My psychology around money has changed significantly over the last two years. While some of that is captured in my monthly portfolio updates, I thought it was worth recording some of my emotions while they are still fresh.

Two years ago

Turning the clock back, my financial situation was, in word, ‘flush’. The stock market boom had just crested – S&P500 was at 4400, FTSE-100 was at 7000.

I generally had a surfeit of cash every month, just from earnings – never mind investment income. I saw several exits over a 2 year period in my angel investing activities. I reinvested both sheltered income and unsheltered income for compound investment growth. I was unmortgaged. Base rates were almost zero – which I exploited with a margin loan – leveraging my portfolio by a target 12% loan-to-value.

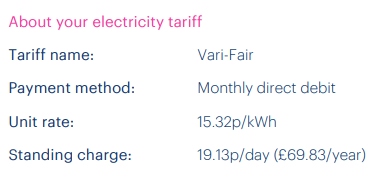

Another key cost, which I never thought about two years ago, is energy. My London home, at that point my only home, which is heated by gas, cost me £250pcm in energy – which in fact was a lot of energy. Electricity cost me 15p/kWh, and gas cost me – weep – 2.89p/kWh.

From a FIRE perspective, I was in a good position. Even ignoring my tax-sheltered accounts I was pretty financially independent – my unsheltered accounts produced enough income at least to pay for daily spending, if not necessarily to keep maxing out on ISA topups.

Then I bought the Coastal Folly

Almost exactly two years ago, I whimsically bought the Coastal Folly. I bought it largely on debt – using my portfolio to finance the purchase. Interest rates remained low; each £1m that I borrowed cost me around £20k per year. I borrowed more than two of them. My loan to value target exceeded 30%.

At the point I made that decision, I expected my household costs, excluding financing costs, to increase by around £10k per year. I have to pay real estate taxes on the Coastal Folly – around £3500p.a. I have to pay for its energy – and the Coastal Folly is 100% electric – so I expected another £3k p.a. for that. Then I have cleaners, window cleaners, broadband, etc to pay. And travel costs to/from. As two year ago readers will know, I didn’t attempt to assess this very carefully. But I would have expected £10k p.a. to suffice.

As well as those extra running costs, I had setup costs. These were significant. A second home needed to be kitted out with furniture. I needed coastal gear. Water toys. A bigger, more practical car. I spent over £100k in year 1 – not all incremental, as the car needed to be replaced at some point anyway. I viewed this spend as ‘capex’, and it came from my investment portfolio, and I was not stressed by that.

Then Russia’s full-scale invasion of Ukraine happened

I realise that any of my griping pales into insignificance compared to what the Ukrainians have endured. I’m not asking for sympathy, nor do I deserve any. I’m just telling my story.

After the Russian fullscale invasion, geopolitics hit European energy supplies. Energy prices skyrocketed. My summer 2022, electricity cost me 28p/kWh – almost double, and gas cost me 7.16p/kWH – triple the number a year earlier. Suddenly I was facing £10k per year of energy cost per household.

I didn’t enjoy 2022. S&P500 fell from 4600 to 3600 over 9 months. Not catastrophic, but along with those energy prices, this was not good for my mood. Especially since I was pretty fully levered.

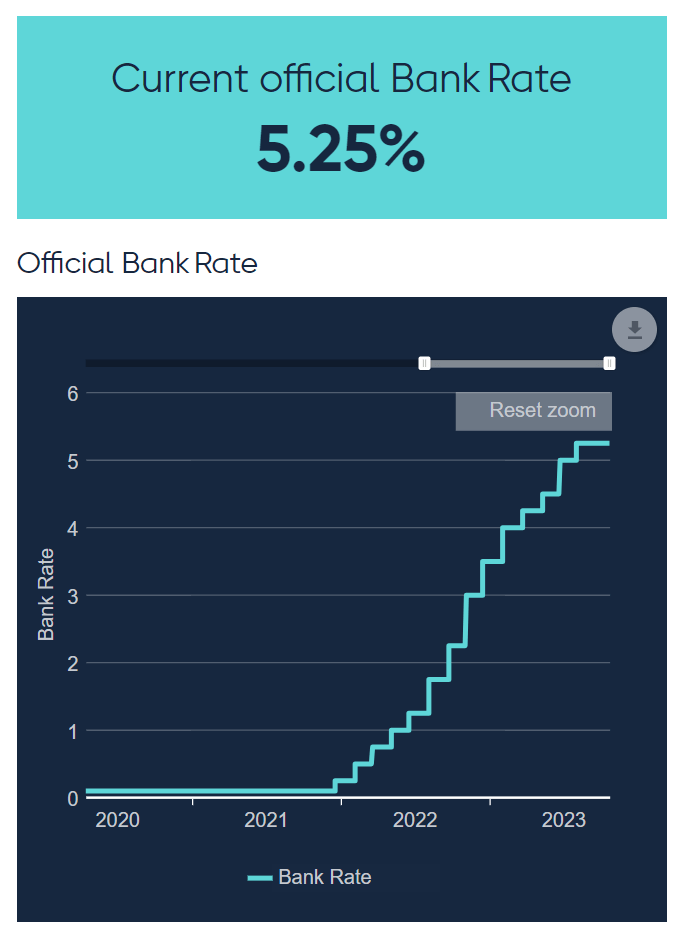

And as energy prices skyrocketed, inflation went with it. And the central banks rose to the occasion – or at least base rates rose to the occasion. And possibly are still rising. Starting December 2021, the month I bought my Coastal Folly on margin, the Bank of England started increasing rates. By the end of 2022 the sterling base rate had reached 3%. And it carried on rising. At the time of writing base rates in the UK are 5.25%.

My interest costs alone, on the margin loan I took out to buy the Coastal Folly, would be well in excess of £150k. They are considerably higher than base rates – currently my cost of funds is almost 7% a year. Thankfully I have already reduced the size of the margin loan quite considerably, but my interest costs remain on the wrong side of £100k per year. I have been using unsheltered investment income to pay down my margin loan. Which delivers compound growth in a manner of speaking, but it isn’t growing the investment income itself.

Inflation has affected many other prices too. My car insurance has shot up 30%. Flights to Australia have doubled. It is now quite hard to buy a meal at Pret a Manger for less than £10. It all adds up.

Roll on 2023

Somehow this year has felt better. The S&P500, always a driver of my mood, has risen from 3800 to 4250, and FTSE-100 is flat at around 7400. It is noticeable that there have been negligible exits / liquidity events to speak of in my angel portfolio, so I haven’t had ‘windfalls’ to play with.

Base rates have continued to rise but appear to have hit or neared their peak, with my cost of funds a bit less than 7%.

Inflation has been falling in the West. It’s still quite high, at around 6-7% in the UK, but somehow it feels like we are slowly improving.

Energy prices are on their way down too. I’m still paying around 29p/kWh for electricity and 7.15p/kWh for gas but the bills themselves are actually dropping a bit.

And I feel broke

While the macro picture in 2023 feels a little bit better, the day to day picture feels poor.

I can’t remember a month in which my earned income has covered my outgoings. I have to raid investment income or, worse, investment capital, every month. Some of these outgoings, to be clear, are (angel, etc) investments – not day-to-day spending – but only a few years ago I generally managed to fund these out of daily cash flow with the occasional ‘windfall’ helping smooth things over.

My earned income has risen slowly over the last two years, by less than inflation. In the scheme of things, this is the least of my problems.

I have managed to repay a useful portion of my margin loan this year, by a mixture of taking profits and using ‘excess’ investment income. But as I did this, increasing interest rates pushed my interest costs up significantly – eating into my ‘excess’ investment income. On the current trajectory I will need around 10 years to return to a ~10% leverage ratio. Several months – especially over the lean July/August months – my unsheltered investment income does not cover my interest costs.

I have continued to reinvest tax-sheltered income. My tax-sheltered accounts are continuing to grow. I’m continuing to make ISA topups, and small pension contributions. But my unsheltered portfolio is slowly shrinking.

This being said, I have managed to resist the temptation to just sell down my portfolio to reduce my margin loan. The interest costs are high, but they remain less than the unsheltered investment income – just about.

I find the few investment topups that I do make are subtle-ly different too. Conciously or subconsciously, I am definitely chasing income. I have always liked the high yield preferred bonds like NWBD, RSAB and I’ve been topping up on those. While I remain long on AMZN and GOOG, their lack of dividends is not helping them right now. And my stance on my rental property was pretty assertive – I was clear with my tenant that if he didn’t cough up a chunky rent increase, I was going to sell the property. He agreed – and avoided needing to join the bunfight for new rental properties, that would have cost him even more.

I no longer feel as financially independent as I’d like to. Right now, I would struggle to give up earned income; in principle I could probably cope, but on a monthly basis I would feel like I was haemorrhaging cash.

Now, mindful of much wisdom in the blogging community, I should issue a few disclaimers. I’ve spent quite a bit on travel and holidays this year, I’m still eating out plenty, I’m still making charity donations, I still treat my friends and family. In no way is my style materially crimped. My lifestyle is expensive – not because of some keeping-up-with-Jones effect, but because I am fortunate to have a lot of opportunities, and I try to make the most of them.

I also realise that psychology changing over the last two years is Exactly The Point. This is why base rates are increasing – to increase the cost of financing things, and thus reduce the disposable income left for everything else. I haven’t found myself existentially exposed by interest rates reaching hard-to-remember levels, but nonetheless my psychology has changed.

But summing up, needing to raid the portfolios yet again as month end approaches is not a good feeling. I have a sense that this feeling won’t last forever, and that by dint of a windfall or two, I will see my absolute interest costs dropping slowly from their 2023 high watermark. As that happens, touch wood I can accelerate the margin loan repayments and shorten the >10 year expected timeframe to restore order. I’m hopeful, but not fully confident. Let’s see what 2024 throws at me.

Over to you, dear readers

How are you faring with the ‘cost of living crisis’? What has happened to your earned income? What has happened to your spending? Have you faced the expiry of a cheap fixed rate mortgage? Have you cut back on stuff? What has happened to your psychology? Please add comments below.

Definitely higher base rates are creating interesting investment opportunities. It is certainly the case that liquidity/available cash is a lot lower for me ! I am also seeking income. One of my go-tos is BXMT leveraged senior loans with a good sponsor (hefty perf. fee) but 12% yield in USD. Helps amortise the USD margin loan perhaps?!

Andy from aus

LikeLiked by 1 person

I hadn’t come across BXMT. From what you are saying it sounds a bit spicy for comfort but I will do my own research nonetheless. Thanks for the tip!

LikeLike

Hi mate

5 years ago I set myself a target to make £1 million in 10 years whilst earning only minimum wage.

Since then I’ve bought 4 houses. Three are vanilla btl’s and the fourth a Serviced Accommodation property. All good news.

Until inflation, Ukraine yadda yadda.

My net income from the btl was £1000pm. It’s now £600pm. It’s just the first month for the SA so the jury is out (although I need 50% occupancy to cover the £1500pm costs).

Like yourself I’m prompted to make some strategy changes. I never wanted to sell from my YouTube channel (too many grifters doing the same,) but I am often asked for mentoring etc. So, recognising that I need to generate more income and not wishing to leave any money on the table, I’m first launching a subscription only site, then an online course, followed by a book and a new brand.

Will they all succeed? Experience would tell me no. Not all of them. But one or some of them will. And that’s key because it’s all about the income.

Watch this space

Perry

LikeLiked by 1 person

My situation rhymes with yours regarding the psychological feeling. At the end of 2021 I felt incredible. In the previous 12m my (15% leveraged) overall wealth had increased by 20%, which is >5 years of take home salary. Exponential growth had arrived. My allocation was approx 20% home residence, 15% high yield shares, 1-3% cash, and the rest 1:1 ratio of vanguard VUSA and VWRL, or similar. Leverage is from 5 and 10 year fixed rate repayment mortgages. 3 years (1% interest) and 9 years (2.3%) respectively remaining My spending was/is much more conservative than yours. Although I have certainly missed fun opportunities in my life. My spending more or less exactly matches my earned income. I used to save a significant chunk. I could not support current spending on a 4% safe withdrawal rate. My only ‘rich person’ signals are a nicer than average house, a non working spouse, and a private education for my two children. No holiday homes, one family car (worth £25Kish). That said – I do frequently attract envy at work from status conscious colleagues and senior managers who appear to regard me as very rich. I’m not in the top 1% for UK, but I am hopeful I will reach that eventually. I think it’s my confidence and interest in global economics that gives the impression of wealth. I definitely have FU money, but not an FU attitude.

2022 was pretty grim. Net worth down 8% overall in sterling. More like 14% in dollars. Confidence fell a little. More worried about retirement etc. early retirement seems a more distant prospect. Feeling more dependent on work income and pleasing managers etc. More worried about helping children set up as young adults.

2023 has been OK financially. An exceptionally good year for family life. Net worth currently up around 8% in pounds. Was more like 12% a couple of weeks ago. Perhaps better than most because I never owned any bonds, so dodged that bullet. I’m considering a BTL purchase (a bond with a roof?). Looks like I can pick up well-located local high rental demand flats with a net yield of 4% allowing for all costs. Not incredible, but hopefully an inflation linked cash flow to diversify my ‘growth’ VUSA and VWRL holdings. I’m not sufficiently expert to fully understand the risks on prefs, or other credit-type financial top investments. For me it’s straight equities, ETFs and maybe a BTL or two. No way I could confidently assess BXMT, as suggested by previous poster.

I think 2024 will be more of the same. 5% interest rates. 4-6% inflation. More taxes on rich people in the UK if/when labour government gets in. Probably lower property prices. Shares about the same. Me working another year.

Love your blog. So refreshing to read the perspective of someone taking risks and living life. Just take it easy on that floating rate margin loan! Ladies, liquor and leverage.

LikeLiked by 1 person

Very interesting post.

I’m trying to assess how much of your feeling is as a result of market conditions, inflation etc which affect us all, and how much is as a result of the purchase of the Costal Folly – which btw I repeatedly misread as “Colossal Folly”. Definitely something in my subconscious going on there!

Current thinking is its largely down to the purchase of the folly. I suspect that the market / inflation issues wouldn’t have troubled you much at all psychologically if you hadn’t made the purchase. So its come with considerable financial cost but I’d be interested to know if you still view it as a worthwhile purchase? I’m well aware the cost is only half of the picture.

Personally this last few years have felt a lot like treading water. I’m progressing well in my career and earnings have followed, increasing over 25% in the last few years having also done so in the few before that.

However more recently so have outgoings. All the usual increases in food and energy costs plus we have recently re-mortgaged from a 2% to a 4% rate, 25% increase overall increase in cost. We have 2 children under school age so are currently paying more than the increased mortgage in childcare. Now struggling to max my ISA investments, certainly not doing so for the both the wife and I. If I track net worth against FI number then we’ve hardly progressed over the last couple of years, still just over 50% of the way there.

But still lots of reasons to be positive. We’re extremely fortunate that we don’t ever worry about paying bills or putting food on the table like many have to. Still holidaying, eating out etc and like yourself have kept our standard of living as high as it’s ever been. We’ll have one in school next year which will half our childcare costs. (We’ve decided not to go fee paying. Open minded about that but haven’t yet identified a public school close to where we live that’s worth the additional cost) With a good tailwind we’d be FI in 3-5 years so feels very much like we’re reaching the top of a hump. Certainly possible market conditions could make it a false summit, but still feeling pretty positive all in all.

# Also as its my first comment here I’d like to echo other comments on what a fantastic read this blog is. You offer a different perspective to many in the FI space and I find that incredibly interesting, thought provoking and valuable in many ways.

LikeLiked by 1 person

Rosario – thank you for your comment and your positive feedback.

You ask a good question re the Colossal (!) Folly.

Overall I am in fact very happy with the purchase. It has brought a new and very enjoyable dimension to my/Mrs FvL’s life. Being by the coast – and in such a different environment to London – is special and every time I visit I grin. I suspect it has gone up in value too though that is a very minor consideration.

That all being said, you are right that a lot of the financial change that I’m wincing about is as a result of the Folly. Assuming my leverage would otherwise have been unchanged, I would be over £100k p.a. better off if I hadn’t bought it or anything else. I think there would still be months where I was dipping into savings/investments, but they would be the exception.

LikeLike

Interesting analysis as ever. I am fairly heavily invested in equities and so recent volatility has reduced nominal wealth and of course real wealth is also being impacted.

I think the main concern on your side would be I feel the downside risk with regards to the S&P500 is very high (TIPS are showing a +ve yield, Bond market high yields, CAPE ratio is very elevated).

We live frugally apart from private school fees and so the running yield on our investment portfolio (bond yields, rentals, dividends) broadly matches expenditure when I include my SIPP and so our earned income means we can continue to add to the portfolio annually.

One would think bond yields are nearing tops albeit tail risk in inflation could obviously increase downside. But US equities look very toppy given yields recognising I have no forecasting ability. I remain heavily invested though as the best hedge I have long term to offset inflation is equities.

LikeLiked by 1 person

There is an old saying: “one house, one car, one woman” 🙂

LikeLiked by 1 person

Great article, very self aware and humble. It chimes with a lot of my own experience at the portfolio, though fortunately I’ve not had an equivalent of a costal folly to further weigh on things. A few years ago, as I was on the cusp of paying off my mortgage with accumulated savings, someone suggested extending the mortgage and putting the savings into (further) equities. I am so glad I did NOT do that, and paid the darn thing off! In my equity portfolio, 2023 has felt like snakes and ladders… with a lot of snakes this month!

Thanks for the great blog. I’m sure, in the long run, the coastal folly will be a great addition. Life is for living and all that, and a bolt hole by the sea must be a lovely thing. Onwards!

LikeLiked by 1 person

FvL. I’ve never totally understood how you accumulated your capital. I’ve assumed it was a tech related windfall. Whatever. What I have concluded is that your post-tax core salary is a relatively modest percentage of your capital. In that sense, you need to see yourself as functionally retired, even if you are not.

I’m not dissimilar. I felt bad for years that my salary could not cover my base costs. But my salary is 33% lower in nominal terms than over a decade ago. Realistically with private school at £50k, multiple holidays at £15k a pop, I spend the first £100k with even thinking about eating or lighting the house. I now see the salary just as a nice divi that comes in monthly. When I negotiated my next job earlier this year, I forget to even ask what the salary was! It’s was all about the sign-on and bonus percentages.

Wealthy people don’t worry about salaries. It’s not an accrual trade. It’s about the capital position.

LikeLiked by 1 person

I *seeded* my capital via a business windfall. Since then I have had additional sources/windfalls- of course the investment returns off that initial seed capital, but also some tech-related, some property related, some income related sources.

I love your point that wealthy people should focus on capital/wealth, not salary. Roughly speaking, that would apply to me. However right now my post tax employment income is high enough to be material – and my unsheltered investment income is largely needed to pay finance costs. A lot of my wealth is either sheltered (and thus not touched) or in property (where it creates notable liabilities, but v little income), so on a day to day basis I do not feel that wealthy and I do worry about salaries! Big picture, your point stands.

I will reflect on your point that I should see myself as functionally retired. I think that’s right, and that I do, but perhaps I not as clearly as I should.

LikeLike

My post tax salary is now <0.5% of my net worth. With a portfolio volatility of 7%/annum (it should be 5% but I seem to have drifted higher), my salary is a rounding error. I've had a string of good years but my post-tax total comp is unlikely to be more than 7% of my net worth. So it can be also be negated by portfolio volatility on a one-standard deviation move.

You run a much more volatile portfolio than I do. How does your salary compare to the portfolio volatility? My impression is that it might be small compared to that. Feels bad perhaps, but, statistically, is this out of sample? Once you portfolio volatility can regularly overwhelm your salary, it's pointless worrying about things like whether the salary cover expenses etc. That metric is obsolete really.

LikeLiked by 1 person

You are right. My portfolio moves in a typical month by a meaningful proportion of my annual salary income.

LikeLike

I never thought of salary as proportion of wealth before. But when I calculate, it comes to around 4% so quite significant. I would need to 10x my wealth to get to around 0.5%. Realistically, I’d call it quits if I managed to double my wealth and get it down to 2%.

LikeLike

Great post – thanks for sharing.

Wealthy people feeling the pinch a touch but not really adjusting their lifestyles – their consumption? Sounds like the tightening is doing its thing but has a way to go before demand for stuff is brought in line with the economy’s ability to supply stuff, durably taming inflation.

For this, some regular people are going to need to lose their jobs, and most wealthy people are going to need to see their asset portfolios decline further in value – potentially a lot further.

Much more pain on the menu for the leveraged. Many more to discover they were over-leveraged. Lots of opportunity – eventually – to those well prepared and patient.

LikeLiked by 1 person

I misread FvL as FmL.

You cover your margin interest with uncovered investment distributions?!? 7%! That’s post tax if its not in a business right?

LikeLike

not sure what ‘uncovered investment distributions’ are?

You are right tho that my margin interest is mostly on unsheltered accounts, and is thus mostly paid out of taxed investment distributions.

Point to note that cash is currently at around -22% of the portfolio allocation.

Roughly speaking that means I am paying 22% x 7% interest i.e. 1.54% is my cost of funds. My pre-tax yield is around 2.5% but on the levered portfolio i.e. about 3% in total. Pre tax. At 45% marginal tax rate, that is too close for comfort – I agree.

An exception is that some (a minority) of the levered portfolio sits in a Ltd Company, which a) pays 25% tax not 45% tax, and b) can deduct interest costs. That improves the situation somewhat.

LikeLike

Ah thanks. I thought you were saying that the securities bought on margin were paying for themselves. Good you’re getting real value from the Ltd Co anyway.

Why do you not use levered ETFs to get desired risk? 7% cost of funding would be eating me up inside.

LikeLike

levered ETFs are short term plays not long term plays. My leverage is a long term allocation – admittedly hopefully not at current levels.

LikeLike

correction; my pre-tax yield is in fact 2.9%, levered up to 3.7%. So even after allowing for tax I am still more the covering interest costs.

LikeLike

[…] enjoyed Fire V London’s post this week, although given the title – Feeling Broke – it sounds sort of cruel to say […]

LikeLike

Thanks for sharing FvL – always interesting to read how different folks are coping with the high inflation/interest rates. My fixed interest mortgage term ends this month, so from next month, my new payment will see an increase of 44%. It will mostly be covered by a fortuitous pay rise but still, I feel like I’m being squeezed from all sides, with my investments just moving along sideways.

That said, I don’t feel broke or skint; probably just more annoyed that I’m not able to save or invest more.

LikeLiked by 1 person

I’m only just getting started at 25 years of age and so the generally not very fun market conditions are not something I am very worried about – the money I am saving now will not be required for at least 25 years. I am in the process of escaping unpleasant and constraining financial circumstances and am finally making some real progress. In that much at least, it has been a decent year. The next step is really pushing my income up which will enable the savings and investment process to make progress much more quickly.

LikeLike

2 years ago, S&P500 was at 4400. Today it is around the same. I guess the only thing that changed was interest on debt. At historical lows, I’m not sure why you didn’t lock in interest rates and also make maximum use of collateral by taking a mortgage on the coastal property?

Given current rates, why not crystallize some losses/gains to pay off some of the margin loan? Why target 12% leverage instead of 0%? Even if you don’t think it is financially optimal (and on this, I would disagree) to reduce the mental load and increase your mood, I think it would be worth it!

LikeLiked by 1 person

All good questions!

Cognitive biases at work here, for sure, on my part.

LikeLike

Responding a bit more fully to these Qs:

Q1 – why didn’t I lock in interest rates and take a mortgage – indeed various people suggested that at the time. I am a bit lazy to apply for a mortgage – the disclosure bothers me and the banks’ understandable preference for regular income. Plus mortgages above £1m are significantly more complex to obtain than smaller ones. Hindsight says this was a bad call but ho hum.

Q2 – why not crystallise /deleverage to pay off loan? Indeed that is the rational thing to do. Two things stop me:

i) my long term rate of return is 8%, which is (just) higher than my cost of funds – ignoring taxes. My YTD return has been 14%. I’m glad I didn’t crystallise on 1 Jan!

ii) whenever I look at what to sell/crystallise, I can’t pull the trigger. I like all my holdings. Much more often I am tempted to top up.

Q3 – Why target 12% leverage instead of 0%? As per above, because I think (by a whisker) that my long term returns will exceed my cost of funds, even at the current elevated interest levels. I am pulling cost of funds down a bit, even with static rates, by paying off my most expensive slices first.

LikeLike

[…] was only six weeks ago that I published a blog post talking about how I felt […]

LikeLike

[…] year felt pretty ‘meh’ for the first nine months – as illustrated by my rather depressed blog post in mid October. But almost as soon as I hit Publish, the US market in particular led a dramatic […]

LikeLike