Right now I am extremely focused on my investment portfolio in an unusual way: I am using it to fund a house purchase.

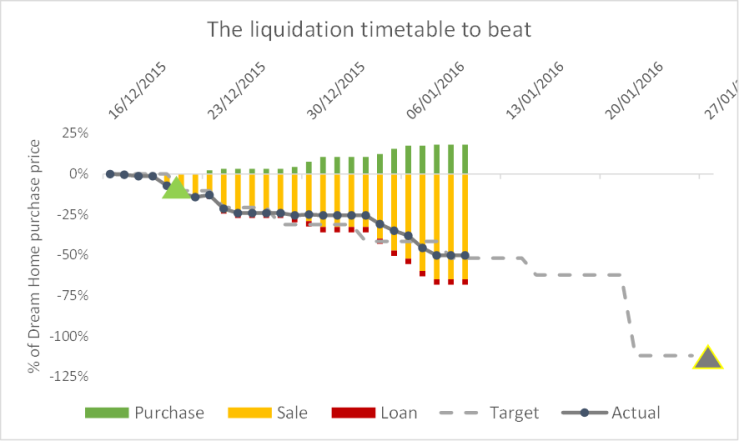

In my last post I laid out the timetable I need to hit to complete the purchase. In the last few days I’ve made good progress, but don’t have quite as much money in the bank account to show for it as I had wanted.

I’ve actually pressed Sell on most of what I need to at this point. However what I’m tracking is getting the funds into a bank account that I can instantly wire it over to my lawyer from. On this measure a lot of my funds are not in the right place yet.

Moreover, I’m selling more of my portfolio than I need to buy the house. This is because I’m also moving some funds into different accounts, so that I can then borrow against them. I’ve tested this with one of my two marginable accounts and it worked surprisingly easily. What I still need to verify is the amount I can take and the tolerances.

Continue reading “Housing, pt 7: racing against the clock” →