I’ve just totted up my invested portfolio’s returns in September. The bad news: I’m down 1.1%. The good news: the markets I’m in fell 1.6% on a weighted average basis.

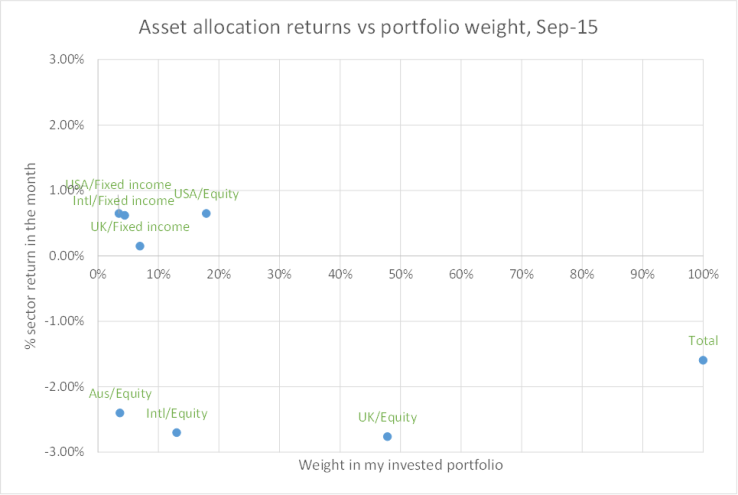

I’ve plotted below the returns of each of my major asset types (geography vs equity/fixed income) for September. Equities fell by 2-3% in UK/International/Australia – though not in the USA. Half my portfolio is UK Equities, where the market fell by almost 3% this month. Fixed Income assets were generally up – a classic case of uncorrelated behaviour between equities and bonds – which helped my overall portfolio return significantly. If I’d had purely passive exposure I’d have had the weighted average return of about -1.6% for the month.

Continue reading “My September 2015 returns – down, respectably”