While the global soap opera of the Gaza crisis, Trump/Putin PR, Ukraine misery etc continued, I have created some warm memories in August.

I spent a bit of time in the New Forest, at both ends, and the middle. Which included a trip to Mudeford, site of the UK’s most expensive beach huts.

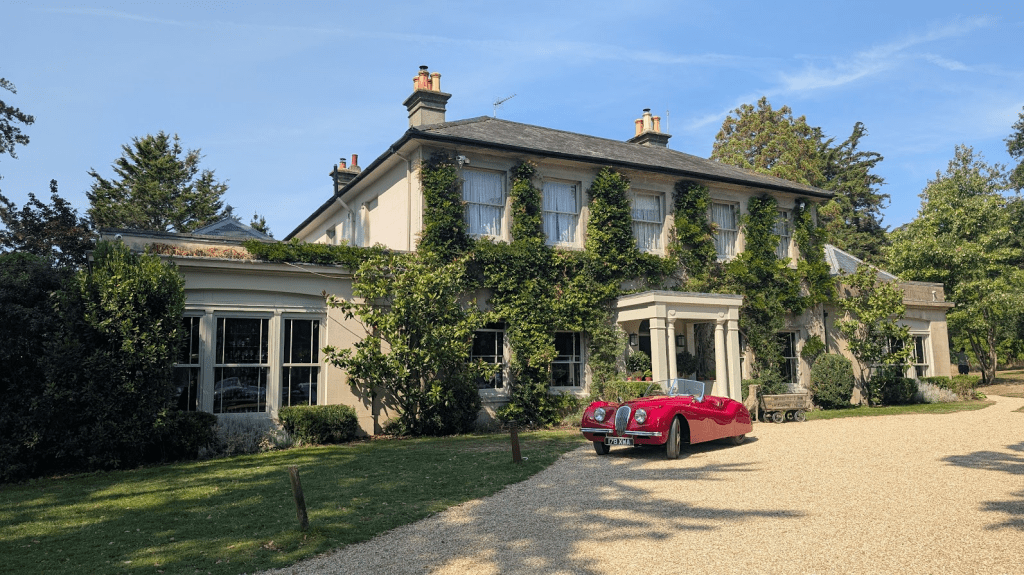

I also finally ticked off a bucket list item – visiting Devon’s Burgh Island, site of the “Agatha Christie hotel” that is marooned at high tide. A real art deco marvel, where Mrs FvL and I appeared to be by far the youngest people in the vicinity.

I spent a bit of time in boats in August. This included a lovely trip to Amsterdam during its five yearly SAIL tall ships event. It is Amsterdam’s 750th anniversary, which feels quite strange versus the much longer London historical timeline.

I also spent did some early morning sea swimming down in Dorset, which is a habit I could get used to – in the summer months at least.

I wasn’t out of London completely. August is often quite an enjoyable work month and this year so it proved.

Markets in August

August saw the recent trends continue, with equities continuing to progress – particularly in the USA where this was accompanied by a drop in the USD. Trump’s attack on the Fed haven’t been helping the bond markets though you have to say the narrative about his tariffs creating a material revenue line to help stabilise the US narrative does seem to be winning versus the ‘the US economy is going to go down the plughole’ narrative we were hearing six months ago.

My weighted market benchmark is a bit fussy in August. There was a sharp drop in the markets on 1 August, which means my benchmark’s movements look very different “31st to 31st” than “1st to 1st”. Having initially thought that the weighted index rose 3%, or 1.9% after currency movements, on closer examination I am settling on a rise of 1.5% on constant currency, and 0.3% in GBP . VWRL, Vanguard’s world equities tracker, which corresponds quite closely to my portfolio over time and is a good guide to the weighted market benchmark, fell 0.2% (in GBP) in the month. This “when is a month a month” question is a reminder how noisy reporting is a monthly level.

My portfolio

My portfolio rose 0.8% in the month. Slightly more than the benchmarks, based on the 31st, but slightly less based on the 1st. Go figure. This stuff will wash out over a full year.

These steady rises in equities are putting me in the familiar position of being perennially underweight on fixed income. My deltas to my target allocation are all manageable, with the largest being an almost 2% underweight position on UK Fixed Income, and a slight overweight in International Equities.

After a mini windfall, which I used to pay down the margin loan, I’m very close to my target leverage/cash position. This is almost a call to tighten my target leverage a notch or two, though for now I’ll leave it as is. It certainly has me wondering about what the right level of long term leverage is, which I aim to do a separate blog post about.

Appendix: Press clippings

Your pictures are quite familiar this month. I like the odd meal at the Pig and I have swam to Burgh from Hope Cove a few times.

LikeLiked by 1 person