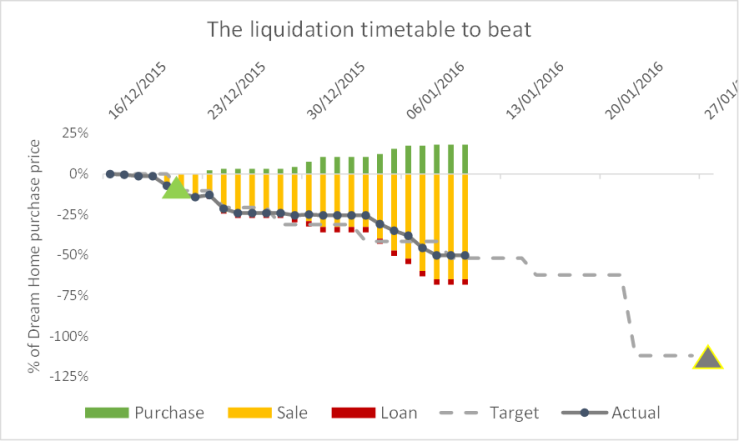

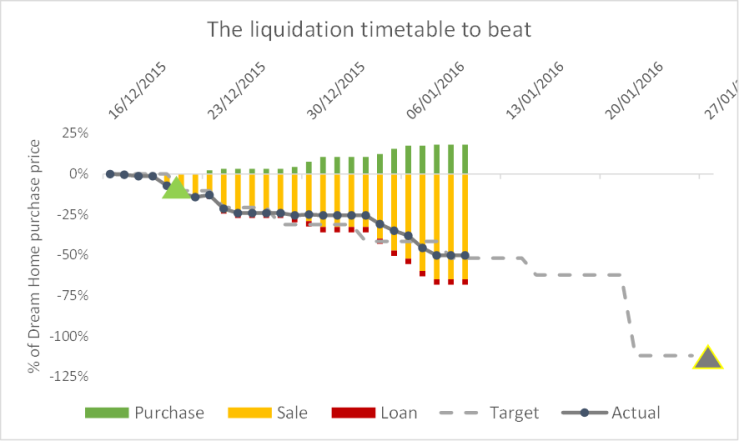

I’m about half way through the five weeks I’ve got to pay for my Dream Home. And my race to raise the funds is progressing roughly on track. Meanwhile, the global stock markets are in turmoil – the new year has had the worst start in two decades.

Financial independence, but in pricey London

I’m about half way through the five weeks I’ve got to pay for my Dream Home. And my race to raise the funds is progressing roughly on track. Meanwhile, the global stock markets are in turmoil – the new year has had the worst start in two decades.

The principles of successful investing are, so I gather from my extensive reading, pretty simple. Pick your asset allocation, making due allowance for your risk tolerance. Invest passively in it, optimise for tax and minimise fees, rebalance regularly – annually is often enough. Job done. Resist the temptation to tweak your allocation, trade within it or even look at your portfolio valuation .

Of course I’m not the only blogger who knows the principles yet ignores them in certain practices. But I certainly respect the principle of sticking to your asset allocation. One of the benefits of having a consistent allocation and rebalancing against it is that this enforces a ‘buy low sell high’ behaviour. Taking fright at, for instance, the Australian market underperformance and lowering your target exposure to the Australian market is exactly the wrong thing to do.

So, please believe me when I say that I take changes to my asset allocation very seriously. But nonetheless I am making one – quite a big one – and I’d be interested to have my thinking challenged.

Every month I calculate my investment portfolio’s returns to date. I’ve been tracking the portfolio in detail since the end of 2012. With 2015 now complete I now have three years of returns to examine.

December was an extraordinary month for me because during the month I bought a house. On 1 December this wasn’t anticipated at all. By 22 December I had exchanged and stumped up a hefty six figure deposit – all paid for by liquidating my investment portfolio. During the month the UK stock market (the blue line UKX below) in particular fell 7%, which goes to show why you should never use the equity markets as a savings account.