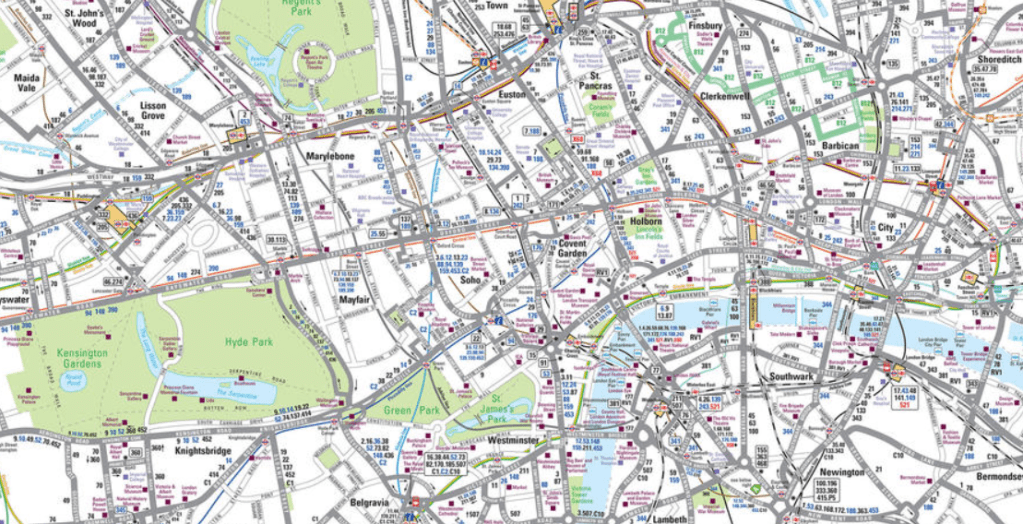

I sold my rental property last year, after owning it over 20 years. It’s a lovely property, worth around £1m, right in the heart of London – near the middle of the map below. I used to live in it, I travel past it regularly, I know its neighbourhood well. The Modern Flat has genuinely been part of my life – in a way I can’t say for most assets I own.

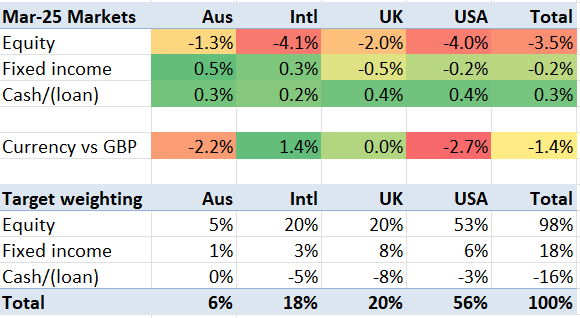

As most readers would I think agree, I am a pretty numerate, analytical person. Yet looking back on the sale of the Modern Flat, in my decision to sell I made two stupid mistakes. I got two of the big numbers wrong. Not just a bit wrong, but properly, materially wrong.

There are lessons here about investing, about selling, and about property vs stocks/shares. Let’s take a look.

Continue reading “A stupid decision to sell my rental property”