What’s in the news?

Talking about the news in March, given what’s been happing on the tariff front over the last few weeks, seems a bit pointless.

We entered March with a lot of drama about Ukraine, and some notable ‘ceasefire’ activity on the diplomatic front.

We finished March waiting for ‘liberation day’, April 2nd, when Trump unleashed a basically bonkers cocktail of tariffs on every country in the world – except Russia, of course.

What’s going on with me?

In the meantime, life goes on.

I attended a funeral of a long time friend and neighbour in north London.

I visited a rather bizarre concert in the Royal Festival Hall.

And I visited hospital for my first MRI scan, participating in a clinical research programme at University College London Hospital. I was impressed, I have to say, and grateful that I live within relatively easy reach of this excellent hospital.

I also visited Dorset – Studland to be precise – and went yomping up to Old Harry Rocks, the start of the Jurassic Coast. It’s a beautiful part of the world, and less than 3 hours from London Waterloo.

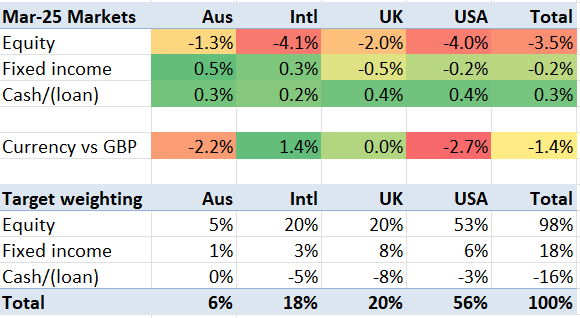

Markets in March

Markets generally drooped in March, particularly the US’s S&P500. Enthusiasm/animal spirits from Trump’s election win are being replaced by trepidation / concern about Trump not being good for the US economy after all. The dollar, and the AUD, fell against the pound.

Continue reading “Mar ’25: Anticipating tariffs”