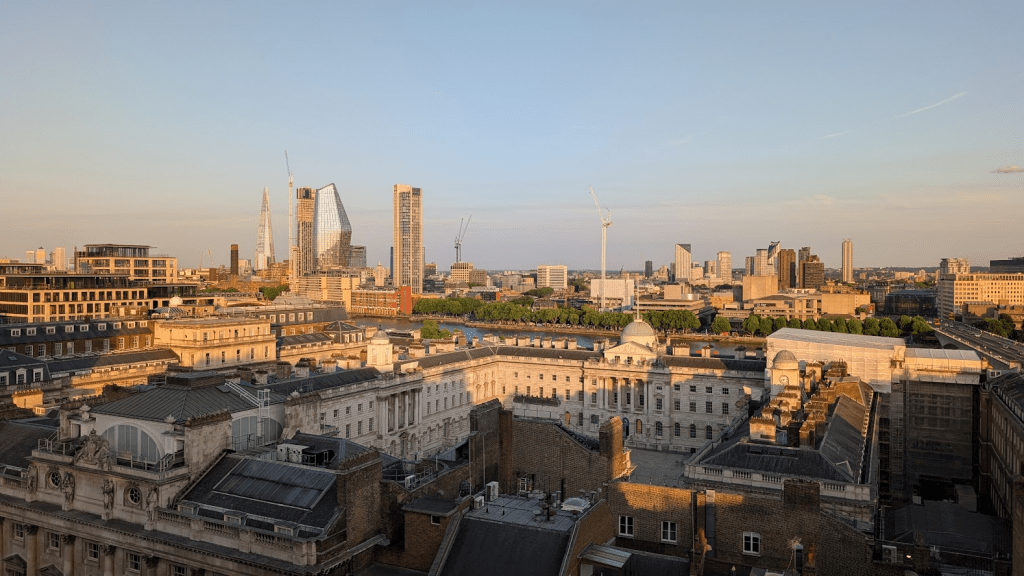

The big news in the UK this week was the latest Budget by the Chancellor Rachel Reeves.

The scare story in the budget runup

All UK readers of this blog will know that the rumours and counter-rumours in the run-up to this budget exceeded anything we have seen before.

There were too many rumours in advance of the budget to catalogue properly here. But I want to highlight several key rumours:

- Taxes up by 2%. For a crucial couple of weeks in November, the government was rolling the pitch to break its manifesto pledge by increasing income taxes by 2%.

- National insurance on investment income, notably property rental income. This rumour felt credible to me, because it happens elsewhere – such as Ireland. However most of the commentary missed a key characteristic about NI which is that there is an Upper Earnings Limit of around £4k per month (£50k p.a., roughly) above which you only pay 2%, not 8% (or, until quite recently, 12%).

- Mansion taxes. The key rumours here were that there would be a tax of 1% on ‘mansions’ above the value of £1.5m or £2m. This move would have been the most impactful for me – with over £8m in two ‘mansions’, I was facing potential £40k p.a. of an entirely new tax.

- Pension changes – potentially reducing the ability to take around 25% tax-free, for instance.