January media seemed dominated by Greenland and Davos. As part of my efforts to avoid amplifying unstable narcissistic media-whore leaders, I haven’t got much to comment about. London has been pretty wet and miserable, as is January’s reputation.

Meanwhile, markets were up quite a bit in January, for those of us measuring in GBP. This is despite widespread mayhem over Greenland – which the markets shugged off – albeit with a mid-month wobble.

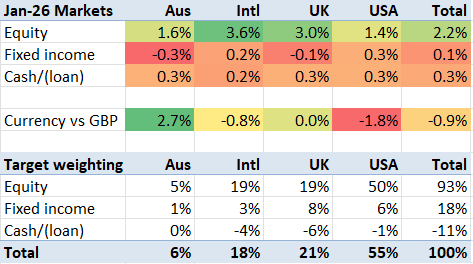

My target allocation’s markets grew 2.4% on a constant currency basis. But their currencies fell by 1.4%, meaning my benchmark rose 1.0%. Against that my actual portfolio was flat. I am a little bit underweight USA equities, and a little bit overweight International equities, which in theory is not a bad tactical position to be in. In any case, I took a couple of hits on larger individual holdings.

Continue reading “Jan ’26: Greenland saga doesn’t disrupt tax bill”