I really want to stop mentioning Trump.

Even when he sends troops into LA, one of my favourite cities.

But when he launches 30kt bombs on Iran, it is very hard to avoid talking about him.

In the context of what Trump’s been up to, the welfare reform screw-ups by the Labour government seem almost laughably trivial. Even though they make my blood boil and, I think, will have more impact on our economy than Trump’s militarism will have on the USA’s.

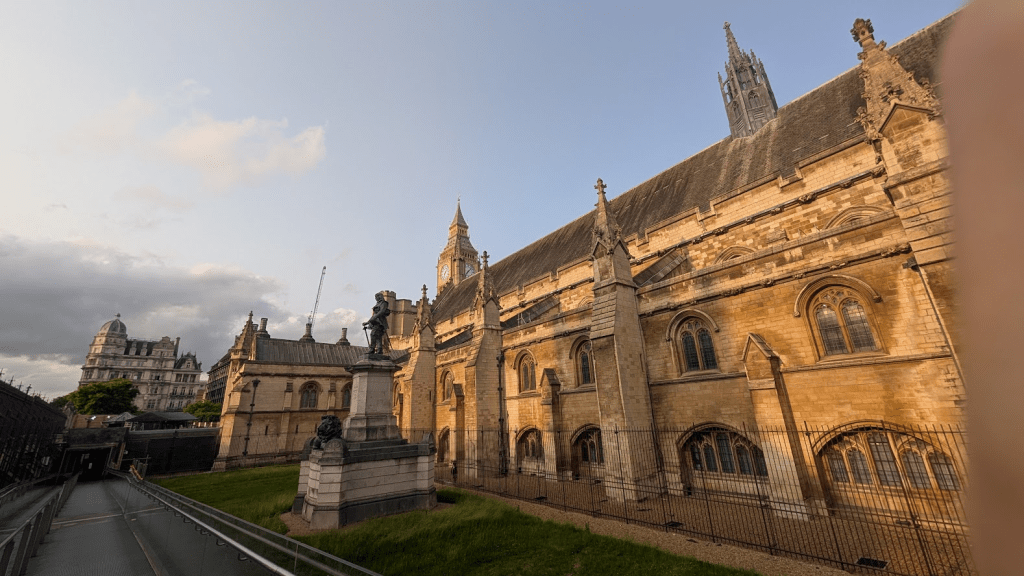

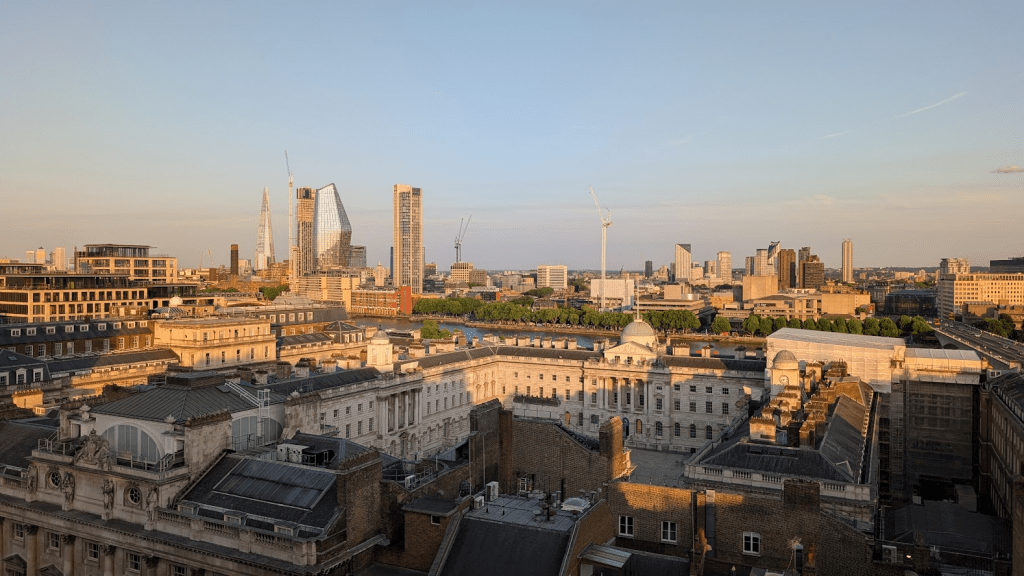

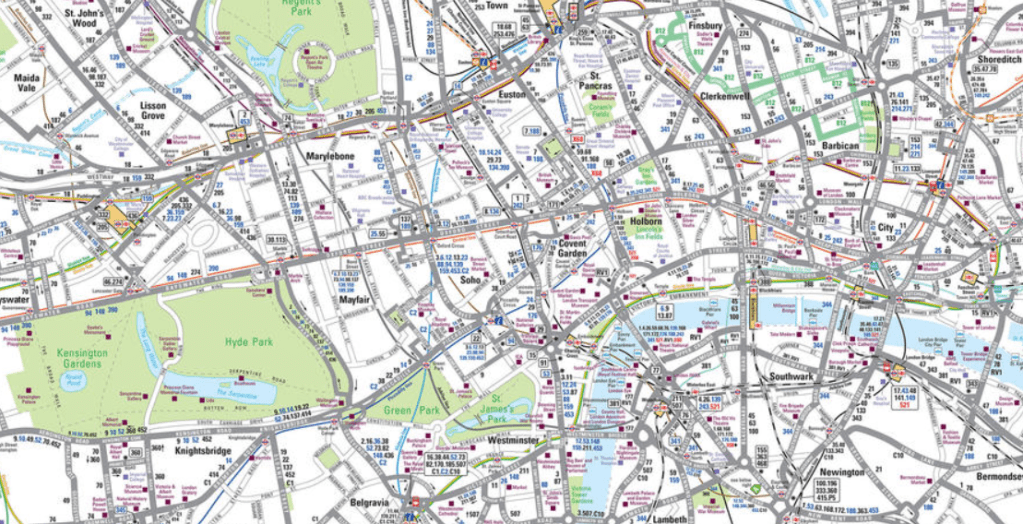

We’ve had some lovely weather in June, with the lovely long evenings to enjoy too. I’ve had some memorable London experiences, including a visit to Parliament, some high altitude fun and two (very different) shows – one of which even saw me on stage in the Barbican Theatre! I’ve also had some fun on the coast – including a very memorable evening in Poole harbour.