My goals in 2016 for each quarter were as follows:

- For my net loan to shrink by £10k per quarter, without any margin calls.

- Maintain investment income of at least £Xk

- Closely track my target asset allocation

Financial independence, but in pricey London

My goals in 2016 for each quarter were as follows:

A year ago I was scrabbling for funds to buy a house, the market was down about 5 points in a month, and Brexit seemed like a tail risk. What a difference a year makes.

My investment portfolio finished 2016 up 24%. A record year. Am I a genius? Was I lucky? Was this normal for stock market investors?

I will wager that most investors, even the sophisticated risk-friendly readers of this blog, returned less than 20% annual gain last year. Feel free to let me know your returns in the comments below as I’d be delighted to hear there are hundreds of similar ‘achievements’ out there but somehow I doubt it (1).

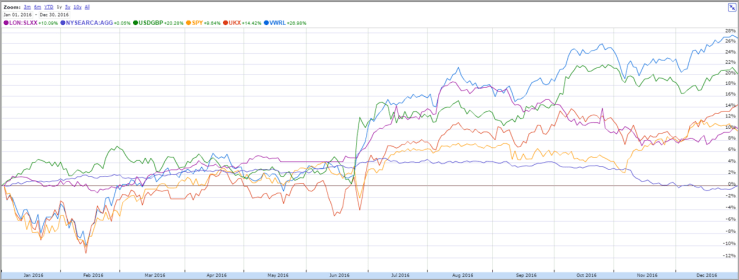

What’s been going on? Well FTSE-100 reached a record high. It’s the red line (‘UKX’) in my graph below. It was in fact up about 14% on the year, plus dividends. So a purely UK equity investor should have been well into double digits.

Bonds had an amazing year too. Despite entering 2016 at ‘unsustainably high levels’, they carried on climbing. At one point in August UK corporate bonds (purple, SLXX) were up 18% in the year. They finished up about 10%. Very few investors would be purely fixed income let alone purely corporate bonds. But a balanced portfolio of, say, 60% equity 40% bonds would have returned about 13%.

If your portfolio returned less than 13% then you have materially underperformed. Which is quite a statement.

Of course as my readers will know I invest much more widely than just the UK. The UK accounts for about 6% of the world’s stock market. The USA is about 50% of it. How has the USA done? Well its bonds (purple, AGG, in the graph below) have not moved in the year, unlike the UK’s (actually they did move *in* the year but they ended up where they started).

Phew. The year’s over. What an incredible twelve months. I made a big change in my portfolio in January and each month since it’s been a fascinating journey – at times nail-biting, at times frustrating and at times pinch-yourself good.

In this post I’m going to record the month’s performance before in the next post widening the view to 2016.

I didn’t notice any particularly market-relevant news this month. The US market kept the gains it had delivered after the Trump election victory. But the UK market decided to go on quite a tear, a so-called ‘Santa rally’ that continued throughout the month, with equities up 4.8% and reaching a record high – FTSE-100 closed up 5.8% at 7140. Resource stocks rose sharply which provided a significant lift for the FTSE-100. UK bonds rose slightly too, clawing back some of the Q3/Q4 falls.

Other equity markets rose too, with the European equity market up over 6% and the Australian market up 4%. The US rise of 2% seems almost paltry by comparison.

Fixed income was essentially flat, outside the UK.

The US dollar continued its relentless rise, up 1.3% against the pound. But the pound rose against the Ozzie. Overall currency movements only affected my portfolio by 0.6%. By comparison the markets I’m in rose by 4.4%, weighted by my target allocation.

How did I perform compared to the averages in my markets?