In the news

It has been quite a busy month out there.

The Israel/Gaza crisis continues. Public opinion is shifting against the Israel government here, even in North London – which would normally be one of the most sympathetic neighbourhoods outside Tel Aviv.

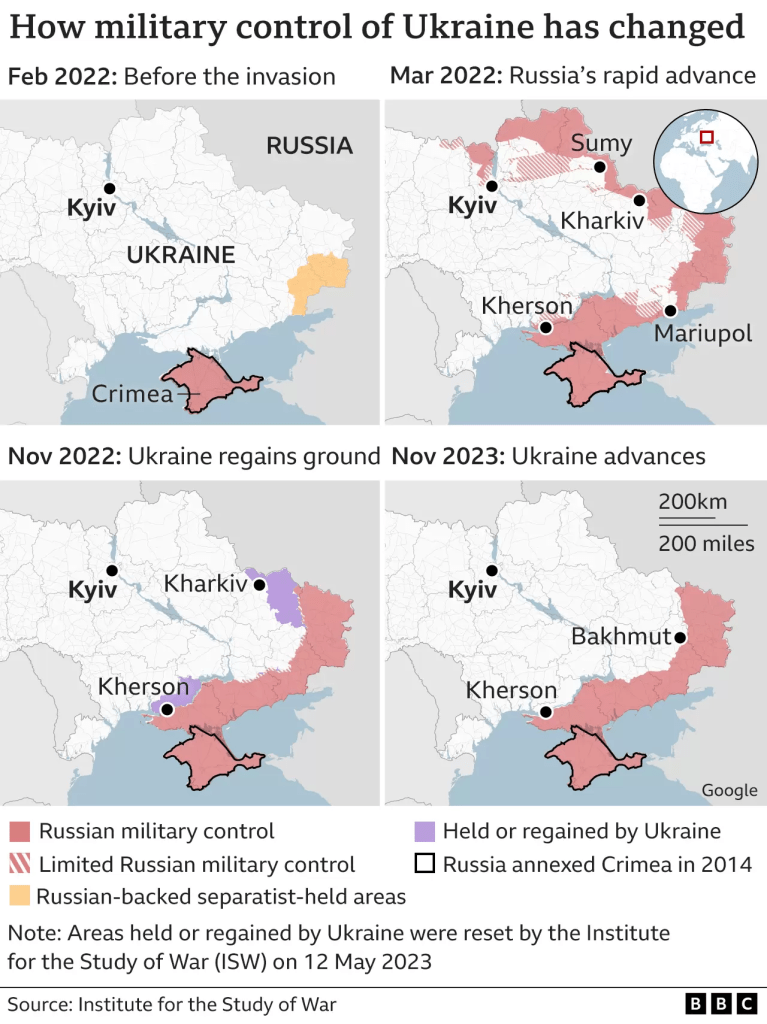

The Ukrainians are left feeling somewhat zero-sum in the battle with Israel for foreign support and attention. Some informed opinion now says the war is over, bar the fighting, and the only thing left is a land-for-peace deal. And the USA election, which is still almost a year away. Sigh.

Here in the UK, the Prime Minister has brought in the previous Prime Minister (but about 4) to take over the foreign stuff, which is just all so damned complicated all of a sudden. I somewhat side with Robert Shrimsley, the FT columnist, on this appointment.

And right here in London, there isn’t that much to report. Though I must admit I did enjoy visiting the Old War Office in Whitehall, now a Raffles hotel refurbished at gargantuan but very visible expense – and I must say it shows London still has it.

In the markets

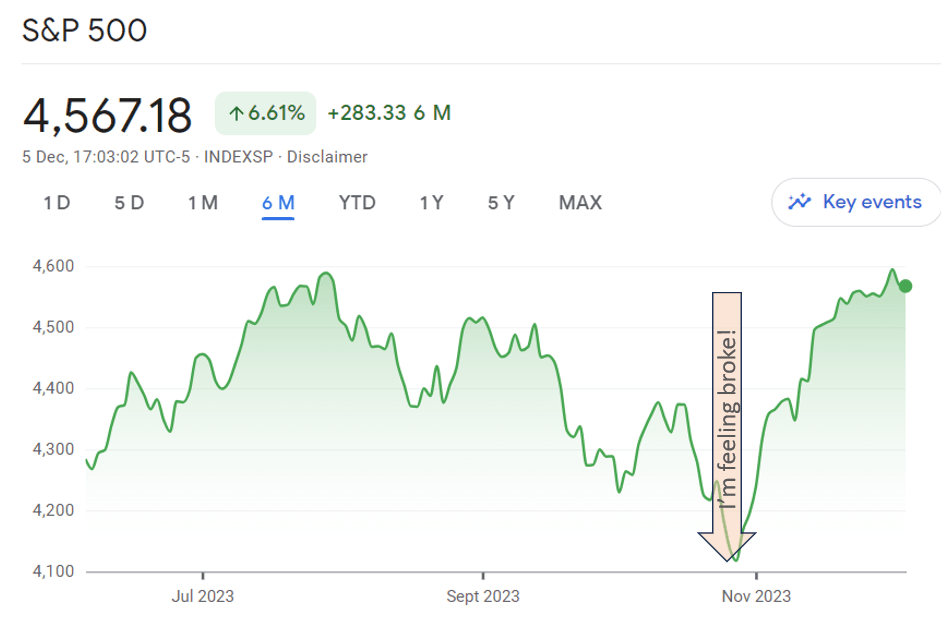

Over in the markets, it has been a rather extraordinary month. US equities rose 8%. This single month is now making 2023 look very positive.

Bonds also kicked up, but by ‘only’ 3% except in the USA – where the USD fell by 4% so the bond prices are not strictly comparable.

What is going on appears to be a significant reduction in inflation coming through. This is reducing interest rate expectations, which in turn inflates the value of the future – which benefits USA equities in particular with their jam tomorrow tech stocks.

My situation

It was only six weeks ago that I published a blog post talking about how I felt broke.

Now I know what I need to do when the market needs a change in direction – I’ll publish another ‘time for some tiny violins’ blogpost. No sooner has my blog post ink dried than the market dramatically changed direction.

In fact I had some fascinating comments to my blog post – if you haven’t read them, I recommend you do. And thank you to all of you who offered perspectives.

One perspective is concern at the elevated risk I run with my leveraged, expensively financed portfolio. And that maybe I should swap my margin loan for a more conventional mortgage. And while I very much recognise that sentiment – the month of November is exactly what my leverage sets me up to benefit from. But nonetheless, I did take some profits in November and I have very quickly and easily paid off a useful amount of my debt – equivalent to more than six months’ worth of interest payments.

And with such a rapid blip up in portfolio value, I took the opportunity to slightly reduce my target leverage level – from 22% to 20%. This target is a bit of a ratchet at the moment. When I am short of cash, I leave the target alone; when I am (occasionally) underleveraged, I tighten the leverage target. Ordinarily, I would do this until the target was back in the 10-12% zone. With my cost of funds now almost 7%, I may tighten almost to zero – we shall see, if we get that far.

Another perspective from commentators on my ‘feeling broke’ post – though not aired too much by my lovely commenters but appearing particularly by the armchair trolls commentators on certain other City sites – is that my lifestyle choices are ridiculous and that I practically deserve some misfortune. Certainly, I am fortunate and my lifestyle is definitely something that I am well aware is a blessing (and, occasionally, a curse). But for the moment I think I will stick with what I am doing – I don’t think I am unaware of my exposures nor of the levers I could pull if I needed to.

But the best insight – led by the always insightful ZXSpectrum48k – is that salaries and earned income are best thought of in relation both to net worth, and to the volatility of wealth.

ZX48k’s wisdom was amply illustrated in November. My portfolio rose in one month by over 5%, which is well in excess of my annual salary. ZX48k compares his post tax salary to his net worth. I think my preferred ratio is pre tax salary to my liquid portfolio. But even my higher pre-tax salary ratio is less than my expected dividend yield from my portfolio. And, as he suggests, really it is the volatility that is really the right comparator. My annual volatility (the standard deviation of my monthly returns multiplied by the square root of 12) is just over 11%, and in £ terms is a multiple of my pre-tax salary.

As ZX48k puts it – “Wealthy people don’t worry about salaries – it’s about the capital position”. Here’s to that.

Appendix: In the media