I’ve used portfolio leverage to help me buy two properties in the last 10 years.

To recap the most recent episode, very briefly, it goes as follows:

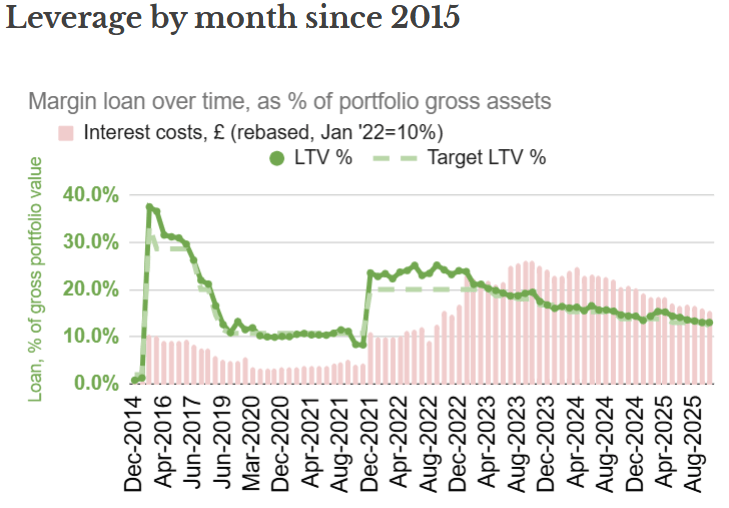

- In December 2021, I borrowed about 25% of my portfolio’s value to buy my Coastal Folly. I targeted reducing this to a 20% ‘loan-to-value’ (LTV) as soon as practicable.

- Only a few weeks later, Russia launched its full-scale invasion of the Ukraine. This disrupted the stock market, and energy markets. The energy market disruption led to a spike in inflation, which caused central banks to hike base rates. It also caused my LTV to go up, not down.

- I steadily paid off a bit of the loan, but the higher rates meant that my interest expenses went up 2.5x over the following 20 months.

- Since then however my portfolio has gained in value, and my loan has reduced, leaving it today at about 13% of the portfolio value. My interest costs are about 1.5x the January 2022 starting point, which is mildly annoying but very manageable.

- I’m left feeling firmly under control, with a relatively low level of risk. The two key risks that I need to consider are

- a hike in interest rates – which feels very unlikely

- a plummeting stock market – this feels a lot more likely, particularly in October 2025. But with my loan being only 12.5% of the portfolio value, even if the portfolio suddenly halved in value (a very rare and unlikely scenario) the loan would still amount to only 20% of the reduced portfolio value.

This leaves me wondering what the long term idealised level of leverage is for my portfolio.

Continue reading “What’s the ideal level of leverage?”