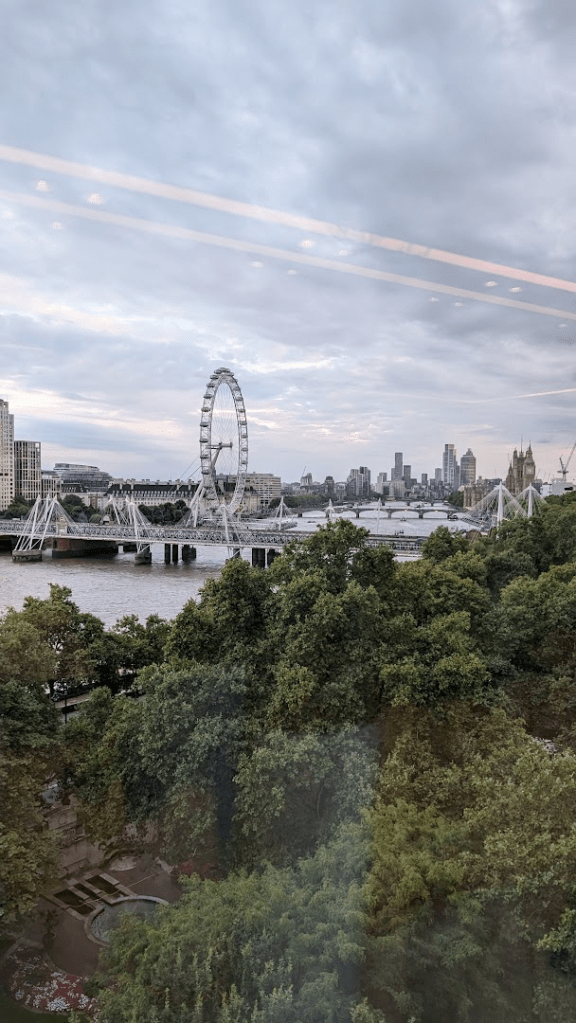

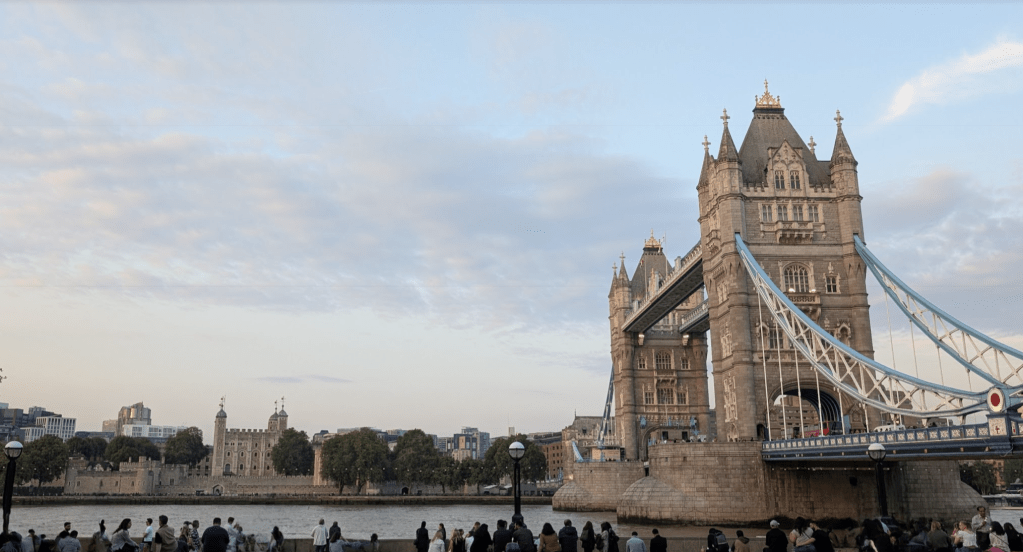

I haven’t seen much of London in October.

I’ve been away every weekend in October, partly in the UK and partly visiting friends overseas.

And now we’re in November, the clocks have gone back, but temperatures haven’t plummeted yet. London feels busy – pubs still have crowds outside.

Finally, the UK’s first Labour budget for 15 years

The big UK political/market news of the month was the new government’s mucn anticipated budget on 30th October. Monevator’s summary is excellent.

What Monevator doesn’t mention is how relentlessly gloomy the runup to the budget was. The government has been clear:

- Taxes are going up, because despite electoral statements to the contrary, those naughty Tories left a ‘black hole’ which, despite numerous commenters pointing out before the election, the Labour highups hadn’t seen coming

- but the key taxes (Income Tax, National Insurance, VAT, Corporation Tax) are not going up, and ‘working people’ (a phrase subject to amusing and relentless parsing in the pre budget runup) are not going to pay more tax

- leaving those who are not ‘working people’ (implication – people with unearned income; they mean us, FIREees) and those with the ‘broadest shoulders’ to pay more tax. Capital gains tax was clearly going to rise, as well as potentially tightening of tax-free pension mechanisms. Non doms were a particular target, as are (those paying for) private schools. In a parallel government narrative universe, the government also was clear it is working to boost private sector investment and woo business – which somehow sounds different from ‘broad shoulders’ doesn’t it?