Supposedly Albert Einstein called compounding the 8th wonder of the world. Certainly the wonder of compound annual growth rates is something I feel quite viscerally, the more so with each month that I track my portfolio. But I’ve been struck recently by a radical improvement in my portfolio’s dividend income, far in excess of the portfolio’s return, that has occurred thanks to the margin loans I’m using. For anybody curious about margin loans, this blog post shines a light on what’s happening.

While my portfolio has grown 14%…..

As a quick visit to my Monthly Returns page can see, my portfolio has returned around 20% over the last twelve months (to September 2024 inclusive). This is a good, but not exceptional period over the 10+ years I’ve been tracking my portfolio – which has returned just over 9% p.a. since inception over 10 years ago.

As it happens, despite the underlying returns of around 20% my own portfolio (and I’m excluding Mrs FvL’s in this analysis) has only grown in size by 14% over this twelve month period, thanks to some significant withdrawals to pay tax bills, make ‘off balance sheet’ investments, and such like.

… my net investment income has grown 56%

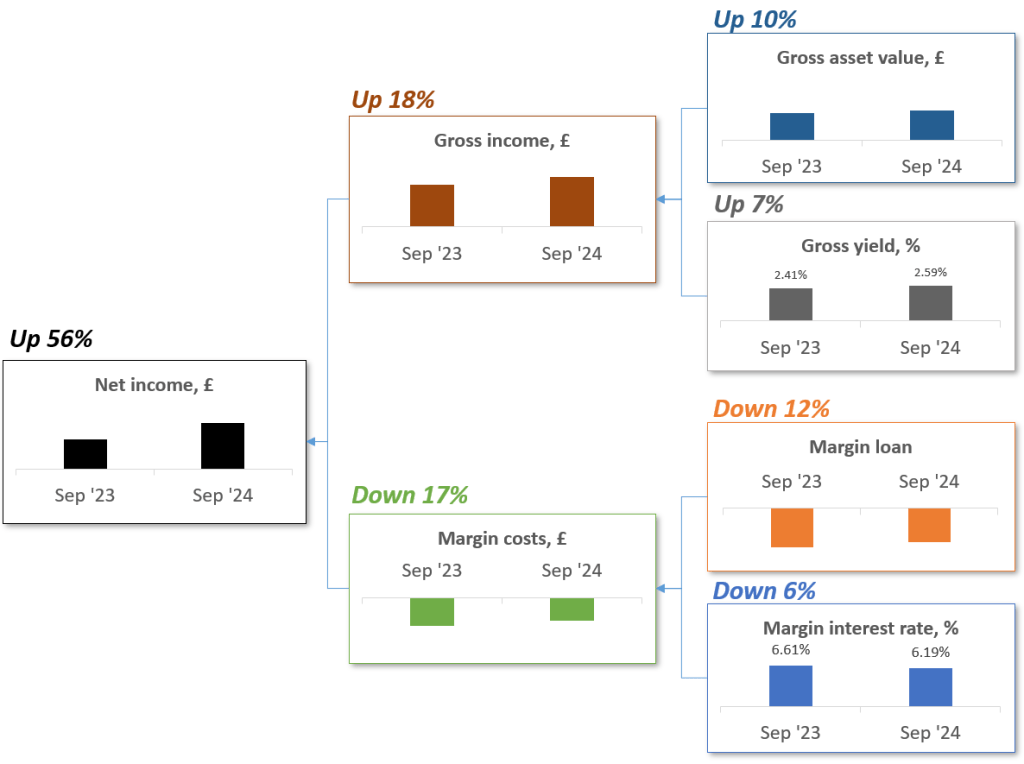

What caught my eye is that my expected investment income, something I record monthly, has grown 56% during the same time period.

My expected investment income is tracked as a net figure. It is the gross expected dividend yield, calculated based on my latest estimate of yield (as pulled from Google Finance / iShares ETF pages, etc), as a %, multiplied by the value of the assets snapshotted at the month end, less the expected interest costs on any negative cash balances (margin loans). It ignores expected fees/expenses.

As a worked example, imagine my portfolio consisted of a single £1.2m holding of VWRL (yielding 2.0%, i.e. £24k of expected dividend), with a £200k margin loan at 5% (costing £10k per year of interest), then the portfolio’s expected net investment income would be £14k. My portfolio value would be £1.0m, so the expected income would work out as a net yield of 1.4%. The 2% gross yield is being significantly diluted by the cost of the margin loan.

Other things being equal, if my portfolio has grown by 14%, then I would expect my investment income to have grown by 14%. How come it has grown by 56%?

Behold: compounding improvements

Looking back over the 12 months to September, the first thing to say is that the margin loan has been reduced significantly – it is 12% smaller after these 12 months. This reduces my interest bill, other things being equal, by 12%.

Secondly, interest rates have dropped a little over the last twelve months. Back in September ’23, by weighted average interest cost (across the three currencies I was borrowing in) was 6.61%. By the end of September ’24, it had fallen to 6.19% – a relative drop of 6%. So I have a 12% smaller debt, which is 6% cheaper. You can see where this is going – these two relatively modest changes are compounding into a 17% drop in margin costs.

On top of the increase in net portfolio value caused by the repayment of debt, the gross asset value of the portfolio grew by 10% over this time period. So in fact share price growth has been a relatively small contributor here. But, other things being equal, this should increase the gross dividend income by 10%. And in fact the fourth thing going on is that other things have not been equal – the gross yield of my portfolio has increased from 2.41% to 2.59%, a relative increase of 7%. A slightly larger portfolio, with a slightly higher income yield, is yielding 18% more pounds of dividend income than the portfolio a year earlier.

And it turns out when you combine an 18% higher top line income with a 17% smaller margin expense, the net income has increased by 56%. As illustrated by the cascading graphs shown below.

For me, this was a wider lesson in the dynamics of leverage. The changes in the fundamental drivers of my net income are all relatively small. But because they are compounding together, the overall impact is sizeable.

Safely past the danger

My net income in September 2023, a net yield of 1.4%, was at the lowest absolute level it has been since I first started using margin loans seriously. It was about half the £ amount it was in early 2020, when my portfolio value was about the same as Sep ’23 (a net yield of 2.7%). Going back to early 2016, when I bought my Dream House, my portfolio dropped in value to about half the Sep ’23 level, but my net income was 20% higher (a net yield of 3.2%). At the Sep ’23 income level, my margin loan wasn’t long term sustainable – the portfolio wasn’t generating enough income for me to be Financially Independent.

After the 56% increase over the last twelve months, my income is back at a level it hasn’t been at since mid 2022, when my portfolio was a bit smaller, my loan was 50% bigger, but interest rates were a lot lower. The net yield is now still only 1.9%, but that’s a lot more usable income given the net assets are 14% higher too.

It’s not just interest rates that matter

What this illustrates is firstly that interest rates are important when you have loans involved. Hopefully that lesson won’t be new to any readers of this blog. But it also illustrates that interest rates are not the only parameter that matters. Relatively small changes in the amount of loan and the dividend yield can make a big difference too.

The nice thing about margin loans, compared to mortgages in particular, is that you retain a lot more control over the portfolio – the collateral for the margin loan. While the value of the portfolio may bump up and down, its income yield is something you can influence. And the gearing level can be flexxed relatively quickly – by selling assets to pay down the loan, or by buying more assets with an increase in leverage. I have also made some useful tweaks to my margin interest rate by shifting the loan from, for example, GBP (currently 6.43%) to EUR (currently 4.58%), and even borrowing a bit of CHF (which trades similarly to EUR but even cheaper – currently 2.36%).

Margin loans remain something not to try at home, but for me it feels like my ship has crossed the dangerous waters, far from safe ground, and can now see a safe port on the horizon. Mooring up safely should be well within my control, even if a bit of work is still required.

I’m glad you made it safely back to port! It’s interesting to hear about your journey, so thanks for sharing!

I’m in the process of deleveraging at the moment – I’ve taken my bond allocation from 0% to about 20% since yields shot up in 2022. I’m creating a “bond tent” to minimise sequence of return risk, as I went part time with my contracting job about 6 months ago, with one eye firmly on the door. Not sure if I’ll do another “one more year” part time or not. Honestly, the income from work barely moves the needle these days relative to the portfolio (boring ETF’s – calendar YTD 24%), so it seems like a waste of time, but when the portfolio is in a large drawdown, it sure is nice to see those invoices paid at the end of the month! With the bond’s I’ve bought, I can live fairly comfortably (not lavishly, but comfortably) off the coupons alone, and can leave the equities to do their thing for the next 20-30 years before the bonds mature, assuming inflation doesn’t do anything too outlandish during that time. If the equity gods are being kind and SRR doesn’t rear it’s head, I figure I can skim some cream off the equities in the good years, maybe up to 3% of portfolio value for luxuries, as I hopefully need the portfolio to last about 55 odd years, assuming I make it to triple digits.

LikeLiked by 1 person