June saw UK’s former PM Mr Johnson leave parliament. Good riddance. I suspect we haven’t seen or (definitely) read the last of him but having him out of Westminster is at least a bit safer than him inside.

Closer to (my Coastal Folly) home, there has been a sad story in Bournemouth of two tourists being killed swimming near Bournemouth pier. After a lot of huffing and puffing about manslaughter, it appears as if it was an act of nature via a rip tide. A reminder of the respect we need to have for all water – especially around the coasts. I’ve had quite a bit of coastal action in June and I am finding it to be a rewarding new side to my life.

June was apparently the hottest June, globally, on record. That certainly wasn’t exactly what it felt like in England. Though a June highlight for me was a trip to Royal Ascot where it was certainly hot enough for me – and I wasn’t even wearing a top hat.

And from a market point of view, it feels like the wider themes of the year continue.

- Inflation is dropping, but too slowly in the UK. Interest rates are continuing to rise as a consequence, which is pushing the pound up (as I write this, in July, we are at £1:$1.31 – this is a factor the swivel-eyed Torygraph/Trussite factionalists completely ignore) and causing a lot of squealing about mortgage costs. The US seems to be ahead of the curve here, never having had the same spike in energy costs as Europe saw, with inflation now down to around 3%.

- UK doom/gloom-mongering. This sentiment is so widespread that even I, never the most optimistic person about our policymakers, am starting to feel the doom/gloom has been overdone. It feels like the only clear fix for the mood rot that has set in will be a general election that throws the Tories out. But that might just be my north London friends’ bubble.

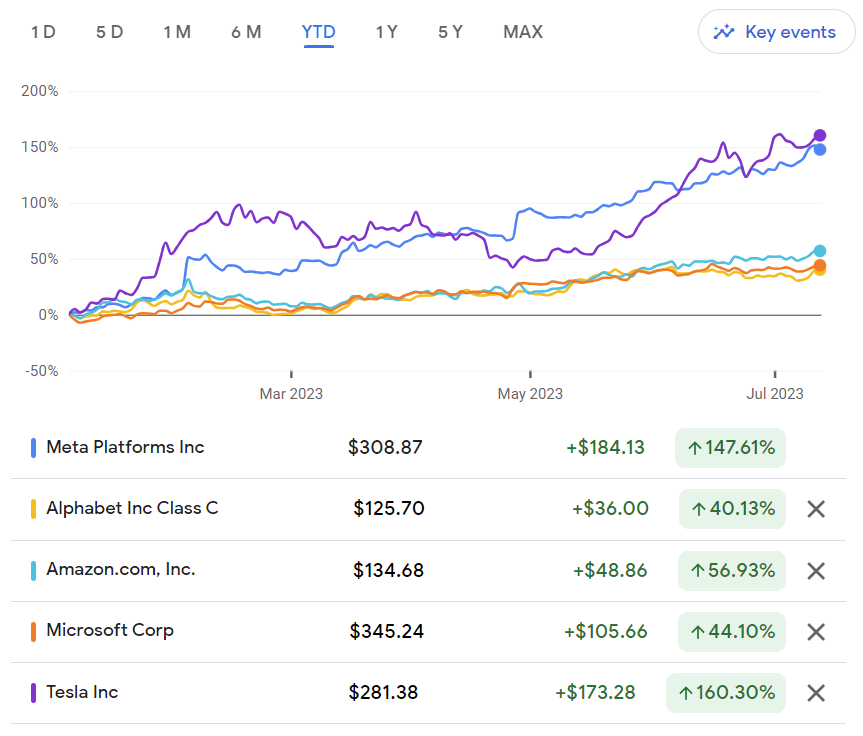

- Tech firms continuing to rebound, dragging the S&P up with them. How I am cursing losing my bottle on META six months ago, and not quite investing in TSLA at $125 in January. Ho hum.

Selected tech mega-cap stocks, YTD

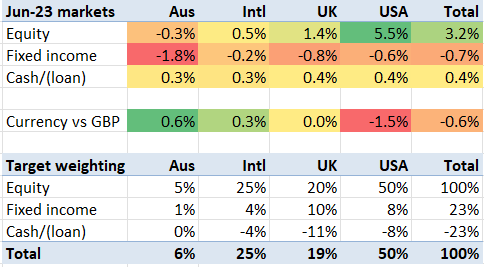

Markets in June

Not much to see in June, except for a significant rise in the S&P. Partially offset by a drop in the USD. Bonds dropping back a bit with the increase in interest expectations.

Overall my markets rose by 3.0%, and my currencies fell by 0.7%, resulting in a market move of +2.2% in June in GBP terms. Against that my portfolio rose slightly less. I saw very little activity in my portfolios.

Shifting my SIPP

I decided in March to move my main SIPP to another provider (neither broker named to protect anonymity). This is a step backwards in my fight against complexity, but a step forwards in terms of fees. I haven’t yet closed the underlying SIPP provider’s account (which has a bit of cash in it, and quite a high IFA-driven fee load) but that is something I will do later this year.

As at the end of June, the process of moving the broking account had not completed, despite quite a bit of chasing and both parties confirming the handful of holdings were all fine to transfer. As I write this in July, I am pleased to see that the securities themselves have been moved successfully. That still leaves a five figure cash sum (accumulated because I didn’t touch the account after submitting the transfer out request) in limbo between the two providers.

Cash/loan exposure

The rising pound has reduced my margin loan a bit in GBP terms. Sadly with most of that loan in GBP (certainly more than was the case a year ago), I have missed a potential free currency gain here. But likewise my risk exposure has been more sensible. In the meantime my leverage graph is staying well away from the Red zone.

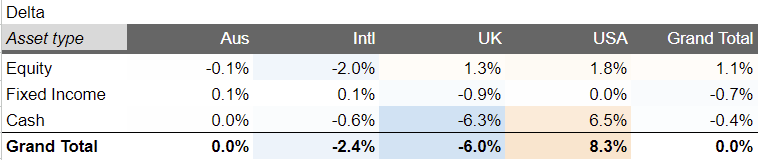

My exposure is a little bit wobbly against my target allocation. I have a couple of modest windfalls coming shortly; these, along with (hopefully) my SIPP cash being shifted should allow me to tidy up a bit.

Media clippings