October in the markets was one of those slightly giddy months. My portfolio crossed through a big number threshold, and kept going up.

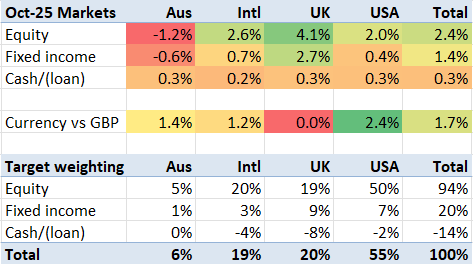

The market stats don’t quite tell the whole story. On a constant currency basis, markets rose 2.8%. Non-UK currencies (AUD, EUR, USD) rose (versus the GBP) about 1.7% too. So my weighted benchmark rose 4.6%, measured in GBP. My (leveraged) portfolio‘s rise of 5.3% is roughly in line with that.

A 5% gain in one month is pretty extraordinary, but it does happen. While October was the best month since January 2023 (+6.6%), I have had 7 better months in the last 13 years.

However, what the market stats don’t show is what it really felt like in October.

Continue reading “Oct ’25: Trim, trim & trim”