What’s it like to be in the top 1%?

According to the statistics, most of the readers of my blog are among the highest earning and/or richest people in the UK.

I bet however that not many of you feel that way.

Let’s start with income

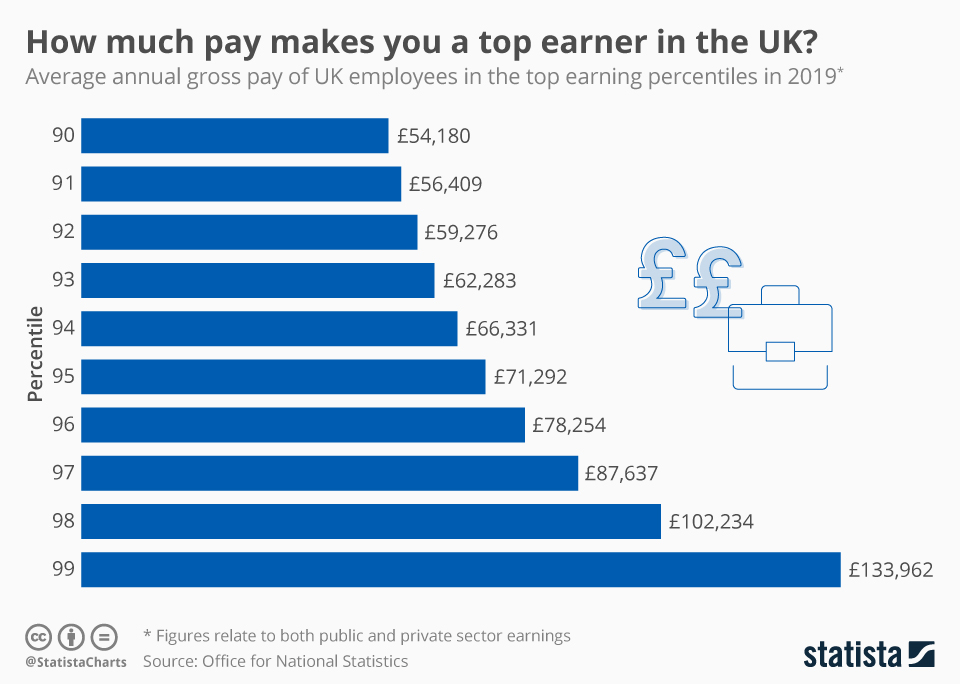

To be in the top 1% of earnings in the UK in 2019 required pre-tax earnings of at least £134k. To be in the top 10%, you need to earn (individually) about £54k. By 2023, inflation has probably increased all these numbers by at least 10%, to say £150k and £60k.

With £134k of pre-tax pay in 2019, a typical UK employee would have taken home £81k. They are not even visible on the distribution graph below showing disposable (net of tax) income (including benefits).

Based on a survey I did of my readers a couple of years ago, the average pre-tax income of my readers is about £100k. This means my readers are roughly speaking a sample of the top 2% of the UK by income.

So, dear reader, I ask you again – do you feel like a ‘top 1%-er’? I’ll wager for many of you, the answer is No, even though in fact you are.

The UK is markedly ‘poorer’ than some economies. In the US in particular, more than GBP£100k (£$125k) of annual income is far more common than 2% of the population. But even there, folks earning say $200k will largely not feel like they are at the top of the money tree.

Back in the relatively short-lived Theresa May as Prime Minister Era, she coined a phrase about the JAMs – people who were Just About Managing. One of the clever and subtle things about this concept is that there are lot more people who consider themselves to be Just About Managing than the income distribution graph would suggest. I suspect that quite a few of my readers would feel that they too are often JAMing, even when objectively they are earning far more than most UK households manage to get by on.

And then we consider Wealth

Gauging wealth is harder. We don’t know who has squirreled away a lot. The Rich Dad / Poor Dad book illustrates this memorably – talking about one person who appears Rich but in fact has squandered his high income keeping up with the Jones, and another chap who is in fact very wealthy thanks to using his money to compound his (invisible) investments instead of buying visible materialistic things.

But again, there are statistics. And here the top 1% look a bit more impressive – to be in the top 1% of UK individuals, apparently you need $1.8m – and to be a top 1% household your household need a wealth of £3.6m or more.

Looking at more wealth means looking at people who are older. The old bought properties in a different era. You could buy a decent London house for under £10k in the early 1970s; such a house now will likely put you in the top 1% if you own it.

For the curious, I found a table showing what the threshold is for being 1 in a 1000. In the UK that needs $4.9m, supposedly – less than a fifth of what it takes in the USA.

There is always somebody twice as rich as you

The reality is that, however rationally or otherwise, what matters to many of us is relative position, not absolute position: https://www.ips-journal.eu/topics/democracy-and-society/the-paradox-of-inequality-5990/

The key thing about these statistics is that the curve has a long tail. The right hand side of the distribution might look low, but it stretches out. And we all know somebody further to the right – with more income / wealth – than us.

If you think of the richest / most fortunate / highest earning person you know, it won’t be you yourself.

Most employees have a boss; many bosses have bosses. Usually the bosses earn more. The two richest ex (employee) bosses I remember both earned over £40m, via payroll, running large publicly listed businesses.

The bosses deal with professionals – lawyers, accountants, etc. Bosses might well be regular employees, in which case typically the partners in their professional service providers will be higher earners and probably wealthier. But of course some bosses are entrepreneurs – who might not earn that much but who have a store of wealth in the business they have built. And in most businesses, we find ourselves dealing with suppliers – where the decision makers are often entrepreneurs, with wealth.

All of these people – bosses, accountancy partners, founders of business service firms, all know somebody they consider to be ‘richer’ than them. Everybody looks right – to the even more extreme end of the tail on the graph.

Who is ‘more to the right’ than me?

A neighbour made over £10m in the City and retired in his 50s with a terrific gold-plated Defined Benefit pension. Now he’s down to his last £5m or so, having given away several houses to his offspring/ex-spouse, etc. I think I might be slightly ‘to the right’ of him these days, though his pension gives him an edge.

I know a couple of entrepreneurs who sold reasonably successful businesses. One has done it a couple of times. They are both firmly in the £10m-£100m range – somewhat to the right of me, but neither of them makes the Sunday Times Rich List.

I know a couple of hedge fund professionals. One an individual contributor – very good at his job – who has earned – via payroll and his stake in his fund – over $50m. The other the principal in a mediocre fund who, again, is worth over $50m.

Almost anybody I know in private equity who has survived 5+ years has made a serious stash. It’s hard to estimate the figures, but the most successful/longest tenured person I know has probably amassed a net worth including his (illiquid) stake in his fund of over $100m.

I know a SPAC winner and loser. A winner because he was a paper billionaire at one point. A ‘loser’ because now his net worth is down below £100m.

I know a 2nd generation billionaire. This businessman would be one of the UK’s top 100 richest people, if the Sunday Times had him right. He knows at least a couple of people who are richer than him, at least 2x as rich.

So, how much really is ‘enough’?

Looking at the top of the money tree puts a different perspective on ‘how much is enough’. I have covered this before, with a bottom up analysis based on an absolute cost of living etc. This got to a number (excluding home(s)) of around £12m in 2020.

But of course the reality is most of us are relative people, not absolutists – and we peg ourselves consciously or unconsciously against others.

In any case, based on the people I know who are at least 2x as rich as me, I would say the amount needed to be ‘enough’ is around £50m. That seems to be the number where conventional economic activity stops, and I don’t discern any perceivable ‘just a couple more years’ nor any obvious pegging. £10m definitely isn’t enough to reset mindsets these days – though it might have been 20 years ago. £100m+ is ‘too much’ to comprehend in a normal way. But £50m seems to be enough to arrange your life literally however you like – and not have to even keep track.

Looking at the stats is a great way to keep perspective . I did this exercise a couple of months ago and was shocked.

I still feel like I’ve not got enough to retire at over a million net worth (primarily due to housing costs on the south) but I find it bonkers to think I’m in the top 5% of the UK and for my age (42) I believe the top 1 or 2% . Certainly doesn’t feel like it but the reality is many many people will retire age 65 on far far less than I have .

I just find it amazing when I look at new 4 bed houses going for 700k to 900k round here and theyre all being sold. I just wonder who the hell is buying them and what kind of mortgage they are paying and how they afford it

My dad says I spend too much time wondering about other people but it boggles my mind . We must be rapidly entering the stage of generational mortgages like Japan I think where you spend your life effectively renting your house from the bank

LikeLiked by 2 people

“Look left, look right. Look left again.”

Nothing wrong with a look to the right (of the graph), but always two to the left for perspective!

I’d take a hug from the kids over another £1mn in the bank any day.

LikeLiked by 2 people

Money concentrates and rich people like to hang out together. I guess good for business and networking but bad for ‘retirement’. I’d venture out and say location is highly important in terms of keeping up with the Jones. The Jones’ in St Tropez aren’t the same Jones’ in Benidorm. It’s easy to feel ‘poor’ in St Tropez in July when your neighboring table all wear 100k Pateks, tender in from a 50m Mangusta and are ordering 10k bottles of champagne for lunch! Rich is relative and always will be. Same goes in Central London where $$$ concentrates.

50M in addition to paid off home and a vacation pad, should support 1.5M a year spending. Maybe our fictional rich person can considering moving to Monaco to save on the 500k a year in ‘forced’ dividend taxes but then they’re running into the same issue as above…. always someone richer, always a bigger boat, always a bigger plane. You can live above your means at 500k/year in a PE job or with 50M in the market and retired.

LikeLiked by 1 person

Incredible! I had no idea the top 1% income where you live is so low of a threshold. I remember going to London for a week and thinking of myself how much more expensive it is the New York City, New York city was the most expensive city in America!

Thanks for sharing the perspective. It is truly needed and appreciated.

Sam

LikeLiked by 2 people

Is relative wealth important?

Anything one does should be intrinsically driven. One should have goals, ambitions, ideas of one’s own, without any regard whatsoever to what other people are doing.

The fact that someone might have £100m whereas I might have only £10m is not relevant. The only thing that is relevant is whether my wealth enables me to reach my goals.

LikeLiked by 1 person

[Once you’ve amassed a reasonable stash] if you move somewhere in the world where the majority of the people you encounter day to day are essentially to the “left”, you’ll spend a lot less time looking to the “right”, and a lot more time truly being grateful for where you already are.

In my mind, constantly looking to the right is a recipe for never being satisfied / content. As was raised above, being in a high cost location surrounded by Patek’s and AP’s is great for networking/earning, but not necessarily optimal for contentment in retirement!

LikeLiked by 1 person

Basically $10mm is the new $1mm. Go back 20y and it was $1mm of liquid assets to be taken on by my private banks. Now it’s $10mm. UHNW was defined at $15mm, now $50mm. So I’d say $50mm is probably about right.

My wealth has almost tripled in the last 5 years. I’ve locked in a multi-million $ sign-on to get me to that magic 50 (assuming markets don’t trash my net worth). Yet I don’t really feel I’m getting ahead. Colleagues are also doing very well. My ex-manager made over a billion last year and is worth way in excess of £10bn. I used to think £12k would cover summer holidays. I booked two holidays earlier this year: £30k total for 4 weeks. There is so much money swimming around that everything is very frothy. I’m not surprised CPI ain’t coming down. What cost of living crisis?

The issue is that at this level, relative wealth is all that matters. The focus has to be on how you are doing vs the Jones. It’s the same as education grades. These days, getting 4As would be crap since everyone else is getting 4A*s. Inflation is rampant in every walk of life, but especially so on the right tail.

LikeLiked by 1 person

“My ex-manager made over a billion last year and is worth way in excess of £10bn.”

Is your post meant to be taken literally, or is it apocryphal.

LikeLike

ZX48k is never apocryphal

LikeLike

The fund made 153% return in 2022. It has no external clients and most of the few billion in AUM is his, though there is some partner/employee money left (of which mine was a minute sliver). Since 2016, an average 65% arithmetic return. You get very rich, very quick at that compounding rate, even after paying your portfolio managers 20-30%.

LikeLiked by 1 person

Thought so.

So if you’re not at BlueCrest/Systematica where are you now?

Are the returns made public accurate?

What would you wealth strategy be, if you were starting out today? (p.s. I am probably about 20y younger than you).

(I can’t reply directly to child comments below this level).

LikeLike

I struggle with “equivalised” income – why can’t they just show actuals?

Is the ONS chart for an individual, couple or family – if it’s an individual has it been multiplied by 0.65 to reflect it’s cheaper to a family unit of one?

Larger families have have their income “reduced” as their living standard is lower v Smaller families on similar income.

I’m guessing it’s all family units with their income adjusted according to family size – not sure how much difference it makes.

LikeLike

London top 1% total income before tax is £357k (2019 to 2020 tax year data)

https://www.whatdotheyknow.com/request/949887/response/2239997/attach/html/3/FOI2023%2010075.xlsx.html

LikeLiked by 1 person

Kinda amazed that you have had two ex bosses who made over 40 mil per year at public companies – was this pre-08? It seems like the ‘rough’ cap these days is c. 10 min per year for a EU bank CEO and 30mln per year for a US Bank CEO…?

LikeLike

Would assume that £40m is over the course of their tenure as CEO, rather than per year?

LikeLike

correct, and including stock price appreciation

LikeLike

they didn’t make 40m per year. They made 40m over time – about 10 years each, with quite a healthy stock component in companies where the stock price grew significantly

LikeLike

“to be in the top 1% of UK individuals, apparently you need $1.8m – and to be a top 1% household your household need a wealth of £3.6m or more.” Is there a #/$ typo there? Are there others? Does it even matter?

The Old Testament may be packed with genocidal folklore but “Thou shalt not covet …” is awfully good advice. Not that it’s reported as mere advice, of course. And not that the people who most need the advice pay a blind bit of notice.

LikeLike

@Financial Samurai – there is absolutely no way London is more expensive then NYC, unless you came several years ago and the exchange rate was briefly close to $2 to £1, and you were only going to overpriced London hangouts for financial professionals and comparing to regular NYC places. NYC is WAY more expensive than London in almost everything, perhaps excluding travel (subway and street-hailed taxis). Even a quick Google will tell you London is a lot cheaper.

LikeLiked by 1 person

Hi I’m a JAM. I’m ok. My health is my wealth.

LikeLiked by 1 person

Being able to turn down the competitive gene within us and the desire for consumer products would make the target figure for financial security a great deal less.

I have spent very significant sums on cars and amongst them, I have also purchased a modest pure electric car. When driving that modest car, I do appreciate that whilst other cars I have are better, they are not proportionally better when considering the money spent on them.

I am increasingly interested in a more minimalistic life and realize that such a lifestyle could easily give people financial independence at a sum well less than £1m. There would be a significant economic consequence of course if such a lifestyle took hold and consumer expenditure on non-essentials was significantly reduced

LikeLiked by 1 person