I really want to stop mentioning Trump.

Even when he sends troops into LA, one of my favourite cities.

But when he launches 30kt bombs on Iran, it is very hard to avoid talking about him.

In the context of what Trump’s been up to, the welfare reform screw-ups by the Labour government seem almost laughably trivial. Even though they make my blood boil and, I think, will have more impact on our economy than Trump’s militarism will have on the USA’s.

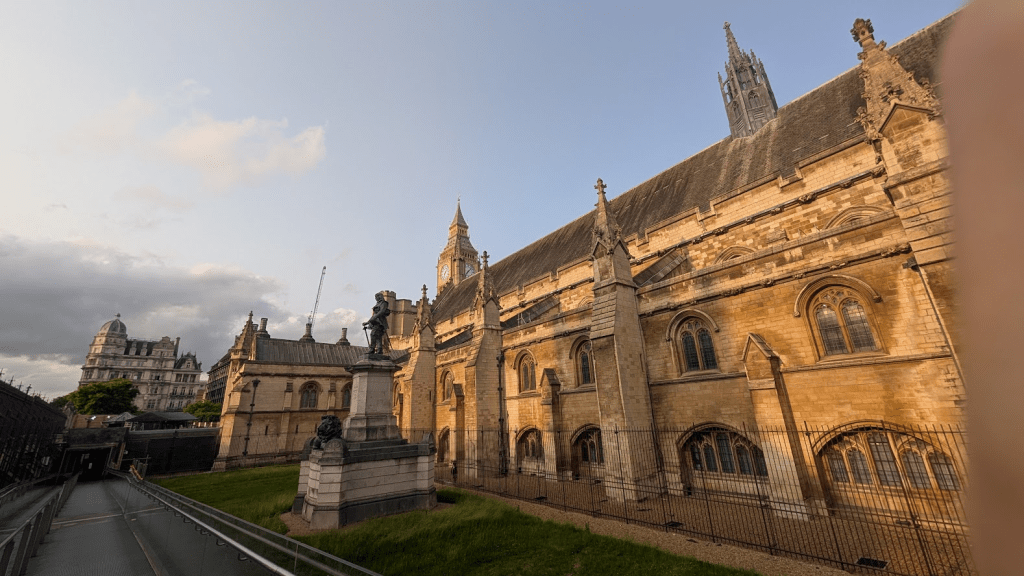

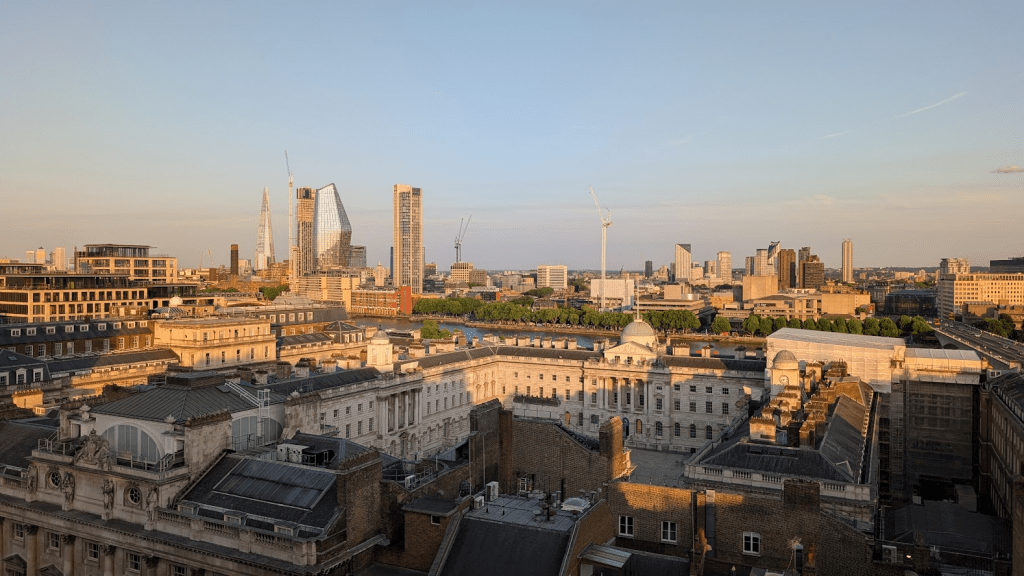

We’ve had some lovely weather in June, with the lovely long evenings to enjoy too. I’ve had some memorable London experiences, including a visit to Parliament, some high altitude fun and two (very different) shows – one of which even saw me on stage in the Barbican Theatre! I’ve also had some fun on the coast – including a very memorable evening in Poole harbour.

Markets in June

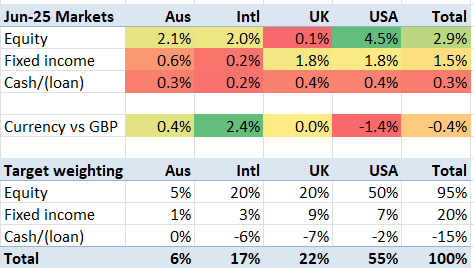

The markets had quite a good June – especially in the USA where the equity markets have shaken off their Tariffs Tantrum, and even bonds rose appreciably. World equities have still not quite recovered to January levels, but that’s being pedantic. The markets I’m exposed to rose a weighted average 3.1%.

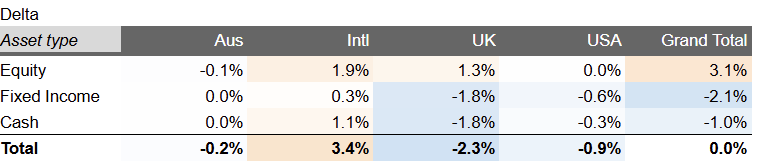

My portfolio itself rose but rather less than my markets, by only 1.5%. Something must have taken a knock, though I haven’t had the time or inclination to diagnose the problem.

Having posted a blog post about my property-proxy portfolio, I had some very useful feedback on it. I took the opportunity to make some tweaks to it.

I remain leery of US equities , but thanks to the slight reduction in my target exposure last month, I am now on my target exposure. I am underweight fixed income, and sense I will be for some time if equities remain so bouyant. And I’m a bit overweight UK and International Equities – something that I am likely to get more proactive with.

Appendix: press clippings