September was a busy month.

In the middle of it we saw a disruptive tube strike. I don’t use the tube that much so didn’t expect it to affect me much but two important meetings were postponed, one of which still hasn’t happened, so that event has stayed in my memory. Thank goodness for rental bikes – Lime in particular played a blinder by ‘flooding the zone’ around train stations in particular.

The evenings are drawing in. But that does afford a new view of central London – there aren’t too many of those around – at the new development at Paddington station.

I took in my first concert at Wigmore Hall, a little central London treasure that has somehow passed me by for decades.

I did some UK travel in September. I visited Birkenhead for the first time – a much more handsome Georgian place than I’d imagined.

And I went to Scotland and saw a red squirrel – my first for over 30 years

In other news

The US was in the news a lot. Our ambassador, Peter Mandelson (who I admire), was defenestrated by the Epstein brouhaha. The US’s president made a state visit to the UK. And a right wing defender of gun rights was assassinated by a shooter at a rally.

More consequentially, Israel attempted its own assassination – in Qatar. At the time of writing it seems as if this unsuccessful attack may have precipitated a giant unintended consequence – a ceasefire between Israel and Hamas over Gaza. My fingers are crossed.

And in the markets

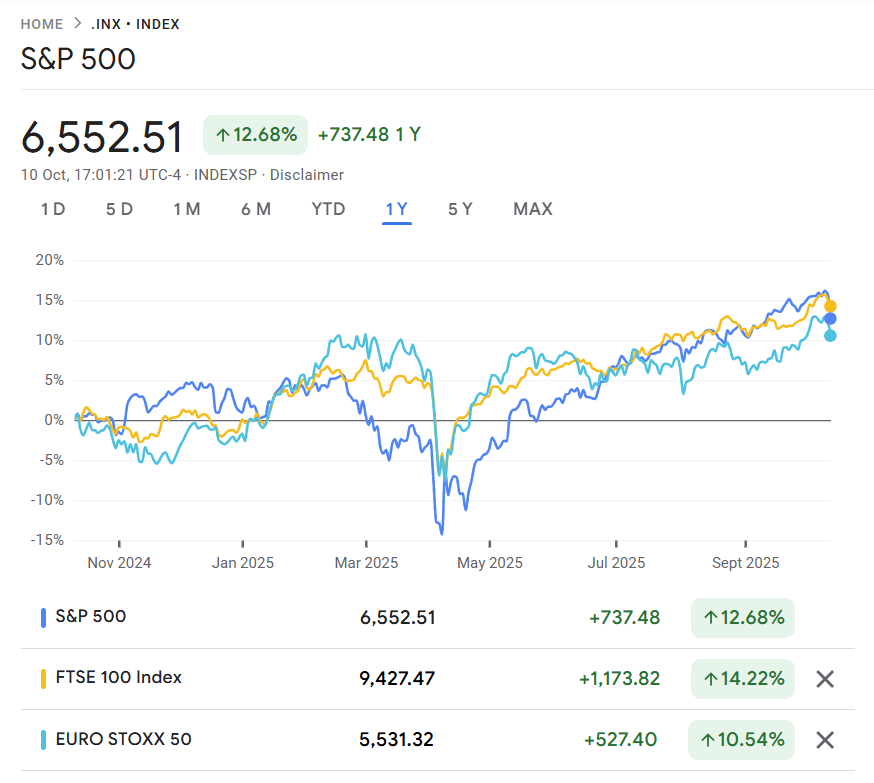

Meanwhile, the market continues to climb. The S&P is up about 10% on a 1 year basis, but up 30% from its Trump Tariffs low. But in fact it is the UK’s very own FTSE-100 which has had the best 12 month run versus the rest of Europe/USA.

In September itself, VWRL was up 3.4%. And the pound fell slightly, so my weighted market benchmark rose 4%.

My portfolio

Against a market rise of 4%, my portfolio rose ‘only’ 2.3%. This discrepancy is largely noise; over the last few months my performance closely tracks the benchmark.

In any case my portfolio is breaking new records. And the equity gains are leaving me underweight on fixed income, and less leveraged than my allocation target calls for. I am almost half a percent long on cash, an unusual experience for me.

Tightening my target allocation

Given the widespread worries about us being in an ‘AI bubble’ – which I share – I am taking the opportunity to tighten my target leverage by one more % point.

By reducing my target leverage, I also need to reduce my target long exposure (i.e. the exposure to whatever I am buying with the borrowed money). Slightly counterintuitively, rather than rein in my US exposure, I am reducing my UK equity allocation by a notch. Much as I think AI is a bubble, I can’t get particularly excited about many UK equities. And I have other exposure into UK equities via my private angel/etc investments.

And as to the leverage itself, I have been targeting non-UK borrowing, but in practice I have a big dollop of my debt with my private bank and it’s all in GBP. In theory I could swap some GBP loan for a EUR loan but in practice I won’t. So to reflect that I’m shifting my debt target from EUR to GBP. This has the slightly unintended consequence of boosting my net ‘International’ exposure by around 10% (from 17% to 19%),

My new target asset allocation is as follows:

You’ll notice my target Loan to Value ratio has dropped from 13.0% to 12..3%. The need to establish my long term target leverage level is becoming more pressing.

Appendix – press clippings