explore in a blog.

The short version…. My thoughts on bonds are a bit incoherent/contradictory. On the one hand I am a big adherent to Modern Portfolio Theory – which says a) diversification is the only ‘free lunch’ in investing, and b) a combination of two imperfectly correlated assets will have a better risk/return profile than just one asset class. This has me holding some bonds as a counterpoint to my long equity positions. As to which bonds – I have quite a wide combination – though generally I have gone off Corporate Bond funds and index linked bonds. I hold a few individual securities but mostly it is through index tracking ETFs – though I do appreciate that the concept of an index, with bonds, is problematic.

LikeLike

If you are worried about volatility, you can manage the risk by controlling leverage, as our host does, and/or diversifying across secors and markets and/or diversify in other relatively stable assets (for example land, real estate etc.)

LikeLike

“especially factoring in inflation”

Then buy index-linked gilts. A ladder of short term ILGs might be a useful diversifier. I’d also buy gold sovereigns if only I know a safe way of storing them. Unsurprisingly nobody online is prepared to describe their own storage wheezes.

LikeLike

I hope that’s not the Hut?

LikeLike

why do you hope that? I love the Hut!

LikeLike

haha, bit too upmarket for me! Was on the island on Sunday. Glorious day for a bike ride 😁. Did find a lovely cafe, Lagom, in Bembridge in case you find yourself over that side.

LikeLiked by 1 person