April was a funny month in the UK. Holidays were back, with a vengeance. Everybody seemed desperate to catch up on overdue skiing, Spanish sun, holiday home action. It was hard getting business done over Easter to a level I have not seen before.

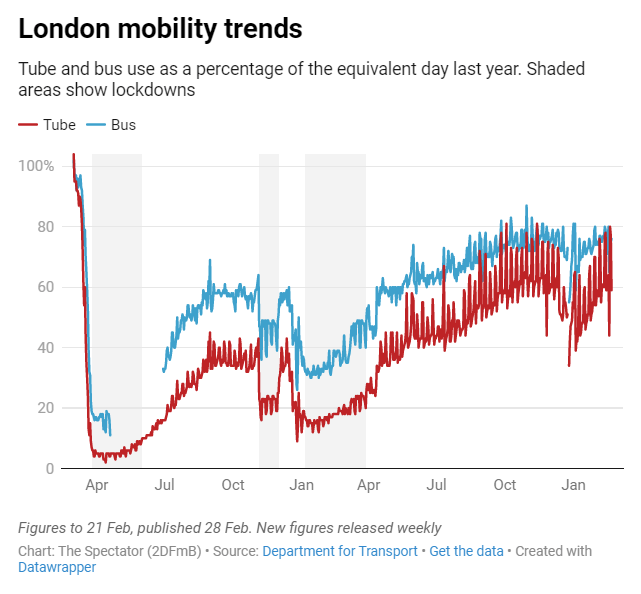

But once Easter was over, boy was London back. The school run traffic is back to not-seen-since-pandemic levels (in fact arguably above – see chart below). Restaurants are hard to book. Theatres are busy. This is all on Tuesdays-Thursdays, note, not on Mondays (which are the new Sundays). And lurgy-ridden public transport is still emptier than pre-covid. The tube is used by workers, but cars are used by school mums. But all in all, a pleasant change is in the air.

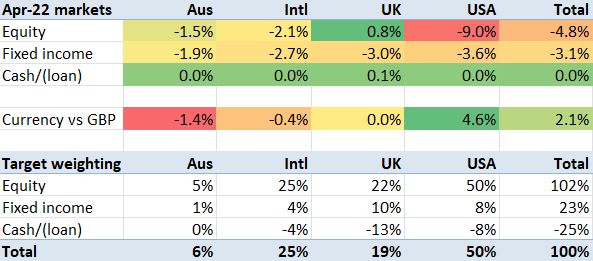

Nobody has told the FX markets, with the USD up almost 5% against the GBP. In one month. And up even more against the Euro and the AUD. I don’t quite follow this – though it is obviously something to do with relative inflation expectations and the attitude to the Fed.

In the middle of this, the stock markets are taking a bath, and I am getting very wet.

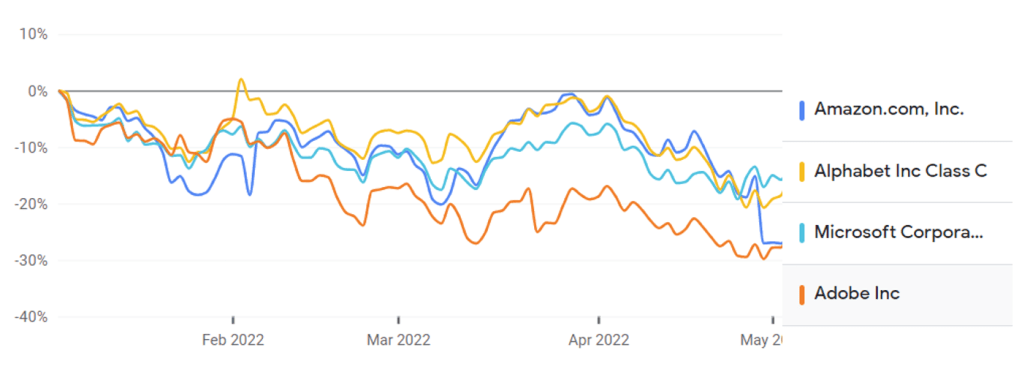

Most notable for me is that I have lost over £100k just on my AMZN position alone, which finished April just under $2500/share (down from an all time peak of around $3800). Being overweight tech, even ‘blue chip’ tech, has not been a good place to be. And being leveraged at the same time has, literally, compounded the misery.

My portfolio contained, at the start of 2022, over $1m worth of just 4 ‘blue chip’ tech stocks. Which between them have shed over 20% on average in 2022 alone. This stuff is seriously harming my financial health.

Thank goodness, for once, for my home bias. UK equity markets continue to be good defensively here.

My portfolio fell about 6% in April. This was somewhat worse than the markets I’m exposed to, measured in GBP. I blame AMZN.

Right now I am feeling the squeeze on cash. I haven’t even fully topped up my ISAs, which is very unusual for me this ‘late’ in the UK tax year. As I write this, markets have continued to fall into May. I am struggling to take advantage, and one my my leveraged accounts is getting into ‘amber warning’ zone. Let’s see what the rest of May holds.

You’re not alone. I had a large position in MSFT Dec’21 circa USD750k which has taken a -25% from ATH. I remember feeling back in Dec’21 these recent gains the past few years were crazy and I should lower my risk, overall my AA came down 15% to 70/30 but regretably I did not trim the MSFT position, in hindsight it must be greed showing its face. Also amusing to read a large sale by the CEO in Dec’21, oh well. On a positive side the remainder of my equity allocation in an all world index which relatively speaking has taken a smaller -11% hit. Most surprising is the -10.5% hit my 30% allocation to bonds (VAGP intermediate index) took. On the positive I guess the USD gains over UKP have made some of these USD holdings losses slightly less extreme and P/E’s are looking a little better. Seatbelts are on for the next stage(s) and if we see a proper Bear in the all world index it will be time to start buying and gliding the AA to more aggressive position.

LikeLiked by 1 person

Hi im new to this blog but it has caught my attention. Struggling with some of the abbreviations in the comment. I assume ath is all time high but what do you mean by AA?

Its Excellent the way you track the investments and delve deeper by breaking it down by region and even currency difference each month. I think I will start tracking my investments now

LikeLike

ATH = All time high

AA = Asset Allocation

LikeLike

Interesting update. My perspectives as follows.

S&P500 is down around 16% YTD. If we look back through history that’s nothing particular. >10% declines occur around once every two years, >20% every 5 or 6 years and >30% declines every 7 or 8 years. I’ve seen a number of commentators talking about stock market carnage but I just don’t see it at the moment.

Fully appreciate tech decline has been greater although I guess this is a reflection of its higher beta to the market – what goes up more comes down more.

I think the main issue is attaching a margin loan to equities as it just levers the risk. I took a similar approach, last year through a five year fixed rate mortgage at <1% and have just been dripping it in on a monthly basis but obviously the mortgage has the benefits of non call / no change of terms. There were also downsides including it being a pain to organise. So I'd be looking to take out that margin loan with a fixed rate mortgage not withstanding higher rates. I don't think margin loans really work unless they are at very very low LTV's.

Anyway, I've no idea where equities are going but this doesn't seem like carnage to me.

LikeLiked by 1 person

Agreed. So far I haven’t exceeded my 10 year max drawdown.

LikeLike

Slightly random question but how do you think about what duration bond funds to hold in your bond allocation? They’ve done damange this year but I think in recent days the correlation between equity and bond etfs appears to be reducing which hopefully will be sustained going forwards.

LikeLike

I am a bit haphazard about it. I have some individual high yield perpetual bonds, some ETFs holding mixed sovereign bonds, and some long duration focused funds. All in all, diversified but randomly.

LikeLike

Thanks – perhaps I am overthinking but my feeling is that longer duration is probably better as short/medium duration is a halfway house between fixed income and cash. I am looking to follow roughly a 70/20/10 equity/fixed income model/cash+equivalents (e.g. NS&I index linked) , but luckily have been slow getting into the fixed income piece.

I’m leaning toward a mix of VGLT and VLCT (or equivalents if I can find ishares or lyxor alternatives) for the US part of fixed income but was also contemplating AGG if I end up not wanting so much duration.

LikeLiked by 1 person