Australia has general elections every three years or so, and just had its latest one last month. How you can sensibly govern a country when your next election is either 1 or 2 years away always puzzles me, but the Australians have made a decent fist of it over the last 30 years – certainly better than the UK has.

Despite the frequency of elections, it is an unusual Prime Minister in recent times who makes it through to the next general election unscathed – Kevin Rudd, Julia Gillard, Malcolm Turnbull, Tony Abbott etc have all been replaced while in situ. In any case, ScoMo made it to the election, but then got replaced by the opposition – Tony Albanese, a centre left union figure. While his win wasn’t a big surprise, the strength of the defeat of ScoMo’s parties was a surprise. Some folks I know are horrified, but at this distance, he looks pretty similar to me.

The markets don’t seem to have much to report. Somehow I suspect not much will change – let the next less-than-3 years roll on.

Meanwhile, up in the Northern hemisphere, London’s Crossrail Elizabeth line finally opened (it’s great!), and the markets have continued the volatile decline they have been on for a year now. My portfolio dropped 7% in January. February fell too, though the fall was recovered in March. Then April fell 7%. And, at points, markets were down almost 7% in May – see the S&P graph below.

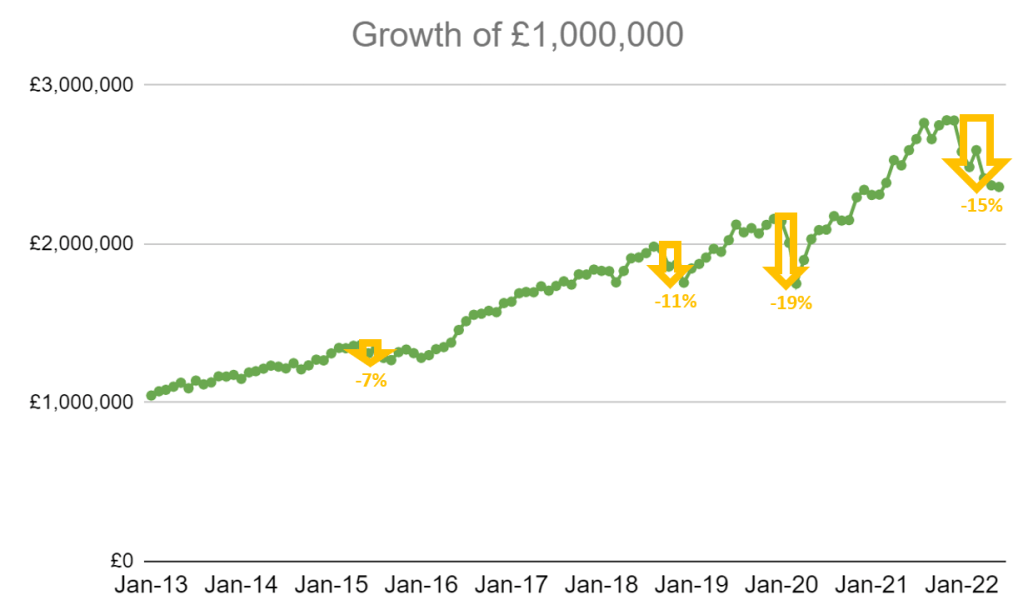

One key measure of a portfolio’s performance over time that doesn’t get enough airtime is the drawdowns it suffers. The maximum drawdown over a period is the highest percentage fall the portfolio experiences. Mine is shown on my real-time portfolio returns page. My highest, to date, is 19% (see graph below). But with two 7% falls already under my belt this year, another 7% fall would have seen me reaching a new worst ever drawdown. Thankfully, once the S&P was down 6%, it started to climb. My ‘max drawdown’ statistic is measured monthly, and my portfolio ended the month down ‘only’ 2% – which didn’t breach my maximum. But from where May finished, a 5% monthly fall would push me into worst drawdown ever territory.

With volatility like that in the month, reporting on the month end feels like a crap shoot. But here is where I ended up (table below). Bonds continued their relentless slide, as interest rates continue to rise. FTSE managed to defy gravity, thanks to its mining/energy businesses. But the pound fell, and other equity markets drooped a bit too.

A key concern for me is the high level of leverage I have. After buying my Coastal Folly by borrowing money, I have been targeting 25% leverage. In fact I am about 5% over-leveraged. This leaves any market drops hitting me disproportionately hard. And in extremis I risk facing a margin call – in which my broker sells some of my holdings to raise cash to reduce my loan – the epitome of selling low something that I bought high.

I resolved six months ago that I would not sell holdings to reduce my leverage. So far, I have stuck to that. What I am doing is using any cash dividends, windfalls, or excess cash to slowly repay my margin loans. My dividend income is rising significantly from the covid 2020 lows, and is on track to deliver a cash yield of over 4%. While my cash position is a negative 31%, this implies it will take over 7 years of cash yield to eliminate my loan.

But I don’t want to eliminate my loan. I am happy with a certain level of leverage. So at 31% ‘negative cash’, I am ‘only’ 6% overleveraged. This means that in principle cash income from my portfolio, at over 4% per year, if all repaid against the loan, would recover my situation in just over 12 months. Sadly, practice is not principle. And my cash income isn’t as helpful for reducing my leverage as I would like, largely because a reasonable amount of my cash dividends comes into tax-sheltered (or Mrs FvL’s) accounts. These accounts are unlevered. But I am not withdrawing funds from them (though to be clear: I could) – I want the tax shelter advantage to compound, so I am reinvesting cash income into the least-overweight (because my only underweight is cash!) asset classes – mostly UK bonds right now.

Of course by using cash income to buy more assets, instead of repaying the loan, I am improving the LTV too – just much more slowly. With a LTV of around 20%, i.e. a ratio between loan and value of 1:5, any given repayment of the loan (reducing the ‘L’) makes about five times the difference that the same sum makes if used to buy more assets (increaseing the ‘V’). And the assets I buy can themselves drop in value – something that has been rather too common in recent months!

So despite me looking for ways to reduce my loan, last month it shrunk by only a few thousand pounds. This drop was only 30% of my investment cash income in the month, most of which landed in other places and was reinvested. With such a small reduction of the loan, but a 2% drop in markets, my leverage ratio rose to the highest it has been since buying the Coastal Folly: 24.0%. I don’t enjoy months like May, but I can take a few more of them yet.

[…] May 2022 – markets nearing my max drawdown […]

LikeLike

Not sure Australia has made a decent fist of it over the last 30 years….`the economy is still very unsophisticated as its all based on mining and property, or second derivatives of those industries. The quality of its political and business “elites” is much poorer than the UK because they just haven’t had to try – they haven’t had a real recession since the 1990s due to the China boom. The one bright spot used to be higher education for international students, alas that too doesn’t generate real income for the country now as most of the students only come to work during their “course” – no limits of how many hours they can work – and eventual permanent residency. Great for business wanting cheap labour – large scale underpayment of wages and abuse has reported over recent years – and also good for universities, where pay is higher than most top universities in the world

(and look up Australian politician salaries – much higher than many other western countries!)

As an Australian I’d like to think we would have developed a sophisticated economy specialising in high value services/goods if we didn’t have the mining wealth but we’ll never know. Debt levels are extremely high – no 4.5x mortgage to salary limits in Australia like UK – and if China ever does have a sustained downturn Australia will be in a world of pain however it doesn’t look like it’ll happen for a while!

LikeLiked by 1 person

FvL, understandably you do not want to sell down assets that have recently fallen in value in the leveraged accounts just to manage the margin loan. You also do not wish to withdraw dividend payments from the ISAs as you wish to compound the tax free advantage. Could you identify a particular holding in the leveraged account and buy this holding in the ISA with dividends from the ISA and then sell the exact same amount in the leverage account? You can manage your loan and meet both your (very reasonable) constraints. Small transaction fees may apply but you may also help to manage your capital gains somewhat in the taxable accounts .

LikeLike

ZF… I reinvest ISA dividends already. So in effect your suggestion still involves net selling in the levered accounts, which I don’t want to do. I want to maintain my long exposure and not be forced to sell. Yes I could buy the same holdings in the ISAs but in practice I prefer to ‘buy low’ and I use my asset allocation to drive the tactical buy decisions. I’m also mindful of complexity, and try to ensure minimum number of holdings – buying the same security in my ISA that I already own in a GIA would be a (small) backward step in that regard.

LikeLike

ZF: would your wheeze qualify for the Bed and ISA terms offered by some brokers?

LikeLike

dearieme: Potentially, yes. Although Bed and ISA is usually aimed at new ISA subscriptions whereas above is to use existing allowances to use dividends to, effectively, pay down a margin loan. Also, not sure if FvL has an IBKR ISA. Separately, if FvL targets non (or low) marginable assets in the broker account, available funds can be improved even more.

LikeLike

I… hope you’re okay dude.

LikeLike

thank you sir! not very happy about market drops but hanging on in there….

LikeLike

Cool! Let me know and I can put a Wine Society order for you as well. It might help during the squeaky bum time.

LikeLike