The UK has the most sophisticated financial services industry in Europe. And in some respects, one of the most sophisticated in the world. But in one area it clearly lags the USA – the stock market. Whether it comes to the size of the stock market, the % of society who own stocks/shares, or the number of stockbrokers – we in the UK are a long way behind our transatlantic cousins.

In the UK, even the concept of ‘margin loans’ would leave financially savvy stockmarket pundits scratching their head. Perhaps a couple of them – monevator comments readers I’m sure – would cross-reference to the excellent movie ‘Margin Call‘, starring Kevin Spacey, Demi Moore and Jeremy Irons, but that movie’s lack of success in the UK tells you what you need to know about the wider understanding of ‘margin lending’ in the UK.

As regular readers of this blog know, I am a member of that rare and unusual species – a UK user of margin loans. This page is to serve as some form of introduction to the concept for UK/European readers, as well as summarising some of my experiences and linking to further reading.

What is a margin loan?

Loans generally come in two shapes/sizes – secured loans, and unsecured loans. Secured loans – where the lender has some form of collateral – are cheaper, reflecting the lower risk that the lender is exposed to.

Mortgages, i.e. loans secured by homes, are the classic ‘cheap’ loans in the UK – with headline interest rates of around 2% for owner occupiers. As well as the interest charges, various fees apply – arrangement fees, valuation fees, etc, so the total costs expressed as an ‘annual percentage charge (ARPC)’ are typically higher than 3%.

Margin loans are a form of secured lending offered by stockbroking accounts, which give investors a way of borrowing against shares they own. The stockbroker uses the stocks/shares portfolio as security. This is in theory a very low risk form of lending – a bit like a wine merchant offering you credit when you buy wine ‘in bond’ – because the broker can liquidate (no pun intended) the portfolio to settle the debt. Such loans are known as ‘callable’ – the lender can in theory call it in at any time (like overdrafts, in fact).

As a result of being low risk loans from the point of view of the stockbroker, margin loans can be very cheap loans. You can get margin loans in GBP for as little as 0.6% above base rates, i.e. under 1% per year. In the case of a margin loan there may be no additional fees at all, so the ARPC is the same as the headline rate.

The key risk with a margin loan is that the value of your collateral drops to a level where the lender hasn’t got enough cover to protect them from you not repaying the loan. If that happens they will hit you with a ‘margin call’ – i.e. saying you must sell assets in order to reduce their risk. This ‘request’ is in fact often out of your hands – in the extreme case the lender, as your stockbroker, can and will liquidate positions for you – to a level where the loan outstanding is reduced to a level they feel appropriate.

Mortgages are not callable, so lenders have no ability to access your collateral unless you stop meeting your repayment commitments – the borrower is in control of his/her destiny. With margin loans this is different – if markets crash, or your holdings suddenly get clobbered, the lender may foreclose on your collateral with little or no warning. For reference, there are usually different levels of urgency here – e.g. once the loan is say 70% of the collateral you get ‘a polite warning’ and once it is 80% the bank will do what it has to do with no warning.

[UPDATE thanks to Alex P] In the UK, interest charges on margin loans are not tax-deductible for individuals – but they are for Ltd companies. So if you have an investment company/similar, margin loans are even more cost effective.

An additional benefit of margin loans is that they can be in any major currency. If you feel that borrowing money off a stockmarket portfolio is crazy enough risk for you, you won’t fancy doing it in another currency – but if you want to buy some USD securities on margin without selling your GBP holdings, it is super convenient.

How do you get a margin loan?

The process of agreeing a margin loan is very quick. Your bank/broker will only let you use assets in their account as collateral, but that means the process is super quick. The bank doesn’t need much paperwork on your assets because they have them all already.

The interest is charged typically monthly, and is just applied to the cash balance in the account. So your negative cash balance just becomes very slightly bigger each month. If any any point you want to clear it off, you can just liquidate some of your holdings in the account, enough to turn your cash balance positive, and your margin loan is gone. No paperwork is required.

In the case of my private bank, the process of trading on a margined-account is a tiny bit more cumbersome. With a margined account, the trader needs to check with the risk team. That process takes typically an hour or less, and the trade is then confirmed. It isn’t as slick/realtime as online trading is, but it feels barely any more hassle than trading in an un-margined account. Whereas with Interactive Brokers, there is no difference between using a margined account and using an unmargined account.

What can you use a margin loan for?

The typical use for a margin loan is to allow you to buy more stocks/shares (or contracts of difference, or options, or whatever your poison is).

In theory margin works exactly the same way as for buying a property.

Let’s say you put £100k into a stockbroker account. Say you borrow £50k on margin. This means you can invest in £150k of stocks/shares. Your net liquidation value is £100k, but your total assets amount to £150k and your cash position is -£50k. If your assets yield 3%, and your margin loan costs you 1%, it is easy to see how this investment strategy could appeal.

As with property, your risk is amplified – leveraged – by borrowing. In the example above, if your assets fell by 10%, i.e. from £150k to £135k, your net position is now (£135k less £50k=) £85k – i.e. it is down 15%. The more margin, the more risk.

However, as with property, you do not have to use a loan to buy more property. You can ‘equity release’ cash for other purposes – e.g. your next foreign holiday. If you have £100k in your stockbroker account, and £100k of stocks/shares, and your account has margin enabled, you can simply withdraw £10k (or rather more) without blinking an eyelid. At that point, your net liquidation value would be £90k; your assets would remain at £100k, but your cash position would be -£10k.

My biggest use of a margin loan was to buy my Dream Home, as extensively documented on this blog.

Who offers margin loans in the UK?

If you Google ‘UK margin loans’, there is not a long list of providers. You won’t find it mentioned on the comparison sites with meerkats.

In fact, the UK retail stockbrokers generally do NOT offer margin loans. In this respect, the UK is very different from the USA – where most reputable stockbrokers would offer margin. To the best of my knowledge the main UK players Hargreaves Lansdown, AJ Bell, Interactive Investor, Barclays Stockbrokers, etc do not offer margin loans.

The most obvious and notorious providers of leverage are the spreadbetting firms – IG Index and its rivals. However they offer margin in such a way that causes 70-80% of their customers to lose money – hence the FCA warnings they are obliged to show on all their promotions.

The leading player outside the spreadbetting/Forex trading space, so far as I know, is Interactive Brokers – an American broker which does operate in the UK. I use them myself and their rates are notably low. De Giro appears to provide a UK margin lending service (‘Debit Money’) too – albeit somewhat cludgier than IB’s offering.

The other players are the private banks. Barclays Wealth, Coutts, JP Morgan Private Banking all offer margin loans (a.k.a. ‘Investment Backed Lending’, ‘Lombard Loans’, etc) Goldman Sachs probably do – though a few years ago they told me they didn’t offer it to UK clients, but I imagine that has changed. The Swiss private banks would offer it, I assume, though I don’t know anybody who uses it. I don’t know about Alexander Hoare, and the other ‘niche’ private banks but I imagine they at least understand the question ‘do you offer margin lending?’

| Provider | Min assets, £ | Interest rate (for $200k loan, May 2021) | Max loan-to-value, % | Notes |

|---|---|---|---|---|

| Interactive Brokers | none (but $120 p.a. for <$100k assets) | 1.30% | 70%? | |

| Barclays | £500k | 2.35% | 75%? | |

| Coutts | £1m | ? | ? | Must not be used for |

| JP Morgan Private Banking | $10m | Low – even lower than IB, apparently | n/a | |

| De Giro | N/a | 1.35% | n/a | To get this rate you must apply (‘allocate’) funds – unapproved loan costs 4%+base – and you then pay whether you use it or not |

How much can you borrow via a margin loan?

I don’t know of anybody who allows you to borrow against tax-sheltered accounts i.e. ISAs or SIPPs.

As mentioned above, the spread betting firms allow very high levels of leverage – up to 10x the amount of collateral. This is extremely risky and often goes wrong. I don’t think of these firms as well suited to long term investors and have never got my head around any of them – even though I understand that IG Index’s platform is remarkably good if you can avoid being trapped into excessive levels of leverage.

Normal levels of margin lending depend on the assets you are securing the loan with. In the USA, there is a standard level of risk known as Reg T, which broadly speaking allows you to double your money. In the UK there isn’t anything as standardised.

My UK private bank will advance 70% margin against any discretionary portfolio they manage for you. This suddenly makes discretionary portfolios feel more attractive. With a £1m portfolio, you can borrow up to £700k, very quickly.

For execution only portfolios, the amount of margin available depends on the security. Broadly speaking, for highly liquid securities, you can borrow 70% or more. This applies to FTSE-100 stocks, big ETFs, and quite a bit else. For less liquid UK securities, you can typically borrow 50%. For some securities – particularly overseas ETFs or microcap stocks – there is no margin ability at all. I’m not sure if the same applies to Interactive Brokers but I suspect it does.

The danger/trap here is that if a security sees its trading volume dip, and its liquidity levels fall, it can suddenly become less useful as collateral. I saw this happen when I first set up my margin account – a large position I had in a relatively illiquid stock flipped overnight from ‘marginable at 70%’ to ‘not marginable at all’. My illiquid stock hadn’t fallen much in value, but its trading volume had dried up. If I had been near my borrowing limits, this would have triggered a margin call.

One point to note is that the products that private banks love selling the most – e.g. structured notes – are not marginable at all! Roughly speaking, the less money your bank makes out of you, the more liquid and thus margin-able the holding is. All the more reason to resist those persuasive sales pitches.

How was it for me?

I started off with margin loans, dabbling in a Dividend Growth portfolio with Interactive Brokers. I ran with a very small – approx 5% – level of leverage. I reasoned that the portfolio had 3-5% yield, and rates were 2-3%, and with a 5% level of leverage the dividends would repay the loan in 12-18 months anyway.

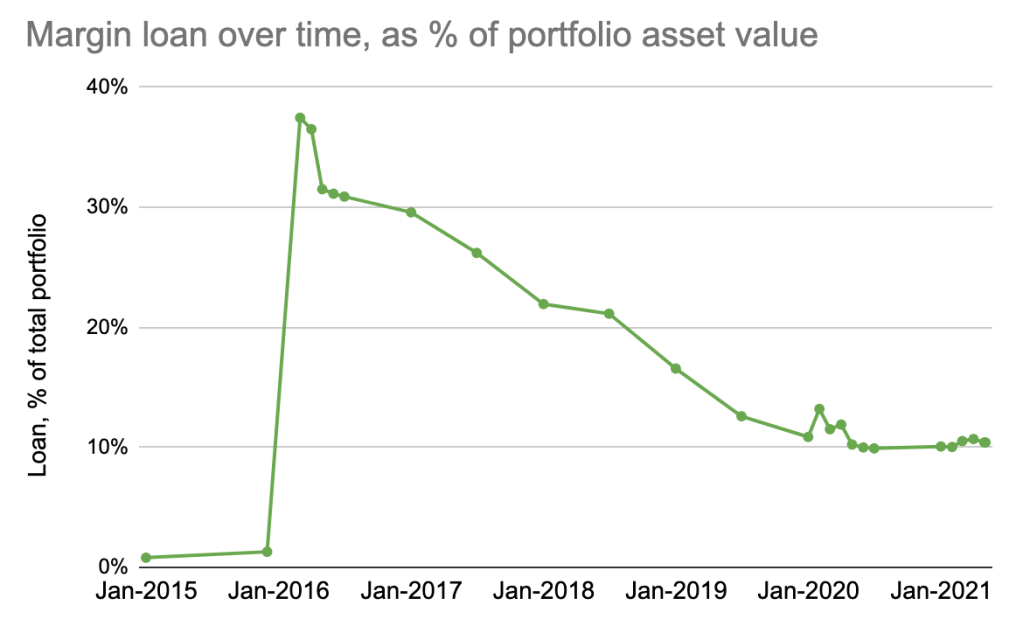

Then I found myself using a £2m+ margin loan to buy my Dream Home at the start of 2016. This was primarily to avoid having to liquidate an extensive portfolio, at a point I felt to be a bad time to be selling (and where hindsight shows I was right). This loan required almost 40% leverage against the ~£5m portfolio it was secured against. Had things turned nasty I would have struggled to avoid margin calls – if the portfolio had dropped say 20% in value my loan would have exceeded 50% of the portfolio, which would have been nearing portfolio limits. However, I knew I had a windfall coming a few months later, and I also had some significant sums in other unmargined accounts (e.g. ISAs), so I felt able to manage the risk – and in time a combination of that windfall, and stockmarket gains pulled my leverage down well below 30% in a matter of months.

What I love about margin loans is how easy they are.

I can decide to buy a new stock, and I don’t have to think about how much cash I have – or whether to sell something, and what to sell, and whether I need to wait for the market to open. I can just buy the new stock – however much I want. If I am comfortable with the additional leverage, that is it; if I prefer to ‘settle the debt’ I can do so at my leisure, perhaps with a couple of judicious limit Sell orders taking advantage of any price pops when the time comes.

Alternatively, if I face a sudden call on a significant sum – e.g. a follow on private equity investment – I don’t have to liquidate any assets to meet it. I can just withdraw from my margined account, and send on the money. And likewise if I receive a windfall, I don’t need to decide what to deploy it into – I can just move it into a margined account and know that I am getting at least a reduction in the loan and the interest charge.

For some time now I have been targeting 10-12% leverage. This is somewhat more than the dividend yield – but still low enough that in fact the dividends would naturally pay off the debt in 3-4 years if I didn’t touch the account. I consider this level of leverage to be almost negligible risk.

On the other hand, my portfolio’s assets are now approximately 80:20 equities:bonds. With the recent S&P bull market, all my dividend reinvestments are into bonds. In practice this feels like using borrowed money (at about 2%) to buy bonds (yielding about 1%), which doesn’t feel too smart. But I tell myself that I am borrowing money to have a slightly larger portfolio, and the mix is 80:20. If equities fell, I would be reinvesting cash into them – and expecting the long term return to more than justify the lending.

Could margin loans be right for you?

Most stockmarket savers/investors in the UK will have the vast majority of their funds in their pension or ISAs. For such investors, margin loans are not much use.

For investors who have significant amounts invested in equities outside tax wrappers, margin loans could be worth considering. Whether it is to provide rapid liquidity that avoids crystallising gains, run a modest level of leverage on long term investments, or access cheap debt without needing to mortgage a house, they can provide very useful.

Those investors with significant unwrapped assets have probably considered private banking/wealth management. If you’re one of these people, but you’ve been put off by the high fees / poor value for money, then the only provider I’m aware of in the UK at the moment is Interactive Brokers. If you find more, please let me know in the comments below.

A couple of sneaky tricks played by the CFD providers (well IG anyway):

They charge you interest on 100% of the position. This has two ramifications:

– Your interest is charged on 100% of the exposure. For example, a stock traded at 75% margin, requires 25% margin from the investor. But they’ll charge you interest on 100% of the exposure. So you’re essentially paying interest on your own capital. Clearly the less leverage they provide the bigger issue this becomes. Imagine having a mortgage where they charge you interest on your deposit. Outrageous!

– They charge you 100% of the mark-to-market value of the position!! This, to me is very sneaky, and why CFDs should never be used for any longer-term investing. For example, let’s say you buy £10k worth of shares on 20% margin. The stock doubles, and your position is now £20k, they’ll charge you interest on the whole £20k, even though the original loan was only £8k. Imagine your bank charged you interest on the value of your home, not the amount you borrowed, OUTRAGEOUS!

You could take advantage by taking the other side (shorting CFDs against physical shares) in theory. But the interest rate spread and short borrowing costs ensure people like us can’t take advantage of their tricks. It’s also worth noting if you go long and the position goes against you, you could benefit from lower interest charge. However markets have a positive skew and investors a long bias. Generally the punter will lose.

CFD providers often don’t hedge themselves either, which opens all sorts of conflicts of interest (i.e they don’t buy the underlying instrument that the investor does, so take the other side of the trade). They know that over the longer term, interest charges, spreads and commissions will erode the investors capital (or as often is the case, retail traders just blow themselves up with leverage). So not hedging is more profitable, it is in their interest for their customers to lose. They are playing casino operator and the deck stacked in their favour.

As a short-term tactical tool, in markets with tight spreads and low commissions, CFDs can be useful. Outside that I’d be very, very wary.

If you want to buy stocks/bonds with leverage, 100% interactive brokers. You won’t find better. Rates are ridiculously low and they don’t have the same conflict of interest (they own the physical underlying on your behalf).

LikeLiked by 1 person

Thanks for this. Great post as usual.

I have been deciding between Interactive Brokers and Barclays. For fund investors, I think Barclays might be more suitable given that they’re willing to take wider range of funds as collateral. I’ve had a look on IB’s website and there’re limited UK funds they would consider as collateral for margin loans.

Another aspect to point out is that Barclays execution charges and custodian fee on asset held (15bps) is likely to be more expensive as they only offer over the phone execution for asset held as collateral for margin loans (and not their cheaper, electronic execution platform). I believe they charge 0.5% transaction charge on listed equities and funds!

One reason one might choose to go with Barclays over Interactive Brokers is that there’s a relationship manager on the other end of the phone, hence I suspect they’re less likely to randomly terminate the facility vs. Interactive Brokers (computer says no) in situations where providers themselves face liquidity problems? Or maybe I’m just old fashion?

LikeLiked by 1 person

Thanks for the post. I’ve had an IB margin loan for the past months based on your prvious advice and it’s been going pretty well for m.

One thing you forgot to write is that holding the margin loan in your family investment company (if you have one) might be better tax-wise, since you can offset the interest costs from the company profits. This also works for contractors who somtimes loan the money sitting in their company to their other investment company.

LikeLiked by 1 person

I find that my interactions with my US private bank (US) is best summarized by the word “chisel”. Whatever the product or service, they start off with some huge fee. I then have to chisel them down to something that’s reasonable. Offshore bond starts at 100bp, ends up at 40bp. Custody starts at 15bp, ends up at 5bp, margin loan starts at Fed funds + 1%, ends at Fed funds + 3/8ths. Chiseling fees is always required.

The charges for margin loans of the UK private banks you quote though are just outrageous. I don’t understand how these banks justify it. There is simply no economic reason why a money-centre bank, like Barclays, who has private seigniorage and access to central bank lending windows, should be charging more for borrowing than a broker like IB who does not. It’s not as though banks are actually lending out deposits. They only need to fund the reserves against the loan, which on £1mm might be £100k. So they lend on £1mm at 2.35%, borrow £100k at 0.25% (say), so they are earning 23% on their reserves. Moreover, their collateral is highly liquid and transparent, not some totally illiquid, opaque property, with huge fees to sell.

Don’t touch Barclays. Use IB.

LikeLiked by 1 person

Very interesting. I obviously don’t have as good a chisel as you!

Tho Credit Suisse would have a different opinion, based on this week’s headline in the FT:

“Credit Suisse made just $17.5m in Archegos fees in year before $5.4bn losses

Paltry revenues raise more questions about strategy of taking risks for wealthy clients”

LikeLike

Investec also offer margin loans. 65% loan to value and an eye watering 1.5%+base. I’m using Interactive Broker as well, having heard about it first from you. Shame their interface, support, manuals etc are so difficult for simple buy and hold investors.

LikeLiked by 1 person

[…] Margin loans in the UK […]

LikeLike

[…] Margin loans in the UK – Fire V London […]

LikeLike

[…] Margin loans in the UK – Fire V London […]

LikeLike

I have had a margin account with IB for a couple of years now after first reading about margin accounts here – thanks!

Very happy with IB, love the platform. I tend to use a small margin for my core investments (global trackers, ITs) with larger margin for shorter term, more speculative trades. I have experimented with CFDs too but don’t like them for medium/long term holds for reasons already mentioned.

LikeLiked by 1 person

Thanks for this post, which makes me realize I’m using too much margin in my IB account (currently 26% of portfolio) just for long term top ups and some stock forays. I’d been meaning to reduce this for some time and this has given me the impetus to do so.

LikeLike

I suspect margin loans in connection with pension funds are not catered for might be because there is legislation against assigning or surrendering pension benefits (resulting in unauthorised payment tax charges)?

(https://www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm133200 and following pages)

LikeLike

They’re ubiquitous here in Canada. All 5 of the big banks, 2 of the smaller ones and about 5 independent brokers including IBKR, offer margin loans through their discount brokerages, in addition to the traditional brokers. With Questrade, their default account is a margin account, unless you specify no margin. Generally you have to put up and maintain 30%. You can hold USD and CAD in the same account as dual or multi-currency margin accounts are standard. The loan is extended the moment you click “buy.” Generally speaking we don’t have CFDs or spread betting anywhere in Canada and I think they’re disallowed in the USA. IBKR has the best margin interest rates that I am aware of. The bank on-line brokers only offer Canadian and U.S. stocks but Interactive Brokers offers stocks from many different countries, such as Britain, the EU countries, China, Japan, et al. RBC, BMO, Scotia Bank, CIBC IBKR and TD have good margin trading examples on their websites. Per the Canada Revenue Agency, interest is tax deductible as long as the stock pays a dividend or there is a reasonable expectation of a dividend at some point in the future.

LikeLiked by 1 person

Further to ZXSpectrum48k’s comments — in Canada at least, the dealers have to put up and maintain 20%. If they lend at 9% and borrow at 5%, they make (9%-5%)*5 = 20% on their money.

Margin money is getting expensive in Canada and has become a consumer ripoff in the USA. Some of the banks there are charging small traders upwards of 14%. You might as well get a low fee credit card and pay it back over time and not have to worry about a margin call.

LikeLiked by 1 person

Sorry, one more comment re: John’s comment on CFDs. I think those CFDs, contracts for difference, are simply a form of bet where you pay interest if you’re long or earn interest if you’re short. You don’t borrow money to buy or sell a CFD.

That form of margin is akin to commodity futures margin where you put up a cash deposit to make good your marked-to-market (meaning, paper) profit or loss on the position. The bank that makes your CFD either charges or pays interest depending on whether you’re long or short the contract, so that that they can keep the contract open.

That is not margin as the term is understood in Canada or the U.S., as it applies to stocks, where you are either borrowing money against your shares (the margin being your equity position, or, the value of the shares less the loan), or borrowing shares and selling them against the cash proceeds if you are going short (the margin being the sale proceeds less that value of shares).

CFD margin would be more akin to commodity futures margin, as the term is understood in Canada.

LikeLiked by 1 person

Terrific blog by the way. I live in Edmonton, Alberta so FIRE v. Edmonton LOL. That, assuming the whole province doesn’t go up in smoke over the next few weeks. Keep up the blog and best of success.

LikeLike