Rishi Sunak, the former UK prime minister and current Sunday Times journalist, observes that every CEO is talking about AI – so why aren’t political leaders? So it seems a good time to bring some AI into the world of FI blogging.

Large Language Models such as ChatGPT have been mesmerising, but it doesn’t take long playing with them to realise they are much better with Language than with Numbers. However with the latest models bringing more inference into their logic that is starting to change.

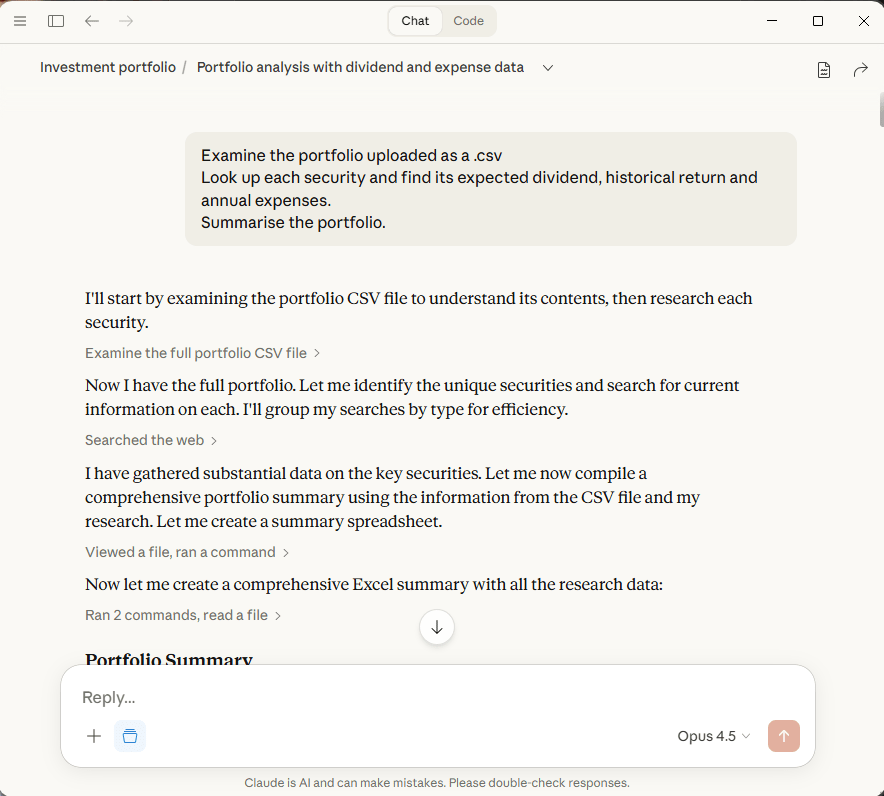

I’ve been playing with Claude and Gemini in the context of my portfolio and blog. They are proving genuinely useful. For reference, I am a paying customer of both – and am using Projects/Gems to partition my experimentation and (I believe) avoid uploading key financial data into their wider cloud/models.

Key tasks AI has proven useful for so far (UPDATED 21 Feb) include:

- Take my 24/25 tax return and estimate my tax bill for the next financial year. Gemini notably better than Claude on this one.

- Review a 24/25 tax return for errors. A HNW friend of mine found a £100k error in his accountant-prepared tax return using Claude.

- Update dividend yields and TERs/OCFs in my master portfolio list. This is a task made for Claude.

- Estimate the next set of dividends I can expect – based on a screenshot of my portfolio – good dopamine hit!

- Disaster scenarios – examining the disaster scenarios my portfolio faces, and the warning signals for each

As a taster I’ve appended below what Claude said when I asked it what Warren Buffett/Charlie Munger would think of my portfolio.

Continue reading “AI comes to FI”