My last post, reviewing 2020, observed that my performance is, superficially at least, very similar to Vanguard’s WoRLd equity tracker ETF VWRL. Despite my portfolio involving a helluva lot more complexity/faff. My post elicited this comment from Bob:

Thanks for sharing, intriguing as always. As someone who recently (18 months ago) simplified my portfolio into three holdings: 1 VWRL seven figures, 2 [single megacap tech stock] six figures, 3 Vanguard Global Bond six figures. I find myself reading about your complexity and not feeling jealous one bit. So the question is, why do you dislike VWRL (or similar global tracker) so much? You mention the comparison several times, what is stopping you making the change? That is after all what reviews should lead to e.g. insights, and change.

Bob, commenting on 2 January 2020

Bob’s challenge is a good one. Why wouldn’t I just swap out my entire portfolio for, say, holding only a single world equities tracking ETF like VWRL or its non-Vanguard equivalents (see Monevator’s updated list of alternatives here, or the SRI alternatives listed on my ETFs page)?

How exactly does my performance compare to VWRL?

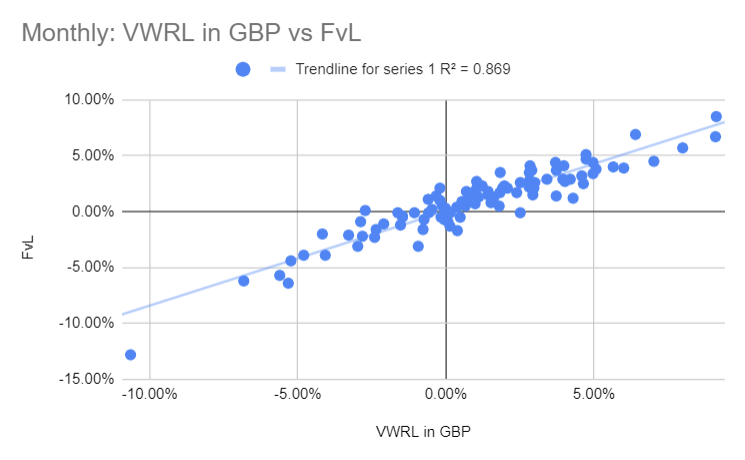

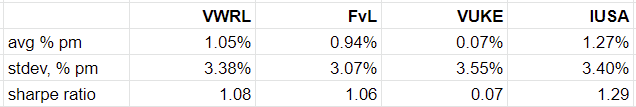

As it happened even before this comment I had started a deeper dive into this question. The graph below plots my monthly performance, since Jan 2013, versus VWRL (share price only; this ignores the ~2% annual dividend yield). As you can see, there is a tight correlation – with an R^2 of 0.869 (R^2 is a measure of correlation between 0 and 1, where 1.0 means completely correlated, 0.0 means no correlation at all). In contrast, my R^2 versus VUKE and versus VUSA are both a lot lower, at 0.74 and 0.50 respectively. So VWRL is indeed a close fit with my portfolio. I owe blog-izen zxspectrum48k my thanks for first bringing this to my attention a couple of years ago.

The other analysis I did here is to consider the ‘unitised’ return, per unit of risk. My favourite measure of this is the Sharpe ratio; higher equals more return for a given level of risk (volatility), where anything above 1 is generally considered decent (professional, hedge fund quality, ahem). A first order approximation of Sharpe suggests my Sharpe is 1.06, VWRL’s is statistically-similar 1.08. VUKE’s, by contrast, is a dismal 0.07 – reflecting more volatility than my portfolio, and far lower returns. But the standout Sharpe performer is the S&P 500; IUSA’s Sharpe is almost 1.3 – off, incidentally, high volatility but even higher average returns. A S&P index tracker has beaten almost everybody for years (though the MSCI USA index has done markedly better of late, due to Tesla).

So, based on this initial scrub, I would do well to replace my entire portfolio with VWRL. That set me thinking.

What are the sources of my return?

When you dig into any portfolio, its returns come from different components. Classic portfolio theory, for instance, divides a return into the market’s performance (beta/passive) and the return over and above (or, often, below) the market (alpha/active).

Asset allocation

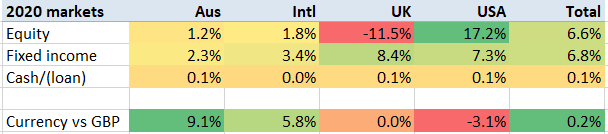

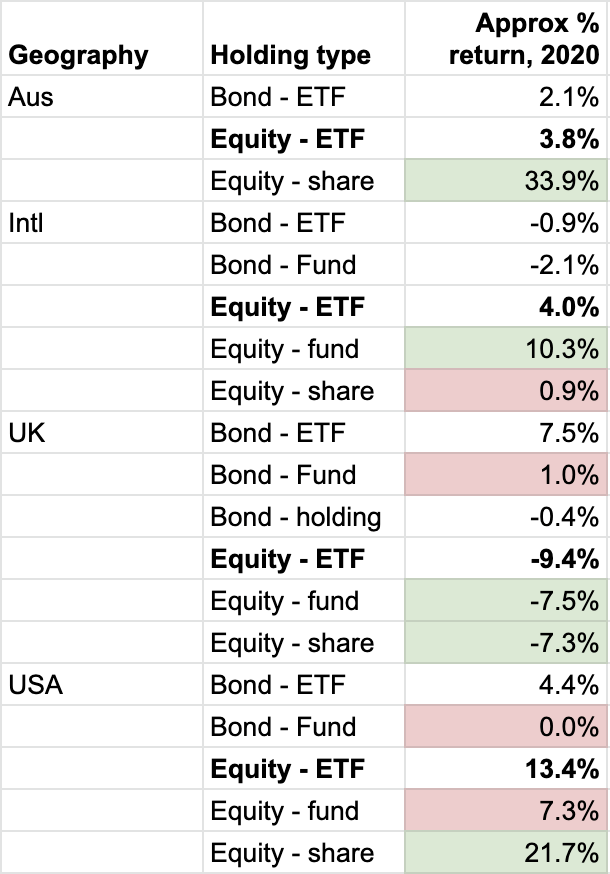

The starting point for breaking down any portfolio though is the markets it is investing in – what its beta is, in effect. This is the asset allocation question. My mental model is that asset allocation accounts for 80% of a portfolio’s return. The year 2020 makes it easy to see why – here are the returns of the obvious geography/asset markets I look at, in 2020:

Your ability, with any UK-focused equity portfolio, to beat almost any US-focused equity portfolio, in 2020, was practically nil. And, likewise, if you held UK/US bonds in 2020, you more than likely did OK – but not as well as if you had a broad basket of US stocks.

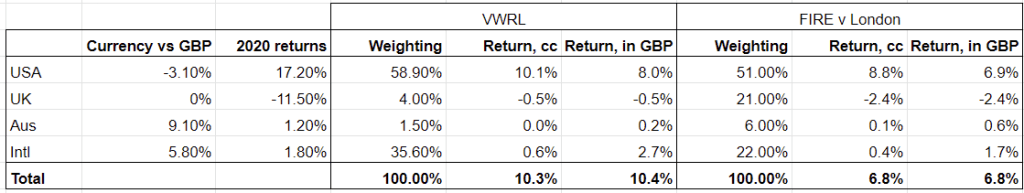

My asset allocation is, in fact, significantly different from VWRL. We are both fairly similar with our US weighting. But my portfolio is 21% UK weighted, deliberately far higher than the UK’s 4% global weighting these days (down from 6% not too long ago, sigh) – reflecting my home being in the UK. VWRL’s international (i.e. non USA) exposure is correspondingly far higher than mine, at 36% compared to my 22%. My Australia weighting is also deliberately high, at 6%, compared to what I estimate is a 1.5% VWRL weighting.

And this difference in weighting makes a big difference. My 5x greater exposure to the UK, in a year when the UK stockmarket fell by 11.5% and other key markets all rose, hurt me. VWRL’s weighted average markets rose by 10.4%, in fact. Whereas my weighted average markets rose by only 6.8%.

Against VWRL’s benchmark rise of 10.4%, VWRL’s actual performance of about 9.5% does not look quite so good. I assume dividends are the difference. But in the meantime, my own return of 8.5%, compared to my market’s average of under 7%, looks quite a lot better.

This suggests that, rather than owning VWRL, perhaps instead I should simply mirror VWRL’s asset allocation? In fact I think my asset allocation is a better fit for me than VWRL’s, with my life being orientated around the UK far more than an ‘average global stock market investor’. This year, my UK exposure cost me, but imagine if the opposite had happened – the UK had risen by 17% where the US had dropped by 11%. In that case I would be feeling pretty sour if I was down almost 10%, while all the ‘nearest’ assets were up 17%, and my relative financial firepower was down by 25% relative to my home market.

In fact my allocation includes a significant weighting towards bonds, whereas VWRL has none. But in 2020, the weighted equity return in my geographies was +6.6%, and my weighted bond return was +6.8%. There was negligible difference. This isn’t always the case, though bonds have done surprisingly well for surprisingly long.

Substrategies

While I am considering where my return comes from, I have three experimental portfolios to consider. Each has been running for most of the last 8 years, albeit not tracked as carefully as my overall portfolio:

- High Yield Portfolio. This miserable portfolio is a clear dog. I have for some years owned a handful of ‘guaranteed income’ holdings, and leveraged them up cheaply. In theory this produces a nice high single digit return with relatively little risk. In practice the holdings have always disappointed, and my returns suck – I don’t know exactly but I think annual returns are under 5%, less than half of my portfolio average, with approximately similar volatility. I keep holding on, telling myself “one more year”, mainly because I have never felt I understood clearly what is going wrong. In my defence, the total size of this portfolio is less than £50k – about the same as many of my single holdings. Nonetheless, after 8 years, I’m pulling the plug.

- Dividend Growth Portfolio. Another subaccount I run is a ‘Dividend Champion’ portfolio – of mostly USA stocks that have a long track record of increasing dividends. This portfolio has been a solid performer; I don’t have exact numbers but I would say it tracks S&P minus the tech component. But at the end of the day I think I’d be better with an S&P500 index tracker.

- Tech growth. My other subaccount contains only tech stocks – mostly USA, big and small – and needless to say it has done very well indeed. Again, no numbers, but it is in danger of lop-siding my portfolio. It has grown to be about 10% of my total equity portfolio. And I also have significant tech holdings mixed into my other accounts. Given that NASDAQ grew over 40% in 2020, it is reasonable to think that my tech investments alone drove all my outperformance in 2020.

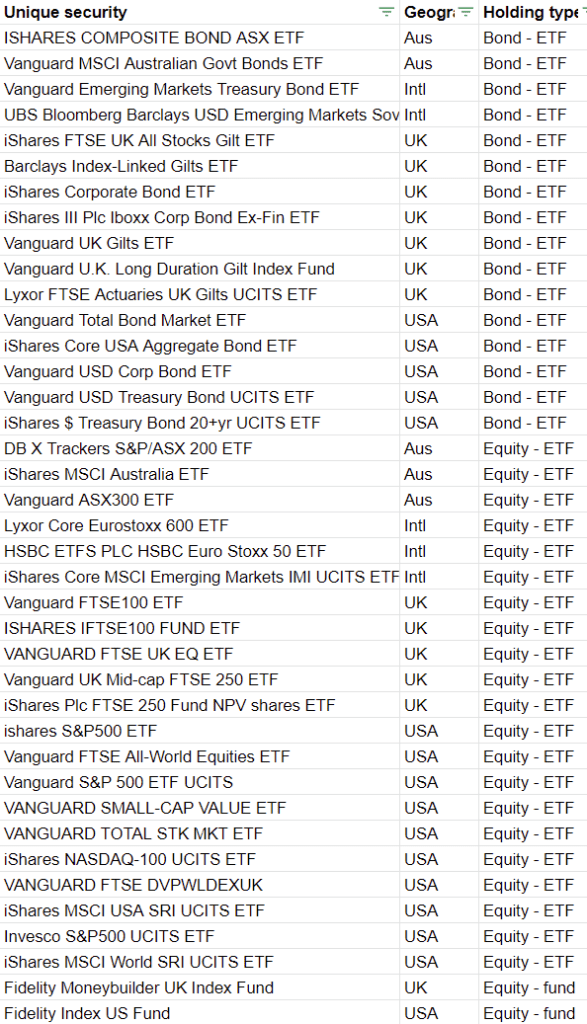

Active vs passive

The other obvious analysis to do here is to compare my ‘beta’ with my ‘alpha’. This is not an easy analysis to do properly, so I haven’t. But if I break out my performance based on type of holding, by geography, I get a rough feel for the breakdown. Green represents outperformance versus the equivalent index tracking ETFs (shown in bold), pink represents underperformance.

The analysis above is approximate. It ignores dividends/coupons, for instance, which makes my UK individual bond holdings look a lot worse than they are (as they yield 6-7% each).

But some patterns in 2020 stand out:

- My passive holdings tracked effectively, more or less. The bond ETFs look a bit skewiff but don’t allow for coupons. In some countries my equity ETFs outperformed the markets, in others they lagged – but they were definitely on trend.

- My stock picking did OK, in English speaking markets, in the UK, USA and USA. This is primarily about my tech holdings – my Australian portfolio includes a significant holding in XeRO, for instance, which almost doubled last year. In the UK, where I don’t have any tech holdings, my direct shares lost about 7%, but the market and ETFs lost more.

- My stock picking elsewhere did not work. This makes sense to me. I have a handful of European stocks, none of which have done very well. I also made a significant error by investing in Airbus in January, which promptly halved. I cut my losses. I don’t know these stocks well; I am buying large megacaps like Adidas, Heineken, Airbus and others. I think also that whereas the UK FTSE-100 has some clear duds in it (banks, Vodafone, BT, the list goes on), so by buying large UK businesses that are not duds gives you a reasonable chance of outperforming, if you go for Eurostoxx 60 you are less likely to own the walking dead. This argument is basically that the top 60 European companies (which will include 5-10 UK companies) are better, on average, than the top 60 UK companies, which sounds a bit unpatriotic but reflects the ‘pollution’ I perceive in the FTSE from banks and extractors.

- My active equity funds are generally doing OK, albeit not in the USA. Again, there is some logic for using fund managers to pick stocks in emerging markets, and even continental Europe. They know them better than me.

- My bond funds are losing to ETFs. I have been sceptical about the ability to index track bonds, so have swallowed the relatively high fees that come with bond funds. But the evidence above is fairly clear – I should stick to bond ETFs, not the funds.

While these conclusions are coming from only one year of data, I would say that they feel more robust than that – I am pretty sure they would hold over 5+ years too.

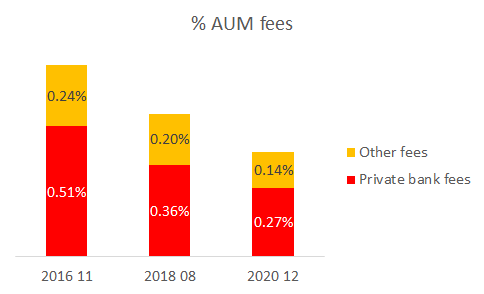

Tax efficiency & fees

For many portfolios, when you look at the return you see tax and fees make a material difference. Both are, mathematically, equivalent – they are deductions from the gross portfolio return.

In my case, my analysis effectively ignores tax. I pay tax ‘offline’, so to speak. And even where I make withdrawals from the portfolio to pay the tax bills, by unitising my portfolio I strip out the effects of additions or withdrawals – so what you see on my blog is analysis of just the underlying returns.

As to fees, I have reduced my blended average fees to just 0.41% of my investment portfolio. This is not negligible, and will reduce my returns accordingly, but it is within the margins of error of my analyses in this post. VWRL’s fees of 0.22% are lower than mine, but by less than 20bps. I could, perhaps, compensate for that with superior stock picking.

Leverage

This leaves one more potential component of my returns to last. My leverage. I’ve been targeting a 12% level of leverage, though for most of 2020 I was also running tactically overweight cash – reducing my typical net leverage to 8-9%. In principle this boosts both returns and volatility (but holds Sharpe constant, I think). By comparing Sharpe ratios I think I am stripping out the effect of leverage. But in absolute return terms it will have an effect.

My leverage of about 12% in theory amplified my return, but came with a financing cost too of about 1.5%. This has helped my returns by a bit, but is not a big factor relative to the geographic asset allocation and the tech overweight.

What are the sources of complexity?

Having considered my sources of return, I’m now turning to the sources of my complexity. Whereas I’d like as much return as possible, for a given amount of risk, I would like as little complexity as possible! Hence the thought experiment about replacing my entire portfolio with one holding of VWRL.

Multiple accounts

The first driver of complexity for me is having multiple brokerage accounts. Even within one brokerage, if I have a General Investment Account as well as an ISA account as well as a SIPP account then this is three accounts, and even holding just VWRL in each account would represent three lines in my tracking spreadsheet.

I have veered from too many accounts to having too few. My main argument now for having several is the government guarantee, via the FS Compensation Scheme (FSCS), which has a cap of £50k £85k per investment account. I kind of assume that this limit will in practice apply to per-person-per-brokerage. And on that basis I have accounts with 6 brokerages – providing me with, I hope, at least £500k of guarantee. Mrs FvL has accounts with 3 of the same, plus a 4th different one. So 7 platforms to track, and 16 different unwrapped/wrapped accounts across them – 9 of which are taxable. I am comfortable with these numbers.

If I held simply VWRL and GBP cash in each account, I would have 32 rows in my spreadsheet. Add in some USD/EUR/AUD holdings, and my effective minimum is more like 38 rows. Of this 9 are taxable, there would be 9 tax reportable holdings to deal with – across me and Mrs FvL. This would be a very welcome improvement in the current reporting, it must be said.

Diversity across fund providers

The next source of complexity is my desire to avoid having all my eggs in one ETF provider’s basket.

In principle though, I could ‘alternate’ my holdings between VWRL and another alternative (which needs thought – as iShares don’t have an obvious one), so each account had only one ETF holding in it. On this basis I could theoretically keep my number of spreadsheet rows unchanged, at fewer than 40, and hold up to 16 different ETFs across, in theory, as many as 16 different providers.

Not wanting to realise capital gains

A key driver of complexity is my longstanding aversion to selling holdings. This has left me with over £1m of unrealised capital gain.

However right now there is so much media chatter about capital gains tax rates increasing that, if anything, my unrealised gains are providing quite a strong incentive to take action now. If I were to realise £1m of gains now, crystallising a £200k Capital Gains Tax liability, I could reset my costbase. If CGT rates went up to, say, 40%, I have halved my liability on any subsequent sales. Against this there is the risk that CGT rates don’t change, or change a lot less than mooted in the media, and I have paid the tax for ‘nothing’.

Overall I think the risk of significant hikes in CGT are real enough that they make me relatively sanguine about enduring a six figure CGT bill. I also feel that after the strong returns over the last few years, my portfolio ‘can afford’ a significant tax bill – especially if that tax bill is smaller than a single month’s swing several occasions over the last year.

Other sources of complexity

Leverage, an unusual aspect of my portfolio, adds negligible complexity. In fact it adds flexibility, and reduces the need to sell holdings when I need access to liquidity.

Obviously my desire to do some active stock picking is a significant source of complexity. Right now I have about 60 individual holdings. This is higher than I need to be an effective stock picker, but is not absurdly large – based on other portfolios one reads about in the blogs.

Some of my active stock picking is in the form of ‘sub strategies’. These have between 6 and 15 holdings each. I quite like these from a reporting point of view – it makes it easy to see my monthly performance by strategy.

A key source of complexity for me is Experimentation. I have been running, for example, a small High Yield Portfolio for years – with half a dozen small holdings in it. This HYP is in an unwrapped account, so it is landing in the tax return. I like the ability to Experiment, and think this aspect is worth allowing 20 or so rows in the spreadsheet for.

Edging towards a more refined strategy

In all of this discussion I am mindful of my Investment Policy. This policy hasn’t changed, materially, in the eight years I have been tracking my portfolio rigorously. And its principles – diversify, use tax shelters, prefer passive, etc – remain the right ones for me. But at the same time the policy has a lot of flexibility – it would support me splitting my money equally across VWRL and five near equivalents, in my existing wrapped/unwrapped accounts, for instance.

Moving forward, I am tempted to adopt the following approaches – but would very much appreciate feedback on this post before I follow through completely!

1: Stick to the existing asset allocation. My UK overweight has cost me in relative performance to VWRL, but it suits me and my personal circumstances. I wouldn’t feel comfortable having as little as 4% of my invested wealth in the UK, the market that I know best and where I do have at least the potential to see some outperformance from active investing. Likewise being underweight on Europe and Emerging markets works for me. My professional and personal life are entwined with the UK, USA and Australia – so I’m happy concentrating there.

2: Dump the substrategies. I intend to axe my existing substrategies. However I will keep the accounts I use for them, and continue to use them as testing zones, value £50k, with max 10 holdings in total.

3: Adopt a new ETF diversity policy: keep as few ETF holdings as possible, subject to my asset allocation and my existing accounts, and capping any single provider (iShares, most likely) at 25% of my total portfolio.

4: Focus single stock picking on English language markets – i.e., in my case, UK, USA, Australia. In these markets there is at least some plausible evidence that I have ‘edge’ – my individual holdings outperform the index. These securities to be held in unreported accounts (ISAs/ SIPPs) if at all possible, and if not then my Ltd company portfolio.

5: Focus active funds on sectors/geographies that I don’t know so well. For markets where I do not have ‘edge’, the question is ‘index track’ or ‘give it to professionals’. I tend to think the professionals don’t earn their keep in the UK and USA, where markets are closer to efficient, and thus index tracking here is better. But in less liquid markets I suspect professionals can do better – and a couple of my holdings reinforce that belief. So I’m OK using active funds in E.g. continental Europe, China, other emerging markets.

6: Unwrapped accounts should be for a few large, passive holdings. Or, at a push, core holdings that don’t pay dividends – like big tech stocks such as AMZN and GOOG. My numerous single line stocks, especially those that pay dividends, should be ideally in my wrapped-and-unreported accounts (ISAs/SIPPs).

Targets for 31 March 2021:

No more than 50 unwrapped holdings

I want to own no more than 50 holdings in unwrapped accounts, i.e. that aren’t in a tax wrapped account like a SIPP or ISA. Fifty still sounds like a lot, I hear you think. After all, why can’t an unwrapped account look like this one?

And not like this one (truncated at the letter E!):

For starters, I currently own 39 ETFs listed below. I am sure this can be pruned down to 30, but am not so sure about getting down to 20.

Then I have twenty or so holdings that I regard as ‘Core’ – including individual stocks such as Amazon, Disney, Nestle, Xero, and some funds I am happy to own such as Blackrock European Dynamic Fund, the City of London Investment Trust, and so on. A couple of these are not holdings I would buy into an wrapped account these days but they have significant unrealised gains which I am not minded to crystallise, possibly ever.

I also have a couple of illiquid holdings, in the (unwrapped) private bank account, which I can’t sell.

So, getting my unwrapped holdings down to 50 is a tough target. It does however feel like the right next step for me.

In terms of ‘unwrapped’, I in fact have different layers of wrapping to contend with:

- 10/10 Fully unwrapped – in my name. My personal name, in a ‘general investment account’. These funds are taxable at my marginal rate, which is 45% income tax and 20% capital gains tax. And this activity is all reportable on the tax return. My initial goal is to get the number of holdings in this category down to max 50.

- 6/10 In a lower tax name. Funds that are in Mrs FvL’s unwrapped accounts are at a slightly lower tax rate than mine. Her marginal income tax rate is around 40%, and her marginal capital gains tax rate may even be lower than 20% (i.e. we don’t always use her £12k annual allowance in full). And funds that are in my Ltd company pay tax on both income and gains at corporation tax rates, which are currently 19% but rumoured to go up probably around 25% before long. The activity here is also all reportable to the tax authorities.

- 3/10 In an offshore bond wrapper. I have a small offshore bond wrapper. Income in this account is free of tax, and I can withdraw the original capital tax free over 20 years. However any subsequent distributions, of any sort, are taxable at my marginal tax rate. I think of the effective tax rate here as being about half my own tax rate. Until I take any distributions, none of this activity is reportable to the taxman.

- 2/10 In a SIPP. Funds in the SIPP are tax free, and not reportable, until I take distributions or cross the lifetime allowance of about £1.1m. However 75% of distributions are fully taxable in my name. And I am on course to hit the lifetime allowance in the next few years, at which point any gains above that level are fully taxable.

- 0/10 In an ISA. The best of the best, certainly for any funds above/beyond any pension limits. No tax or reporting obligations at all, ever. Under current policies.

Max 20 holdings duplicated in more than one account

I have a lot of holdings that are duplicated across accounts. I know how this is happening – I reinvest dividends in each account, usually against the same underweight allocation, often aiming for the latest ‘watchlist’ stock, or if in doubt a core ETF like VUSA or INXG (both of which I have in 6 separate accounts). I have 78 holdings that are in more than one account, and six holdings that pop up in five+ accounts.

The complexity cost is significant, with more reporting, more logging than is necessary. My investment tracking spreadsheet gives me the ability quickly to see my consolidated picture, and removes any need for accounts to be somehow diversified or balanced within themselves (though I do have a couple of accounts that I like being ‘self contained’, which both have about 9 holdings in). So part of my streamlining will be to try to identify the best account/wrapper for each stock and concentrate my holdings there. I don’t know quite what the right target is here but I think I should be able to pare down duplication to max 20 holdings, all of which I will own at least £50k of.

I have started this streamlining already. My brokers are going to have a bumper month, as I am doing a lot of transactions. I will report back after the end of this UK tax year – on the 5th April 2021.

I’d be interested in comments. Have you considered which ETF most closely tracks your portfolio performance? How much duplication do you have across accounts? How do you trade off diversification vs simplicity?

Enjoyed this FireVLondon… must cheekily admit that your posts on complexity are about the only thing in the blogosphere that makes me feel like there’s somebody out there making life more difficult for themselves than me! 😉 But we love it, right?

I have spent more than 10 years slowly getting rid of unwrapped dividend payers from a combination of legacy holdings and what was once a (similarly lacklustre) small-scale experimental HYP. I was down to one dividend payer as of the last tax return and having to report the income and pay tax on it just reinforced that’s one too many. Can’t wait to get rid of it.

Capital gains taxes are an issue here, albeit on a small absolute scale. My largest holding is a multi-bagging US tech stock that’s worth 10% of my entire portfolio, with a six-figure gain at it’s peak that’s still around there after a couple of years of (reluctantly) trying to defusing down the gain under the allowances.

I don’t even have the excuse of a high income that you have — I could have had most of this stuff in wrappers if I’d got my act together in the early 2000s. Sadly I didn’t know then what I know now. (Although that doesn’t apply to the tech stock, which I only bought and added to six or seven years ago. And yeah, I’d rather have the gains than the simplicity of not owning it. 😉 )

I do think your analysis would be better for incorporating dividends – both yours and your benchmark’s. You do well acknowledging their missing (many just ignore them) but they do move the dial as you know, especially as the years mount. Seems a little odd to do such a deep dive and then brush them aside, IMHO.

Good luck!

LikeLike

Thanks TI. Fair challenge on dividends. My tool for analysing divis is Quicken, but I don’t have my main trading brokerage account in Quicken, so I can’t do full analysis in that. And my investment trading spreadsheet, which I used for this analysis, does NOT cover dividends at security level – the divis just accumulate as cash, which then gets reinvested, so the IRRs are all good but not at a security level.

My analysis here is over 12 months – which is obviously not a reliable timeframe. It is very noisy. I think the dividends signal would be lost in that noise. With the exception of my individual bonds where I know they are yielding about 6% and that is the difference between ‘why do I own these?’ and ‘ah, these holdings kind of work for me’.

Re the capital gains, i haven’t finished yet but my initial experience suggests that the realised gains are surprisingly modest, considering how much I am liquidating / rebuying. I am more alarmed by the bid/offer spreads on a few holdings. We shall see. I will probably have £100k+ of net gains to report, and a £20k tax bill, but touch wood a portfolio that is an order of magnitude ‘cleaner’.

LikeLike

Yes, it was the dividend-less bond return that leapt out at me. 🙂

Re: capital gains taxes, I totally get your logic of saying take the hit now and rebase — although worth remembering your new investment that you put the money sort of has to deliver a ‘prior-tax-adjusted return’, compared to if you’d left it unmolested by tax and continuing to compound. And such a new investment would still be unwrapped I presume given all the cash you have everywhere, and so will be taxed again in the future someday…

I have a weird quirk in that I don’t have all the data for one of my significant CGT liabilities. I didn’t keep great records when I bought/added to it, and the platform threw away the digital copies after a merger. So if I did want to dispose of it I’d have to declare I wasn’t sure of the purchase dates or exact price of any tranche. (I can see the absolute gain because the platform does still show my total cost).

Any thoughts or experience with HMRC in this regard re: declaring CGT? I’ve reported and been liable for CGT in the past but only where I had all the data. Instead I’ve actually avoided selling this holding because I can’t give all the exact details, which is even crazier than the usual ‘don’t let the tax tail wag the dog’ wisdom! 🙂

p.s. Have added you to Weekend Reading, even though you slipped out after the first print haha.

LikeLike

late entry into Weekend Reading? Am honoured. thank you.

No experience with HMRC over that. I think i have guessed in past and not been bitten for it, but with low numbers. Could you just slowly sell, entirely within your personal allowance (under worst case assumptions), and rebase into another account, until you have none left of original holding? Probably too much of a tail for the dog, I imagine.

LikeLike

Hi TI, thought I would jump in here as I am a private client tax specialist (as well as an avid reader of Monevator). The problem you have with the historical information is not an unknown one as you can imagine – I have had clients sell houses where they have added tennis courts and the like and could not find all of the invoices to substantiate the cost of the “enhancements” they wanted to claim for, and HMRC have generally accepted some sensible estimate of the missing amounts. Capital gains tax changed a few years ago so that it works on an “average cost” basis now (it used to be awful – you had to match each sale of shares to the price paid for specific purchases in the past), meaning that as long as you have the total cost then the figures you are using should be accurate (ie if you sell 5% of your shares then you would claim 5% of the total cost as the base cost for that disposal). In terms of putting in the correct acquisition date I would just enter something that is around the time of your earliest/largest purchases and then use the additional information “white space” areas of the return to explain that you do not have all of the details.

It strikes me that the most uncertain part of any CGT computation you do is going to be the currency issue – you mentioned your holding is in a US stock, so presumably trades in dollars, so unless your broker statement gives you the total cost in sterling you are going to have to estimate what the sterling base cost is – without knowing the precise dates you purchased the stock you obviously cannot know what the sterling price you paid was (your base cost for each purchase is the sterling equivalent of the price paid on the date of purchase). In that type of situation I would suggest using your best estimate of the timing of the purchases and use fx rates for those dates, or otherwise use something like a blended average fx rate for the period you were acquiring shares and apply it to all purchases, and just disclose in the white space the approach you have taken. As long as the approach taken is reasonable HMRC are likely to be fine with that.

Best of luck!

LikeLiked by 1 person

Helpful insight on CGT thanks for sharing.

LikeLike

FSCS cap is now £85k per insititiution for investments (it moved up in the last few years).

LikeLike

“Could you just slowly sell, entirely within your personal allowance (under worst case assumptions), and rebase into another account, until you have none left of original holding?”

Yep, that’s what I’ve been doing. 🙂 It keeps growing though… nice problem to have!

The reason for the sale would be to take the tax hit now ahead of any hike, as you muse, and then look to get the cash sheltered, probably in a SIPP (albeit by spending it and socking away my company income), or possibly even pay down a bit of debt if I couldn’t.

Without the threat of a CGT hike I’d probably be content to keep on keeping on.

You’re welcome, re: the late addition. Please try to publish before Friday haha! (Retirement Investing Today used to always publish on Saturday/Sunday and I missed a ton of his stuff out for that reason).

LikeLike

Hi FireVLondon

Before you dive into any active emerging market funds you should check out the SPIVA scorecard on active fund performance.

https://www.spglobal.com/spdji/en/spiva/article/spiva-europe

You are actually less likely to pick an active fund that beats the index in emerging markets than in UK and Europe. The only region that I have been able to trust myself to successfully pick an active fund which is likely to outpeform is Japan, based on the evidence from SPIVA.

LikeLiked by 2 people

I don’t think you should be at all concerned by having an overweight vs. VWRL in places like the UK and Australia. My other half is Australian so we have a definite overweight to that country (in FX, cash, property, equity terms etc). That makes total sense given there is a small, but definately non-trivial, probability we could live there at some point. Your passive benchmark portfolio should reflect your long-term objectives/liabilities, not a global market-cap weighting. That idea seem to stem from those that confuse two concepts, passive investment and index tracking, and decided they are one and the same.

I think you have a good idea of what you want your long-term passive benchmark looks like so stick with that. Express that benchmark in terms of an parsimonious set of index trackers. That may or may not include something like VWRL.

The active porfolio should be considered totally separately and tracked as a discrete portfolio. Think of it as a long-short overlay (in your case with modest leverage) over the passive benchmark. Don’t mix the performance of the two. Bit like this https://docdro.id/Zx4tKZo (ignore the fact it’s FX, it applies to any type of portfolio).

LikeLiked by 1 person

Your analysis looks sound to me; and as you say, a significant factor is how comfortable you are with it.

I wonder how much you would have to pay yourself in order to do the management… should this be included as a ‘fee’ for comparison purposes?

Since you invited comments on ETFs:

I drastically simplified my portfolio this year, jettisoning all the ‘factor’ stuff and moving all my equities into a single developed market tracker: IGWD (iShares V plc MSCI World monthly GBP Hedged). I personally like the currency hedging but YMMV.

On the bonds side I gathered my courage (impudence?) and moved a significant wedge into NCYF when the dividend yield was 9.1%. Time will tell whether that was a good idea; but as a ‘safety net’ I retained a couple of years’ running costs in SUKC and IS15.

LikeLiked by 1 person

I am pursuing a similar strategy i.e. having decided on AA I consolidated my equity exposure to a single global tracker ETF and one bond tracker. Albeit different choices to yours, and one seperate holding which is a legacy from an ESOP that I’m happy to hold. I am choosing to believe that simplicity will give me the greatest chance of good returns over the long term and in addition free both my time to pursue other passions and prevent me from making potentially costly mistakes.

LikeLike

Hi Bob

Can you share your etf choices and particular current thoughts on bonds. Will they really protect in current climate for future downturn. Interest rates can’t go much lower and no upwards signs. Better a defensive fund cgt or pnl type ?

Thanks in advance

LikeLike

Hello Lawrence,

To answer your questions

VWRL for global equities

Vanguard Global Bond Fund for Bonds

I’m not the right person for commentary on Bonds, other than to say i. I am a long term investor, and don’t chase short term performance ii. Bonds for me are not about maximising annual return but part of a rebalancing strategy iii. I prefer to take market returns than move between active funds (whether bond or equities) chasing short term active performance.

Best

LikeLike

Hi FvL

Enjoyed this read because I see similar complexity with my own portfolio, ie with the different platforms (I use 3), and duplication of investments across said platforms. I did do a recent ‘cull’ of these investments so it’s a bit more manageable now (although probably still too many at 12)

LikeLiked by 1 person

Hi Weenie! Thanks for commenting! Are you saying 12 investments in total? I was pretty sure you had more, with your Dogs and suchlike?

LikeLike

Sorry, I should have made clearer – 12 overlaps/duplications across different platforms.

Hopefully can continue to whittle that down and try to avoid doing it in the future.

LikeLike

As someone who has had around 60 investments and had dropped to less than 15 and am now adding a few more…I was interested in this article, having had until recently a World Index exposure of around 60%

The problem with all into VWRL, is that whilst the performance has been great the last few years ( large exposure to USA helps……).I have some interesting data snapshots from July 2007,2009,2012,2017 that each look back 1,3,5 and 10 years. It also gives me data on individual Investment Trusts and by sector.

Only in the 2017 data does All World Index look fairly sensible. It’s a mistake to data mine, but equally so to go forward on the basis of recent good performance. I have been investing for 30 + years and that experience suggests a more even split between different regions ( with very occasional rebalancing) works very well.

The other interesting thing is that whilst charges matter, many investment trusts effectively overcome the cost disadvantage by the use of gearing and by being able to purchase at a discount.

LikeLike

Hello HariSeldon

Interesting, would you offer any more detail on your commentary below, I’m not clear what the data you refer too is highlighting? Apologies if I’ve missed it.

“I have some interesting data snapshots from July 2007,2009,2012,2017 that each look back 1,3,5 and 10 years….Only in the 2017 data does All World Index look fairly sensible….”

Thanks

LikeLike

@bob

The AIC publishes data on investment trust performance, at the level of individual trust , the sector and for comparative performance a very long list of indices. They stopped doing this in late 2017, ( the data is available online still, without the indices though) but by then I had collected PDFs of many prior years ( at one time they were published in monthly booklet form, in a fit of tidying for a house move I discarded the printed booklets I had covering the 90’s and early 2000’s..a mistake)

The indices provide a great way of benchmarking performance on a total return basis, the indices went well beyond simple regional indices. When I first started index investing as a sub portfolio I used a mix of regional ETFs that were more equally weighted than the World Index and its interesting that this mix performed well both ex ante and post ante the investing of a real world portfolio. It also showed that as a whole active investing need not lose out to index investing, I favoured measuring investment trust NAV performance after costs against the indices without costs, provided you used a few investment trusts to reduce the dispersion of individual managers for a particular sector, then the active approach is entirely rational.

LikeLike

Thanks for taking the time to reply, helps me better understand your comment and the emphasis on geographic allocation, my interest is primarily here rather than on IT’s.

LikeLike

Hi FvL

I had similar thoughts. I was running a portfolio modelled after TEA’s Simplicity portfolio with a value tilt with VHYL as a screen. However the poor performance of Value over the past few years is just a performance drag for a growth portfolio. Perhaps there are companies in the value trap that an high yield fund cannot screen for. Therefore I am dropping VHYL as well. Although there is suggestion there will be ‘reversion to mean’ (https://www.aqr.com/Insights/Perspectives/A-Gut-Punch), but who knows how long that will take to come.

I agree with your assessment that less efficient markets would benefit from active funds picking stocks that are of better value. I am going further and choosing smaller companies for specific geographical sectors, Japan, US, UK, Europe.

Do you need to go with an ETF, I have used HSBC FTSE All World Index C Fund which is similar to the VWRL but OEIC rather than ETF. I think it may be a good alternative.

Fireplanter

LikeLiked by 1 person

Very timely post thanks. After many years of fairly sporadic ‘hit and miss’ investing (mostly HL Wealth 150 recommendations) I started reading and researching via Monevator, Citywire, Morningstar, Tim Hale etc a couple of years ago. I then constructed what was supposed to be a fairly simple 60/40 portfolio across 2 SIPPs and 2 ISAs (mine and Mrs T’s). This was based around a couple of Global trackers – SWDA and Fidelity Index World – with a home bias via L&G UK Index and Vanguard FTSE UK All Share Index. Like a perennial alcoholic I couldn’t resist a few active satellites – FGT, LTGE, First State Asia Focus and Stewart Asia Pacific Leaders, and a couple of small ‘punts’ – Blue Whale and OCI. I hesitated to put the full allocation into Bonds, so spread some of it across 3 Bond trackers, and put the rest into several ‘defensives’ – Newton Real Return, CGT, PNL. Overall, my ‘simple’ portfolio is still around 20 holdings, albeit some are deliberately split to diversify between companies.

A recent review showed performance almost exactly mirrored the GBP Moderate Allocation index (well done Martin!)…. both of which have been significantly outperformed by VLS60 (which has the same ‘home bias’)! Food for thought…

LikeLiked by 1 person

Now getting older(74) so simplification getting important

But for many years-11+ have held a 3 fund portfolio only

Withdrawing 3-3.5% pa and portfolio now many thousands more than at the start of the journey

30/65/5-equities/bonds/cash

Vanguard Global Equities Dev World Index Fund ex UK-26%

Vanguard FTSE AllShare Index Fund-4%

Vanguard Global Bond Index Fund hedged to the Pound-65%

Cash-5%

Cheap,simple and easy to understand

Never rebalanced except when withdrawing which maintains Asset Allocation

Sat out all market downturns

Boring but lets me sleep at night!

Pays your money and takes your choice!

xxd09

LikeLike

Very interesting – thanks xxd09! Question for you – do you have any concern about your entire nest egg being with one provider, Vanguard? Fraud/N Korean cyber attack/similar?

LikeLike

Good to hear these real experiences. I am following a similar strategy albeit a little earlier in life so a heavier weighting on equities. Thanks for sharing.

LikeLike

Hi xxd09 – Very interesting and simple strategy. Can i ask when taking the 3.5% annually are you selling down fund units or getting it from dividends and coupons on the bonds?

LikeLike

All three funds in Accumulation units inside ISAs and SIPPs

So just sell number of units as required once a year after April 5th -start of U.K. tax year

Sell to maintain Asset Allocation-rebalancing in effect

Simple ,cheap ,easy to understand transaction

xxd09

LikeLike

@xxd09

Thanks. Ok all acc so no dividends growing cash. Sounds very simple and easy to manage.

Are you concerned about bonds looking forward and their ability to support income and support found in downturn? I have a reasonable gilt and corp bond holding recently brought but wonder for this year whether to go more equity or whether bound can really protect a downturn in the future. At 65% for you is this a concern?

LikeLike

Cannot find a safe alternative to bonds to balance equities in my portfolio

Still looking -the alternatives seem too risky to an amateur investor like me

Have a big enough pot so that I can be conservative in my investment policy

The main role of bonds is to reduce volatility in one’s portfolio-I achieve this and can sleep at night

As a bonus my Vanguard bond fund (VIGBBD)has returned over 4% pa over the last 10 years( no doubt there are some corporate bonds in the mix)

Will this be the same going forward -who knows?

xxd09

LikeLike

Simplification versus Security

A never ending conundrum and I know of what I speak -my wife and I escaped Equitable Life with capital intact-thanks to Motley Fool U.K.-sadly no longer with us.

My wife is a retired Teacher with a DB pension and we have State Pensions -safe income stream ?plus our children are well established (a bolt hole -if required)

So having been all in with Alliance Trust Savings for many years and smoothly transited to Interactive Investor(I did not mention that all investments on one platform-more simplification!) I am relying on the too big to fail argument-choosing Vanguard and Interactive Investor

If they go down for long we are all finished

Plus I keep 2years living expenses in cash-currently Tesco Bank

So far so good plus my wife can understand it!

xxd09

LikeLike

I think your last point about your partner understanding it becomes increasingly important, you never know how life can change. I have posed a question to Vanguard UK about implications of company failure, if I receive any useful reply I’ll share.

LikeLike

@FvL & @Malcolm Beaton

Re: Too big to fail and the risk of having all your investments (or majority) with one provider, I questioned Vanguard on this, their response:

“Vanguard must comply with the Financial Conduct Authority’s (FCA) regulations. The regulations state that we protect and segregate clients’ investments by keeping them separate from Vanguard’s own money and assets.

All of your money invested is held in separate holding companies via custodians.”

LikeLike

Hmmm. That is what MF Global said too. Doesn’t protect against alleged fraud, at which point the regulators/liquidators freeze the client accounts while they do their thing. Even if allegations are groundless, you won’t get any money out for months/ages.

LikeLike

@FvL

Thanks for the reply. Ok, let’s challenge them further and their followers. I have sent a further query to Vanguard specifically referring to MF Global, in addition created a post on Bogleheads challenging them on the strategy of being all-in versus risk of company failure/fraud/hack. I’ll share anything interesting.

LikeLike

More from Vanguard on the MF Global challenge.

“Thanks for your message and I understand the concern here.

The key difference here is the type of organisation and the type of products that they engage in. Firstly our unique ownership structure means that we have no need to make a profit as we have no shareholders to which we need to pay dividends too – we are set up in the US so that the funds themselves own the company, like a mutual. We also stick to our core products of managing mutual funds and ETFs rather then some of the other more risky types of products that some firms offer.

Lastly there were a whole raft of regulatory changes following the financial crises. As an investment platform we are required to reconcile our clients assets on a daily basis and ensure that all is accounted for, we report all of these findings on a monthly basis. Also due to the size of Vanguard we are directly supervised by the FCA and have a very close relationship with them as our regulator.

Vanguard take our responsibility of being stewards of our clients money extremely seriously and always take the utmost care to put our clients first.”

LikeLiked by 1 person

@FvL

https://www.bogleheads.org/wiki/Vanguard_safety

The above is a helpful response with respect to Vanguard, responding to FvL’s challenge about the risk due to company failure, fraud, MF Global example etc of being all-in with a single provider global tracker and/or broker.

LikeLike

Super helpful. It doesn’t address the MF Global risk – which to my mind shows ‘it is 100% guaranteed until isn’t’ – but it is what I would say if I was the Vanguard outreach person!

LikeLike

For completeness

Half our income comes from gov pensions-relatively secure

We keep 2 years living expenses in cash in a high interest BS account

xxd09

LikeLiked by 1 person

Stellar post! Thank you for sharing your analysis.

I moved from VWRL to SWDA, VEVE, and VHVG (plus EMIM to broaden the developed world trackers to “all-world” coverage). The latter two have a TER of 0.12%.

LikeLike

Great post thanks FvL

Up until last year I was naively (or maybe subconsciously because I knew it was a low hurdle) benchmarking against the FTSE ASX….after all it is unlikely that Mrs S was ever going to let us move overseas and BoJo has scuppered that dream anyway. Consequently I am 50% UK invested. I spent a number of years congratulating myself for comfortably beating my benchmark.

Until I woke up one morning and peaked through my fingers at LS80. Arrrghh. You guessed it I’ve (slightly) underperformed over a 6 year period. My only saving grace (and dilemma) is that the underperformance is skewed to 2020 and arises primarily from my UK large cap HYP. Mean reversion anyone?

So my decision making involves two issues. Like you I want to simplify and go more passive. At the same time I want to reduce my UK exposure to a more sensible global balance.

I know what will happen if I go all in world trackers straight away (implying a 60% US weighting) – there will be a big correction with the FAANGs taking US down further than the rest of the world. So I’ve decided to adopt a drip approach and gradually sell down my UK holdings and buy global over a period of 18 months. I’ll spread these over VEVE, SWLD, HMWO, SUSW, LCWL and give LGGG a try (10% each) I’ll keep 15% in my small cap UK stock picks and 15% in EM and finally put 10% in WLDS.

I’m mainly on HL (too big to fail?) but have started and will continue to feed ISA subscriptions to iWeb and buy LGITI from SIPP drawdowns (part of my strategy to avoid the LTA issue and also to have some Non ETF exposure.)

Anyway I could ramble on but I need to get back and read your post again!

Ta

LikeLike

Stephen – very interesting comment, thanks! Quick Q – by FTSE ASX do you mean FTSE UK all share index? Or Australian stock exchange?! Or something else? I think of ASX as Oz, but I realise you appear not to.

Had to look up your ETFs (HMWO/SWLD/LCWL – HSBC/SPDR/Lyxor MSCI WOrld, VEVE Vanguard FTSE Dev World, SUSW iShares Sustainable World, LGGG L&G Global Eq GBP, LGITI L&G Intl Indx Trust) – good to know for reference. Would be good to hear how you get on!

LikeLike

Yep FTSE all share and the tickers only was laziness on my part. Sorry for the confusion

LikeLike

Interesting stuff. How do you set your country %? Do you ever change the allocations? Like you, I have overweighted my portfolio in my home market. But I do sit and think about a global tracker.

One thought I raised on Monevator with a global tracker vs market level asset allocation. With a global tracker, if Tesla takes off you buy more Tesla. With market level asset allocation if Tesla takes off you sell US (and Tesla) and buy another, underperforming market. In theory with the global tracker you buy high, with the market allocation you sell high (I know one share moving when you own 1000s in a fund is probably just noise). So while in the short term you may lag, over the long term you would potentially out perform the tracker and see less volatility.

LikeLike

[…] V London – Reducing my portfolio to one ETF FvL compares the performance of his varied holdings with VWRL and finds that the performance is […]

LikeLike

@Mike — Thanks for those thoughts about my CGT uncertainty. I do have the total purchase amount (and I remember the bad old days about different tranches! Still gives me shivers.) In terms of dates though, I’d stretch much beyond the year. I guess if I sold it all in one block HMRC might be more likely to extend the benefit of the doubt (or at least I’d only have to roll the dice on who looks at my return once) but then that nails on a big CGT bill. Lots to think about.

(Apologies for the minor thread diversion FvL, though guess it is sort of on-topic to your post!)

LikeLiked by 1 person

[…] Reducing a complicated portfolio to one ETF – FireVLondon […]

LikeLike

Very interesting post with great comments too.

Lots of us struggle with the interplay of complexity, security, etc and it is always good to read others perspective.

The comment from Malcolm B (xxd09) that begins “For completeness ….” could easily be overlooked but IMO makes a critical point about the importance of securing an income Floor in retirement.

LikeLiked by 1 person

Hi, new person here, I just found your blogs. Very interesting and I’m also reading through some of the old ones.

I’m not sure if others have commented on this but overlap and underlying exposure are some things you should analyse in your portfolio to help reduce your holdings. We did that all the time in my career as a fund manager. I mean the following: on top of the obvious duplications (why have you the ishares S&P500 and also the Invesco S&P500? do you really think that there is a chance that one of these two providers will go bust? that would be the only reason to have both) you should spend time looking at the total exposure to certain stocks/sectors/countries by looking through you holdings. For example what’s the exposure to the US tech sector if you have ETFs covering S&P500, Nasdaq, global and then smallcaps and midcaps? Then you have Lyxxor Stoxx600 in which European tech stocks (e.g. Dialog) are heavily correlated to the US tech sector (suppliers to Apple). Once you know that you can decide that maybe you don’t need some funds because there is sufficient exposure to that exciting sector/country/company through another. The biggest case in point is Emerging markets. I found in my career that actually the best way to make high return/low risk in emerging markets (as opposed to high risk/uncertain returns) is to buy developed global stocks, with few exceptions. Mobile phone networks in Africa are being built with Nokia/Ericsson/Huawei infrastructure, not much local content, while people are buying Nestle food and Adidas shoes. Ultimately this analysis will result in a good understanding of the underlying risks you are taking, country/sector/currencies etc. and a lot of optimization. I hope this helps.

LikeLiked by 1 person

Too many holdings you just create an expensive tracker. Better in my view to take on more conviction with fewer holdings, would give better chance of outperforming VWRL. My understanding is the £85k limit is per person per firm (not broker). I.e. You don’t need multiple brokers, as long as one of the main brokers. And keep total amount in each investment house, Baillie Gifford, Fidelity etc. below the £85k limit. I have 12 investments in total, mainly trackers. Interesting thread. Cheers, Adam

LikeLiked by 1 person

I don’t think FSCS is per person per fund provider – what is your source?

LikeLike

https://www.fidelity.co.uk/how-is-my-money-protected

https://monevator.com/investor-compensation-scheme/

Suppose you buy ETF shares through a broker. My understanding is, if your broker goes bust and has lost your ETF shares, then you are covered for up to £85k. But if the ETF provider goes bust, and has lost the underlying shares (the actual Google, Tesla etc. shares that underlie the fund), then you are covered for £85k *if* the ETF provider is in the UK. But many of the UK traded ETFs are domiciled in Ireland (including VWRL), and Monevator confirmed with both Vanguard and iShares that their Irish domiciled ETFs are *not* covered by the Irish compensation scheme. And even if they were, the Irish scheme would only pay out €20,000 per investor.

So what happens if you buy VWRL and “Vanguard Group (Ireland) Limited” goes bust and loses the underlying shares? You’re screwed. The FSCS only applies in case of insolvency of a regulated UK entity. If your broker is still solvent, and if your ETF provider were UK domiciled and insolvent, you could claim using the FSCS for up to £85k for loses of the insolvent ETF provider. But that is not the case with an Irish ETF. You can’t claim against your UK broker, as they are still solvent, and still have your VWRL ETF shares in their trustee account – it’s just that those shares are now worthless. This is the same as with any investment – if Tesla go bust tomorrow, you can’t claim against your broker; if Vanguard go bust tomorrow, you can’t claim against your broker.

LikeLiked by 1 person

[…] to look at the world equities (e.g. VWRL) and world bonds (e.g. AGG/BND or the UK’s IGLT). My portfolio has often pretty closely tracked the VWRL ETF. The graph below shows VWRL and IGLT’s share prices (but not dividends) for the year, […]

LikeLike