It was only a matter of time, some people argue. Which ignores the vaccine efficacy stats. But for those of us with the Astra vaccine, which is only 60% effective at preventing catching symptomatic Covid Delta variant, perhaps it is true that it was only a matter of time.

Does 60% effective mean: if you meet 10 infected people, you have a 60% chance of not catching covid? Or does it mean that you have 60% chance with the first person, then 60% chance with the second person, then 60% the third time, etc. If the latter, then absolutely it is only a matter of time – even for Pfizer jabbees who are extrovert / risk-taking enough.

In any case, my time struck earlier in the month. I got a sniffle, then slight flu-like symptoms, progressing into a headache. I did a lateral flow test. It was positive. Ho hum. Another lateral flow and then, a few days later, a PCR test result all confirmed the picture.

Thankfully the virus has progressed in me in a pretty typical way. The flu wasn’t too bad, and then quickly became a cough, which has slowly been dying down. I’m back to normal, or at least 95% normal – I haven’t got my full sense of taste, and very little sense of smell. Apparently that can take weeks. Which leaves me much more aware than normal of foods’ texture – rather like, so they say, the Chinese appreciate certain foods.

Meanwhile the markets are back on the up, setting new records. Tesla now worth $1tn. Microsoft overtaken Apple as the world’s most valuable company (outside Saudi Arabia, ahem).

And in the financial pages all the talk remains of inflation. The UK is putting its legal minimum wage up by 6% next year. Let’s give that inflation a helping hand, eh? That is certainly one way to attack the national debt.

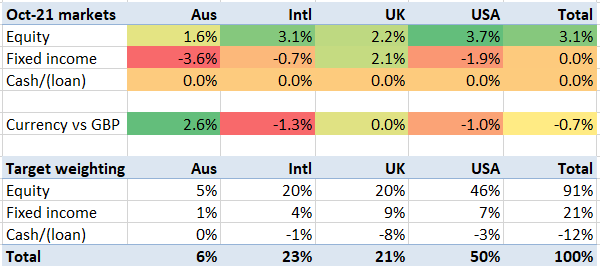

The UK’s economy appears to be rebounding a bit faster than expected – leaving Brexit damage more clear and visible than before – which is I think why the UK uniquely among what I track has seen bonds go up in the month. Australia has had a funny month too, though opening up has certainly helped its currency. But for the most part the story is of equities being up on average 3-4%. This masks some very different individual stories; Nestle (Europe’s biggest company) for instance is up almost 9%, whereas Walt Disney is down. But generally tech is up, which means the USA is up.

My portfolio’s returns are as usual shown here. Things are up about a quarter over 12 months. Amazing.

As it happens, as well as being sick with covid, I ended up quite actively involved with my portfolio in October. Following on from last month’s blog, a 2nd home ‘investment opportunity’ has arisen. It’s far from a done deal, but if it goes ahead then I will need to raid my investment portfolio for funds. This means that temporarily my risk posture is very different from normal – I would be very unamused by a sudden market drop – so I need to reposition quickly. So I’ve:

- Taking profits of holdings that are setting records.

- Sold into a couple of new records – with limit orders designed to sell big gainers, a couple of which have filled.

- Kept idle cash from a recent windfall and from recent dividend payments undeployed.

- Gently trimmed a couple of my more concentrated holdings – AMZN is the main one here – to protect against single stock volatility.

This has crystallised some unrealised gains, and thus a future tax bill – whatever happens. But it also rebases my holdings too, if this 2nd home purchase doesn’t go ahead. It also partially insulates me from a mooted increase in capital gains tax (which, since my activity began, Rishi Sunak has declined to push ahead with).

I’ve now got clear visibility of funds to go ahead with this 2nd home opportunity it if happens, and am relatively relaxed about any more sudden market movements in either direction. I have probably sacrificed about 20% of the market gains in October, but for much better peace of mind. Now into November, to see whether this 2nd home is indeed fantasy or reality.

“Does 60% effective mean: if you meet 10 infected people, you have a 60% chance of not catching covid?” Probably not. When the vaccines were first publicised the claim of 90% efficacy, or whatever, meant that your chance of getting a symptomatic infection was only 10% of that of an unvaccinated person. (Or so my memory tells me).

Later it was learnt that for the first two to four weeks after vaccination you are probably more liable to the problem than the unvaccinated person. After that indeed you were indeed better off. Then that advantage seemed to dwindle away to about zero over six months or so.

It seems that it’s still hoped that the doubly vaccinated get useful protection against hospitalisation or death after the six months are up. Whether that hope will be borne out I have no idea. Judging by the pressure to get a booster I rather doubt it.

LikeLike

Yup, memory correct.

https://www.thelancet.com/journals/laninf/article/PIIS1473-3099(21)00075-X/fulltext

LikeLike

A Swedish medic speaks:

https://sebastianrushworth.com/2021/11/05/covid-how-long-does-vaccine-based-immunity-last/?comment=7680#comment-7680

LikeLike